This week’s edition of Finovate Global looks at recent fintech headlines from the South American countries of Argentina, Brazil, and Uruguay.

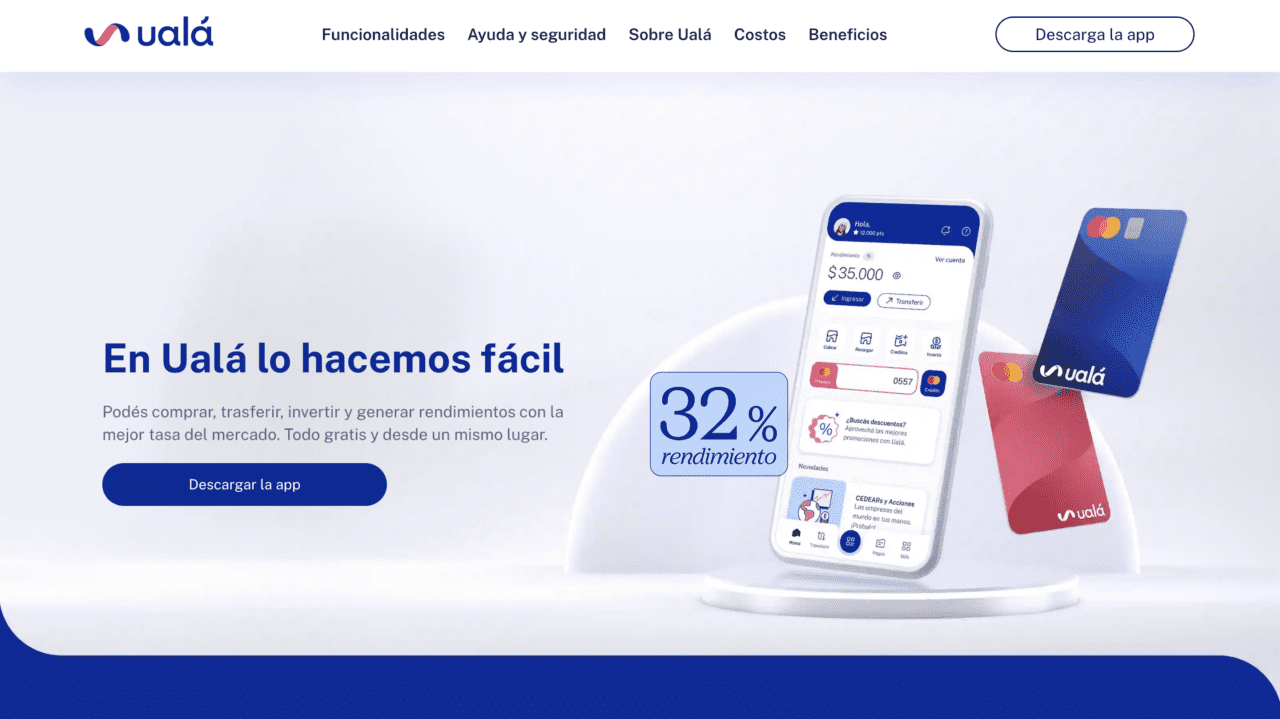

Ualá Raises $66 Million at $2.75 Billion Valuation

In a funding round that featured participation from Mexican media titan TelevisaUnivision, Argentina-based fintech Ualá has added $66 million in funding to its Series E round. The additional funding brings the round’s total to $366 million and gives the company a valuation of $2.75 billion.

The capital comes via an equity sale and will be used to fuel Ualá’s growth throughout Latin America—with a particular emphasis on expansion in Mexico. Ualá Founder and Chief Executive Officer Pierpaolo Barbieri praised the participation of TelevisaUnivision, which he called a “very relevant and influential outlet, across Spanish-speaking markets but especially in Mexico.” Barbieri added, “It will help us create confidence and closeness with a lot of Mexicans that still don’t know us.”

The first close of the Series E round was led by Allianz X, German insurance company Allianz SE’s venture capital arm. Also participating in the first close were Stone Ridge Holdings Group and Pershing Square Foundation. Additional investors in the extension round were not named.

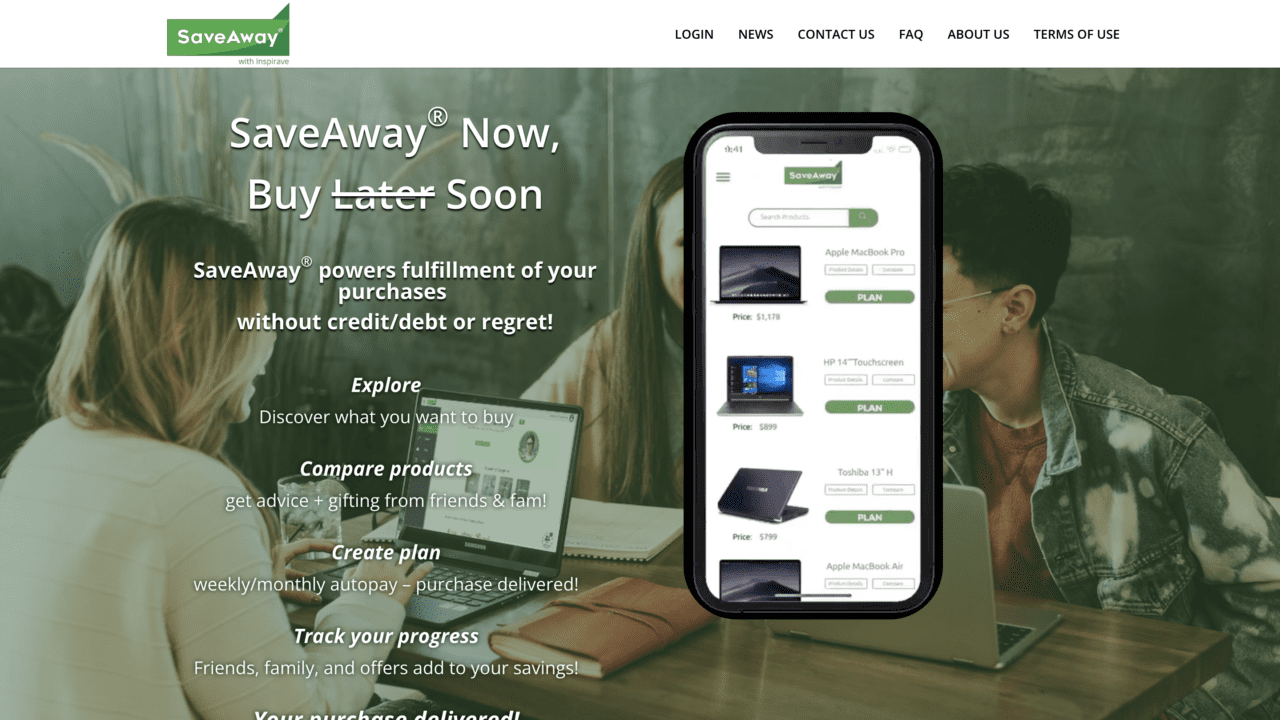

Founded in 2017 in Argentina, Ualá offers financial services including payment accounts connected to an international Mastercard prepaid card, as well as savings accounts, loans, investments, business collection solutions, and more. The company has nine million users in the region, including in countries such as Argentina, Colombia, and Mexico.

Ualá began the year by announcing the availability of six new mutual funds in its ecosystem, including one fund denominated in dollars. In February, the company integrated an advanced artificial intelligence platform, powered by OpenAI’s GPT-4, into its customer service process.

dLocal partners with Temu, Belmoney

Uruguayan fintech and cross-border payments company dLocal announced a pair of partnerships in recent days. First, dLocal launched a new collaboration with Europe-based, remittance-as-a-service (RaaS) provider Belmoney. The goal of the partnership is to facilitate cross-border payouts, leveraging the integration of more than 900 local and alternative payment methods (APMs) such as credit and debit cards, bank transfers, and instant transactions. The collaboration is also designed to boost service reliability and efficiency for those making cross-border transactions in countries including Bangladesh, Ecuador, Peru, and Pakistan.

“Our partnership with dLocal is a game-changer in the remittance space,” Belmoney CEO and Founder Bruno Pedras said. “By integrating with dLocal’s comprehensive network, we can significantly lower costs, improve transaction speeds, and provide a better cross-border payments experience for both senders and recipients.”

Second, dLocal announced that it has formed a strategic partnership with Temu, the international e-commerce platform of China’s PDD Holdings. Together, the two companies seek to provide shoppers in Africa, Asia, and Latin America with new seamless and secure payment options that are suited to local preferences. Millions of customers in 15 emerging markets in these regions stand to benefit from the collaboration.

“By partnering with dLocal, we’re excited to extend these benefits to millions of customers in emerging markets, ensuring that more people can enjoy accessible, convenient shopping experiences,” a Temu spokesperson said in a statement.

Launched in 2022, Temu is an online marketplace that offers consumer goods at significantly discounted prices. Shipping goods directly from the People’s Republic of China, Temu reportedly has more than 292 million monthly active users of its app worldwide. The app was among the most popular in US app stores for both iOS and Android in 2024.

Founded in 2016, dLocal is headquartered in Montevideo, Uruguay. The country’s first unicorn, dLocal offers an all-in-one payment platform that enables companies to accept and disburse a wide range of local payment methods and currencies. In 2024, the company processed more than $25 billion worth of payments. dLocal works with 700+ merchants, supports 900 payment methods, and operates in more than 40 countries. A publicly traded company on the Nasdaq exchange under the ticker DLO, dLocal has a market capitalization of $2.7 billion. Sebastián Kanovich is CEO.

Ant International’s Bettr brings embedded finances services to ecommerce merchants in Brazil

Speaking of partnerships between businesses in Asia and Latin America, we learned this week that Bettr, Ant International’s AI-driven lending business, has gone live in Brazil. Bettr will help expand lending opportunities for small and medium-sized enterprises (SMEs) by working with local partners such as AliExpress. Through this partnership, Bettr will introduce a new financing solution, Bettr Working Capital, for local merchants working on AliExpress’s platform.

“This collaboration reinforces our commitment to helping small and medium-sized businesses thrive by providing accessible and efficient financial tools that can take their operations to the next level,” LatAm director of AliExpress Briza Bueno said. “In this way, we are not only supporting the individual growth of these entrepreneurs but also contributing to the advancement of e-commerce in the country.”

Bettr Working Capital will be introduced gradually; the first round of disbursements began this week. The technology analyzes merchant sales records and other unstructured business data from AliExpress to make smarter, tailored, more affordable loan solutions. This will help small and medium-sized businesses better manage cash flow and expand into new markets.

Headquartered in Singapore, Ant International is an international digital payments and financial technology provider. Bettr is the company’s digital lending business, which specializes in serving micro, small, and medium-sized enterprises (MSMEs). The firm combines emerging technologies like AI and data-driven credit modeling to offer secure financial solutions that better fit borrower needs.

Here is our look at fintech innovation around the world.

Latin America and the Caribbean

- Argentina-based fintech Uala raised $66 million at a valuation of $2.75 billion in an extended Series E round.

- Uruguayan cross-border payments platform dLocal announced a strategic collaboration with Temu.

- Remittance company Pomelo integrated with Visa clearing house in Mexico.

Asia-Pacific

- Indonesian ride-hailing service InDrive teamed up with Singapore’s Fingular and Indonesia’s Sharia-compliant P2P lending platform Ammana to launch its new inDrive.Money app.

- Malaysian wealth management platform Versa raised $6.8 million in Series A funding.

- Japan’s international payment brand JCB partnered with integrated payment provider First Cash Solution, expanding JCB Card acceptance in Germany.

Sub-Saharan Africa

- African payments technology giant Flutterwave integrated with Pay With Bank Transfer to support businesses in Ghana.

- Mastercard extended its collaboration with London-based Paymentology to boost financial inclusion in South Africa.

- Compliance and fraud prevention platform Sumsub announced a partnership with the Association of Fintechs in Kenya.

Central and Eastern Europe

- Lithuanian identity verification provider iDenfy announced a collaboration with mobility provider Evemo.

- Estonian fintech Hoovi raised €8 million in funding via a structured bond issue from Finland’s Multitude International Bank.

- Moldova-based digital wallet and electronic money institution (EMI) Paynet partnered with open banking services provider Salt Edge.

Middle East and Northern Africa

- Israeli fintech FINQ became the first Israeli company to secure a US Securities and Exchange Commission (SEC) Registered Investor Advisor (RIA) license without relocating to the US.

- Egyptian fintech Fawry inked a strategic agreement with Contact Financial Holding to expand access to Buy Now, Pay Later (BNPL) services.

- MENA-based payment service provider Telr secured a Retail Payment Services license from the UAE’s central bank.

Central and Southern Asia

- Digital financial services provider PayU acquired a 43% stake in Indian payments company Mindgate Solutions.

- Mastercard has enabled Google Wallet in Pakistan, delivering secure contactless payments to enhance financial inclusion.

- Indian fintech Pine Labs announced plans for a domestic IPO in the second half of 2025.