What are reliable credit assessments made of? These days the answer could be anything from FICO scores to feedback from social media activity on LinkedIn or Facebook. And while Terry McKeown, practice manager of credit analytics at Envestnet | Yodlee, finds some of the newer approaches to risk and credit assessment novel—and in some instances worth pursuing—his expert opinion is to to keep all eyes on the prize: the borrower’s ability to repay the amount borrowed and a track record of making those payments consistently.

“I’m a big fan of the foundations of credit,” McKeown said in a telephone conversation last week, harkening back to the days when lending discussions took place over a desk in an office rather than over the internet. Besides traditional credit-bureau data, he sees interesting potential in alternative and nontraditional data such as checking-account transactions and utility-bill payments when it comes to risk assessment, especially for those with short or even nonexistent credit histories. Populations with slim to invisible histories include millennials, immigrants, the elderly, the unbanked and underbanked. McKeown also sees value in examining traditional data in nontraditional ways, such as using checking account or mobile wallet payment data as a guide to a borrower’s consistency when it comes to paying bills. “This data can show both income stability as well as income verification by way of direct deposit,” he explained.

“I’m a big fan of the foundations of credit,” McKeown said in a telephone conversation last week, harkening back to the days when lending discussions took place over a desk in an office rather than over the internet. Besides traditional credit-bureau data, he sees interesting potential in alternative and nontraditional data such as checking-account transactions and utility-bill payments when it comes to risk assessment, especially for those with short or even nonexistent credit histories. Populations with slim to invisible histories include millennials, immigrants, the elderly, the unbanked and underbanked. McKeown also sees value in examining traditional data in nontraditional ways, such as using checking account or mobile wallet payment data as a guide to a borrower’s consistency when it comes to paying bills. “This data can show both income stability as well as income verification by way of direct deposit,” he explained.

Other data alternatives he finds interesting include using LinkedIn to verify employment history and patterns, reviewing milestones in a Facebook profile for potential life changes, or perusing the Yelp reviews of a small business person seeking a loan. That said, McKeown sees many of these alternative metrics as still works-in-progress, saying that while they are “incredibly insightful,” many of these approaches are still very much “in early stages from an analytic standpoint.”

The interest in alternative credit and risk assessment becomes more important as the availability of new forms of data (including new technologies to access that data) converges with financial institutions determined to “catch up” with their increasingly mobile, increasingly young, potential customer base. “It’s been very much an education,” McKeown said, pointing out that millennials have different needs compared to, for example, those of gen-Xers when they were the same age. The upshot: Traditional credit-bureau data becomes less relevant owing to data viewed at a summarized level and not being updated daily as is the transaction-level data that Envestnet | Yodlee provides.

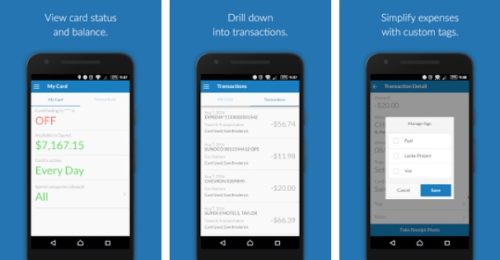

So what’s the solution? McKeown points to two key dynamics: creative engagement and higher expectations. For McKeown, millennials—and to an extent other underbanked communities—”want a partner in their finances that thinks and behaves like them.” This means everything from meeting the customer on their channel (or channels) of choice to greater flexibility and understanding when it comes to matching customers with products. This also means that FIs need to be ready to do more to meet the changing expectations of their potentially less patient, more technologically savvy clientele. “Millennials expect to have real-time pricing information based on real-time data available at the click of a mouse or via their mobile device,” McKeown said. “They expect an intuitive, simplified application process, whether it is delivered in person or over the Internet, or through a phone app.”

That said, the key to attracting and better engaging with millennials is less a technological challenge and more a cultural one, as McKeown sees it. “Problems with accurately credit-scoring people in their 20s and early 30s [are] nothing new,” he says. What is new is a generation that is simultaneously more free and more connected than its predecessors, giving financial services professionals both new challenges and new opportunities when it comes to engaging both “America’s largest generation” and the underbanked alike.

About Envestnet | Yodlee

Envestnet acquired multiple Best of Show winner Yodlee for $680 million almost one year ago. The company announced a strategic partnership with United Capital earlier this month, in which the company’s data-aggregation technology will support United Capital’s FlexScore solution. FlexScore, a Finovate alum, was acquired by United Capital in February. More than 1,000 firms, including more than half of the 20 biggest banks use Envestnet | Yodlee’s platform to drive apps for millions of customers around the world.

“I’m a big fan of the foundations of credit,” McKeown said in a telephone conversation last week, harkening back to the days when lending discussions took place over a desk in an office rather than over the internet. Besides traditional credit-bureau data, he sees interesting potential in alternative and nontraditional data such as checking-account transactions and utility-bill payments when it comes to risk assessment, especially for those with short or even nonexistent credit histories. Populations with slim to invisible histories include millennials, immigrants, the elderly, the unbanked and underbanked. McKeown also sees value in examining traditional data in nontraditional ways, such as using checking account or mobile wallet payment data as a guide to a borrower’s consistency when it comes to paying bills. “This data can show both income stability as well as income verification by way of direct deposit,” he explained.

“I’m a big fan of the foundations of credit,” McKeown said in a telephone conversation last week, harkening back to the days when lending discussions took place over a desk in an office rather than over the internet. Besides traditional credit-bureau data, he sees interesting potential in alternative and nontraditional data such as checking-account transactions and utility-bill payments when it comes to risk assessment, especially for those with short or even nonexistent credit histories. Populations with slim to invisible histories include millennials, immigrants, the elderly, the unbanked and underbanked. McKeown also sees value in examining traditional data in nontraditional ways, such as using checking account or mobile wallet payment data as a guide to a borrower’s consistency when it comes to paying bills. “This data can show both income stability as well as income verification by way of direct deposit,” he explained.

Similar to the way financial risk is aggregated into credit scores for consumers, CSTAR gives businesses such as ADP, Citrix, and Rackspace a single, wholistic risk metric that still enables them to drill down to the server or device level to spot and remedy potential vulnerabilities. UpGuard believes CSTAR can serve as the basis for a cyber-risk benchmark for businesses and consumers alike, and will explore new opportunities with insurance companies, such as with IAG, to help them better assess their customer’s cyber risks. The company also provides a

Similar to the way financial risk is aggregated into credit scores for consumers, CSTAR gives businesses such as ADP, Citrix, and Rackspace a single, wholistic risk metric that still enables them to drill down to the server or device level to spot and remedy potential vulnerabilities. UpGuard believes CSTAR can serve as the basis for a cyber-risk benchmark for businesses and consumers alike, and will explore new opportunities with insurance companies, such as with IAG, to help them better assess their customer’s cyber risks. The company also provides a

Braintree’s payment platform serves both online and mobile merchants, providing a secure payment gateway, merchant account, recurrent billing and credit card storage. The company’s APIs are used around the world, giving businesses in 40 countries in North America, Europe, and Australia the ability to accept payments in more than 130 different currencies. Braintree

Braintree’s payment platform serves both online and mobile merchants, providing a secure payment gateway, merchant account, recurrent billing and credit card storage. The company’s APIs are used around the world, giving businesses in 40 countries in North America, Europe, and Australia the ability to accept payments in more than 130 different currencies. Braintree  Based in Salt Lake City, Utah, Finicity demoed its Data Services technology at

Based in Salt Lake City, Utah, Finicity demoed its Data Services technology at  Twilio

Twilio

Cathryn Chen, CEO and Founder

Cathryn Chen, CEO and Founder Lai worked for HSBC and PayPal before becoming an angel investor. At PayPal, he led the merchant product conversion and revenue optimization of 2,500 enterprise, SMB, and distribution partners.

Lai worked for HSBC and PayPal before becoming an angel investor. At PayPal, he led the merchant product conversion and revenue optimization of 2,500 enterprise, SMB, and distribution partners.

Presenters

Presenters Jaroslaw Nowotka, CTO

Jaroslaw Nowotka, CTO