How will AI help drive fintech innovation? How can digital transformation power greater financial inclusion? Where is the smart money investing in fintech? What will be the Next Big Thing in financial services?

FinovateFall wrapped up just days ago – and much of the three days of fintech demoes, keynote addresses, and panel discussions was dedicated to providing answers to these questions.

Here we’ll reflect of those responses and highlight some of the key takeaways from our mainstage fintech experts, our innovative demoing companies, and Finovate attendees themselves.

What we learned from the experts

Our invitation-only, Leaders+ session held the evening before the conference began featured a number of insights on the present and future of fintech. The lead-off address on major fintech themes set a tone for our invitees that foreshadowed much of what the rest of our attendees would see and hear once FinovateFall got underway the following morning.

Analyst and expert Alex Johnson of Fintech Takes provided one of the more surprising insights of the night in his keynote on top trends in banking and fintech. Johnson suggested that the relatively unglamorous areas of the industry may turn out to be the “Coming Attractions” in terms of fintech innovation over the near term. Much of the fintech revolution to date, Johnson explained, involved solving consumer problems – many of them bearing an uncanny resemblance to the problems of the company founder’s themselves.

As innovation in this space runs its course, opportunities in other, neglected areas can emerge. Johnson encouraged invitees to keep an eye on “the boring stuff” like payments infrastructure and the B2B world when gauging the overall level of innovation and opportunity in the fintech and financial services industry.

Johnson also observed that we should continue to see fintech deployed to solve problems that are not necessarily considered to be financial problems. Our own Finovate research team has noted the increased news flow from companies looking to help small businesses survive supply chain financing challenges. It was heartening to hear Johnson use the example of fintechs providing financing to SMEs caught in supply chain snafus in that part of his presentation.

The other major topic of conversation in our Leaders+ session was AI and the metaverse. This was another discussion that extended over the balance of FinovateFall. The jury may still be out on the impact of the metaverse in banking. But the potential of AI in fintech and financial services seems clear.

From greater personalization of services to more efficient, more secure, and more innovative financial products, banking and financial services are ready to find roles for AI.

Start with Generative AI. One commonality between keynote speakers on AI was to compare the adoption rate of a Generative AI solution like ChatGPT to the adoption rate of previous popular technologies from the past. Think everything from Napster to LinkedIn to TikTok. GenerativeAI was clearly in a class of its own. This sentiment – that AI is here to stay – was echoed in virtually every discussion of the technology – from Leaders+ and keynote speaker Tomas Chamorro-Premuzic to Analyst All-Star Tiffani Montez of Insider Intelligence. At one point, even David Letterman’s classic skewering of the Internet in an interview with Bill Gates back in 1995 (“Does radio ring a bell?”) was deployed to remind our FinovateFall audience that we’ve underestimated innovation before.

What we learned from the innovators

There is no better way to feel the pulse of fintech innovation than by attending the Demo Days at a Finovate event. And there is no better distillation of what direction fintech innovation is going than the companies that take home Finovate Best of Show awards.

FinovateFall was no exception. Of the six companies that won Best of Show last week, we saw three companies demo solutions in areas that observers long have said are ripe for innovation. Chimney demoed a solution for homeowners that gave them actionable advice on their home’s value and equity, their borrowing power, and the availability of relevant pre-qualified offers. Trust & Will demonstrated technology that streamlines and simplifies estate planning and settlement with attorney approved, legally valid documents. Wysh, an innovator in the insurance space, demoed a deposit solution that provides micro-life insurance coverage of up to 10% of the account holders balance.

Best of Show winning companies like eSelf.ai showed fintech to be at the cutting edge of enabling technologies like AI, as well. The Israel-based company, whose founder helped launch three-time Finovate Best of Show winner Voca.ai, demoed eSelf.ai’s AI-powered client interaction solution that provides human-like conversation and engagement. Mahalo Banking, headquartered in Michigan and also winning Best of Show in its Finovate debut last week, demonstrated fintech’s commitment to diversity and inclusivity. The company leverages innovative technology to deliver online and mobile banking solutions for credit unions that help them serve neurodiverse customers with visual, cognitive, and other challenges.

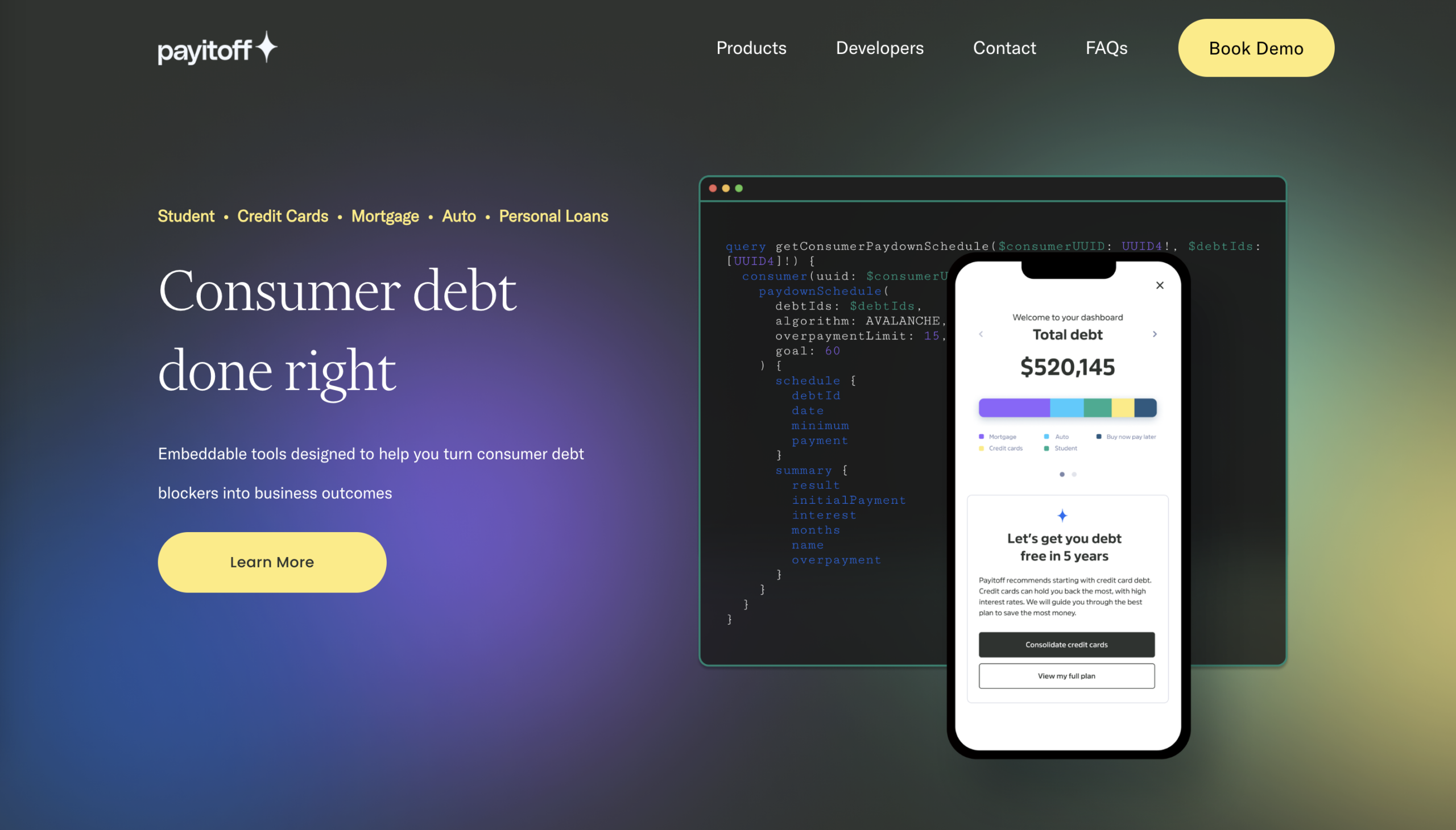

And the return of Debbie to the Best of Show winner’s circle is a reminder that solutions that respond to the basics of financial wellness – saving and reducing debt – remain critical components of the fintech ecosystem. Having won Best of Show in its Finovate debut last fall, Debbie was back with new tools to help users manage debt, including a credit card refinancing marketplace for credit unions.

Where we go from here

There were a few dogs that did not bark – at least not as loudly as they once did. Cryptocurrency and digital assets, for example, did not draw as much attention this year as they have in previous years. We’ve seen more from mortgagetech, as well. It is hard not to wonder what the impact of higher interest rates will have on this industry and other consumer-facing, interest-rate sensitive sectors and services from lending to Buy Now Pay Later.

Therein lies the opportunity. The problems may seem more intractable and the solutions not as sexy as they used to be. But the eagerness of founders and financial institutions to embrace both new technologies like digitization, automation, and AI – as well as new causes like financial inclusion and sustainability – is a strong sign for the future of our industry.