When it comes to predicting the next leap in fintech, you have to risk not only getting things wrong, but also being ok with it. So while I could play it safe and predict that the top fintech trend in 2024 will be AI, or industry consolidation, or even growth in the use of buy now, pay later tools, I’m going to step into less charted territory and say that the 2024 fintech buzzword will be quantum computing.

Why quantum computing?

The concept of leveraging quantum computing in financial services is dated; it has been around since the early 2000s. However, there are three main factors why 2024 may be the year the conversation around this topic really takes off.

- Cost savings opportunities

Banks and other industry players are currently in a wrestling match with today’s economic environment, the expensive cost of capital, and an increase in competitors vying for customer attention. This, combined with an onslaught of new regulatory constraints that not only restrict operations but also result in new costs, has banks looking for new ways to both cut costs and add new revenue streams. Quantum computing’s promise to help firms increase speed, efficiency, and decrease risk appears to be a green field of revenue opportunity for organizations across the sector. - Technological demands

The financial services industry loves generative AI, but even though it is the hottest topic in fintech at the moment, it comes with its own set of restrictions. Because it relies on enormous sets of data to work effectively, generative AI requires scalable computing power. As the use of AI evolves and data sets become increasingly larger and more complex, quantum computing may become a requirement to train AI models quickly. - Hardware developments

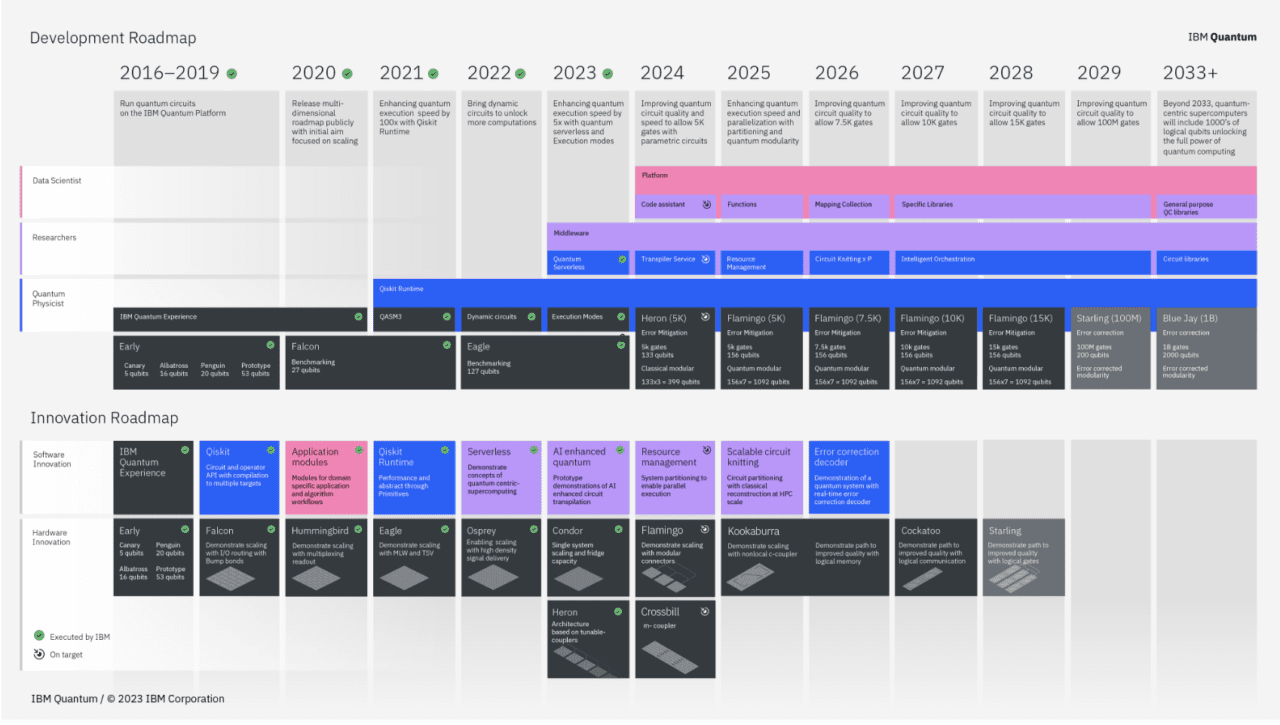

Developments in quantum computing hardware have been slow over the past few years, making the technology inaccessible and unreasonable, even for larger financial services firms. IBM may be changing this, however. Earlier this month, the computing giant unveiled its latest computing chip, Condor, that has 1,121 superconducting qubits and can perform computations beyond the reach of traditional computers. IBM also released Heron, a chip with 133 qubits that boasts a lower error rate.

Along with these hardware releases, IBM also unveiled its development roadmap for quantum computing, which pegs 2024 for the launch of its code assistant and platform.

What to expect in 2024?

Let me be clear that next year won’t be the year that financial services organizations experience widespread adoption of quantum computing. The industry has a long road ahead when it comes to leveraging the new technology and will face challenges with hardware stability, algorithm development, and security.

Despite these challenges, we will see a small handful of larger firms dabble in quantum computing in 2024. Many already are. Earlier this year, Truist Financial joined IBM’s Quantum accelerator program and MUFG purchased an 18% stake in a quantum computing startup called Groovenauts. And just today, HSBC announced it has implemented quantum protection for AI-powered foreign exchange trading, using quantum cryptography to safeguard trading data against cyber threats and quantum attacks.

These firms’ developments in quantum computing will spark conversation and development plans among mid-market firms. It is the conversation– rather than the implementation– around quantum computing that will burgeon in 2024.

Use cases in financial services

So how will firms end up using quantum computing? Specifically, the new technology will enable organizations to develop better algorithms around risk assessment, portfolio optimization, encryption, and security.

In the coming years, as quantum computing chips become more accessible, we’ll see use cases including faster transaction processing for high-frequency trading and settlement systems, customer behavior analysis and personalized financial services, and financial modeling that can more accurately predict market behavior and economic scenarios.

Photo by Dynamic Wang on Unsplash