In eleven weeks, more than 70 companies will step onto the FinovateEurope stage at Old Billingsgate Market Hall in London to demo the freshest solutions in fintech.

Come join us on February 10 and 11. Right now, you can save £200 on a ticket with Very Early Bird pricing.

This has been our most competitive show outside the U.S. so far. The tall stacks of quality demo applications made it difficult to decide who should showcase their newest technology at FinovateEurope.

Without further ado, here are the presenting companies for FinovateEurope 2015:

AdviceGames develops gamified tooling based on data models, specialized in motivational risk games.

Aire is an alternative credit score to help people without any past credit history.

Akamai provides cloud services for delivering, optimising and securing online content and business applications.

AlphaPoint powers the top global digital currency exchanges with its white-label technology platform.

Avoka delivers SaaS-based customer experience management, enhancing multi-channel digital transactions around financial products and services.

Backbase is launching

Backbase Journey Manager, giving banks insight and power to optimize omni-channel customer journeys.

BizEquity is the ultimate lead generator for banks and

financial advisors serving small business owners.

C24 is

a “smart” digital money platform for managing your bills, transfers and wishes.

CashSentinel enables secure, large payments with mobile phones, all in real time.

CoinJar makes digital currency accessible and simple, for the everyday, and the extraordinary.

CPB SOFTWARE’s expertise, creativity and flexibility are the bases to solutions for its partner banks.

CREALOGIX offers digital banking with added value for the customer and the bank.

Delta Bank is a

fast developing Ukrainian bank with a focus on universal payment services.

ebankIT is a software banking company, specialized in multichannel innovation – mobile banking, internet banking on wearable tech, among others.

Encap Security is the only internet scale, device-based, banking-grade authentication platform provider in the world.

eRipple redefines mentorship. We change the fabric of corporates by helping talent and experts connect.

EVRY’s Spendific is the personal trainer for your finances. Know your money. Spend Freely.

Fiserv continues to lead the way in digital banking and electronic payment innovations.

Five Degrees invigorates banks with

Matrix; banking out-of-the-box and in the Cloud.

FOBISS develops Artificial Intelligence-powered technologies that drive smarter business decisions within the retail banking industry.

IDmission offers the modern enterprise an identity-initiated means of engaging with their customers and partners.

investUP is the future of crowdfunding, ensuring that investors never miss out on debt and equity deals.

InvoiceSharing enables improved invoice processing and cash flow by sharing free electronic invoices.

iSignthis keeps

your identity secured, your payments made safe.

Ixaris Systems provides the components and tools needed to build complex payment solutions rapidly and cost-effectively.

Jumio is a next-generation payments and ID software-as-a-service company utilising proprietary computer vision technology.

Luminous solves problems for banks, its aim is to drive transformation and innovation in banking.

mBank &

i3D mBank is the third Polish retail banking group with over 4.5M customers – consistently deemed as a financial sector innovator.

Meniga is the European market leader of white-label PFM and next-generation online banking solutions.

Mobino enables mobile payments for 5 billion people, from any phone, no credit card required.

MoneyHub empowers users to make better financial decisions and plan more effectively for their future.

mydesq provides solutions for wealth managers. It powers your success.

NICE Systems gets you closer to your customers, analyzing every interaction and transaction to build a detailed picture of the customer journey.

Novabase strives to make people’s lives simpler and happier through technology and a co-creative design approach.

onlinepay.com enables users to

securely and quickly transfer or share money with their friends on social networks, such as Facebook.

PhotoPay is the easiest way to pay bills and enter payment data on mobile devices.

Pirean is a leading software and services provider for people-focused Identity and Access Management solutions.

Quisk enables banks to offer cash-less transactions for anyone with a mobile phone number.

Revolut is

your

personal money cloud.

SAS Games develops

TiViTz College $avings Game-a-thon – a fully-automated, activity-based, fundraising tool for financial savings vehicles.

Sedicii delivers strong authentication for mobile and web enabled services without ever exposing your password.

Smart e-Money’s LockByMobile is the world’s first mobile-based anti-fraud security solution for prepaid, debit, ATM and credit card accounts.

SOFORT Banking is the leading non-bank Online Banking ePayment system in Europe and works instantly.

Strands is a global provider of personalization and recommendation solutions that empower banks to offer a superior customer experience.

StreetShares.com is a social-lending marketplace where retail and institutional investors compete to fund loans to U.S. small businesses.

Taulia transforms supply chains, enabling organisations to create a healthy relationship between suppliers and buyers.

Telenor Banka powered by

Asseco will present an innovative financial product offering, driven by telco-bank synergy, powered by Asseco SEE digital banking technology.

Temenos is the market leading provider of banking software systems to financial institutions across the globe.

Topicus provides premier innovative, cloud-based banking software, under the guiding principle: we challenge, you win.

TradeRiver Finance is a secure, non-bank, online solution which finances and executes global trade transactions.

TransferTo enables value remittance across borders.

Trunomi’s innovative

B2ME technology transforms the Know Your Customer market using secure online identity management.

VIPERA is a market leading enabler of mobile financial solutions and customer engagement.

Wipro is leading IT, Consulting and Business Process Services company that delivers solutions to enable its clients do business better.

WS Integration solves complex data processing issues in the post-trade execution.

Xignite provides real-time and reference financial market data to fuel FinTech innovation.

Xsolla is re-inventing e-commerce.

Yoyo is the first app that seamlessly blends payments, loyalty, and discovery – done right.

We’ll announce several stealth companies as we get closer to the event. And be sure to stay tuned for our Sneak Peek series to get to know each company in advance of the show.

Join us in London! Get your ticket to FinovateEurope before November 21 for Very Early Bird savings.

FinovateEurope 2015 is sponsored by: Life.SREDA and more to be announced.

FinovateEurope 2015 is partners with: Bank Innovators Council, BankersHub, bobsguide, Canadian Trade Commissioner Service, Datamonitor Financial, The Trading Mesh (formerly HFT Review) and more to be announced.

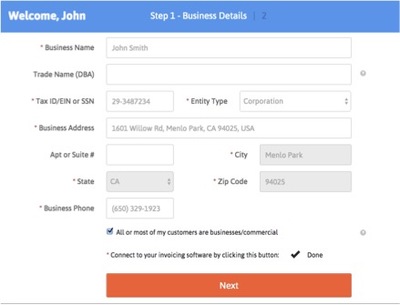

SMBs upload additional information, such as bank statements, online.

SMBs upload additional information, such as bank statements, online.