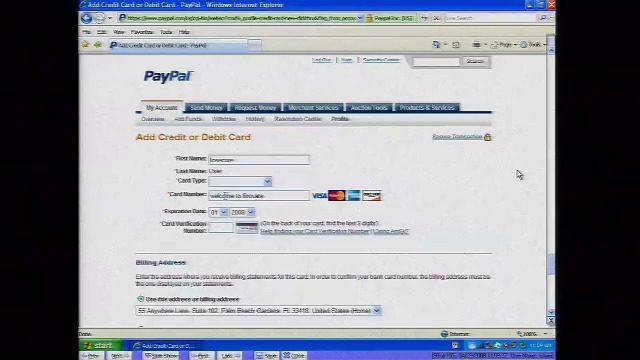

How they describe themselves: ZoneAlarm is a consumer division of Check Point Software Technologies Ltd. (www.checkpoint.com), the worldwide leader in securing the Internet. Our solutions are sold, integrated, and serviced by a network of more than 2,200 Check Point partners in 88 countries. ZoneAlarm ForceField is comprehensive browser security that makes it safer to bank and browse online. Virtualized Web session and layered security technologies protect users against full breadth of browser-based attacks. ForceField provides a protective layer around the browser that blocks drive by downloads, browser exploits, phishing attempts, spyware, screengrabbers and keyloggers as well as yet to be created malware to safeguard users’ identities, data and transactions. ForceField is an essential add-on to PC Security products as PC security is no longer enough to handle the latest browser security threats. Plus it’s fast, lightweight and easy to use.

What they think makes them better: ZoneAlarm ForceField is the first comprehensive browser security product that exclusively protects users against the full breadth of destructive new internet attacks. ZoneAlarm doesn’t have a direct competitor, others offer some features but they don’t offer complete Virtualized Browser Security necessary for protection when banking and browsing online. The virtualized browsing combined with the other features and technologies make the product a stand out.

Contacts:

Bus. Dev.: Joe Barello, 650-628-2322, [email protected]

Press: Heather Haas, 650-628-2355, [email protected]

How they describe themselves: CheckFree, now part of Fiserv, offers a full suite of solutions for large financial institutions, community banks and credit unions. Solutions include electronic billing and payment, online banking, mobile banking and payment, online account opening and funding, account-to-account transfer and fraud prevention solutions. CheckFree Online Advantage™ is the next generation of a seamless, integrated online banking experience which includes banking, bill pay, e-statements and other value added services. CheckFree Online Advantage is designed and developed to assist financial institutions in achieving increased online interactions, deepen overall customer relationships and increase profitability with each touch point.

What they think makes them better: CheckFree Online Advantage redefines what online banking is and can more effectively help online consumers and businesses reach their financial goals. CheckFree Online Advantage delivers new and innovative services to consumers, while leveraging some Web 2.0 and other social networking technologies to drive a greater user experience. This product leverages a lot of the industry best practices available in online sites not only within financial services but, more importantly, also leverages best practices from online retail sites, social networking sites, and online biller sites. This combination of best practices results in a new and innovative way for consumers and businesses to interact with their financial institution and vice versa.

Contacts:

Bus. Dev.: Tim Ruhe, VP, Business Development, (703) 885-4208, [email protected]

Press & Sales: Steve Shaw, Director of Marketing, 503-629-3770, [email protected]

How they describe themselves: Credit Karma is the free and easy way for consumers to understand, monitor and monetize their credit profile. With Credit Karma, consumers can monitor their credit score for free as often as they like, use their score to earn valuable and exclusive offers from advertisers, access information about improving their score, and utilize tools to better evaluate financial transactions based on their credit score. At every turn, Credit Karma is looking out for the individual, helping them to become smarter, more informed and better able to make the most of their credit.

What they think makes them better: At the heart of Credit Karma is a burning belief that a consumer’s credit belongs to them and is a critical piece of their financial health. That is why Credit Karma makes credit scores available for free as often as necessary. We give consumers the ability to own their credit while providing a host of information, services and tools that allow them to better understand it and how it can work on their behalf. Credit Karma is different because it built its business around the consumer. Credit Karma means better information, better decisions, better rewards.

Contacts:

Bus. Dev. & Sales: Nichole Mustard, Vice President Business Development, [email protected]

Press: Michael Azzano, Cosmo Public Relations, 415-596-1978, [email protected]

How they describe themselves: Small Business FinanceWorks™ will help 26 million U.S. small businesses look professional, get organized, get paid fast and maximize taxable deductions — all from within a financial institution’s online banking Web site. The product will make it easy for business owners/managers to: Invoice customers electronically so it’s easy for businesses to get paid faster, pay employees and payroll taxes electronically and enjoy hassle-free payroll tax filings, prepare and submit paperwork to incorporate, form an LLC or DBA, perform trademark searches, as well as scan/deposit checks remotely with a simple home scanner to get faster access to funds.

What they think makes them better: Small Business FinanceWorks™ combines the best of online banking with the best of business financial management offerings to deliver a simple, yet comprehensive solution in the place small businesses are most comfortable and trust — their financial institution’s Web site. Solving the most important small business problems, Small Business FinanceWorks will enable financial institutions to better serve their small business customers and become an integral part of their financial lives. This will change the game for both financial institutions and the customers they serve, helping financial institutions acquire new customers and/or deepen relationships with existing ones.

Contacts:

Press: Eastern Time: [email protected], 650-944-2641,

Pacific Time: [email protected], 818-878-6048

Sales: [email protected], 888-344-4674, option 6

How they describe themselves: Andera pioneered online account opening and funding technology with the first real-time account opening transaction in 2001, and today is the #1 provider in the market with more than 190 leading bank and credit union clients nationwide. The company’s proprietary platform is delivered in a hosted Software-as-a-Service (“SaaS”) model, and is designed to automate the customer acquisition process throughout a financial institution’s various delivery channels, including their branches, call centers, and Web sites.

What they think makes them better: Andera is the only company in the market focused exclusively on account opening and funding, and has been selected by more U.S. financial institutions than any other competitive vendor. Andera’s key differentiators include its extensive pre-built integrations to bank and credit union core systems, unique support for credit card funding, the best user experience, and enterprise-wide deployment capabilities throughout the financial institution’s various delivery channels, and a strong reputation for happy customers.

Contacts:

Bus. Dev. & Sales: Kevin Conway, VP of Business Development, [email protected], 972-899-2901

Press: Jennifer Jensen, Marketing Manager, [email protected], 401-621-7900

How they describe themselves: Aradiom designs, develops and markets a broad range of secure mobile solutions based on a highly flexible and extensible platform, the Aradiom Mobile Framework™ (“AMF”). The AMF allows you to easily build rich mobile applications in just hours within a flexible interface design environment and deploy to all Java-enabled handsets, and have full control over already deployed clients by delivering, managing and updating the clients in seconds. The AMF is the genius behind our core products such as QuickCity™, QuickBank™, QuickFlight™ and QuickOperator™ which meet the unique needs for professional phone based solutions of government and enterprise clients.

What they think makes them better: The Aradiom Mobile Framework™ (“AMF”) allows enterprises to build rich mobile applications in just hours with Aradiom’s fully flexible interface design environment that runs seamlessly on multiple operating systems. The applications can be fully customized and branded for all Java-enabled phones, while keeping data traffic at the lowest level. The phone update management system includes a database that is frequently and automatically updated, minimizing maintenance for you and ensuring very broad handset support. The AMF is built on a client-server model which can deliver, manage and update the clients in seconds without requiring re-installation from users, while seamlessly integrating with the your existing back end systems. With the unique clientID system, enterprises also have full control over already deployed clients.

Contacts:

Business Development: Baris Gul, President, US Operations, [email protected], 512-576-9936

Press: Regina Jun, Marketing, [email protected], 212-404-6950

Sales: Rachael Babcock, VP of Sales & Marketing, [email protected], 212-404-6950

How they describe themselves: SafeCentral provides complete and comprehensive defense from Identify theft, keyloggers, phishers and other malicious software by creating an end-to-end transaction environment linking the user’s PC to the website of their choice. Based on Authentium’s patent-pending VERO technology, SafeCentral desktop interprets and intercepts Windows commands to create an isolated and clean environment for online data exchange. The encrypted SafeCentral browser links directly to the SafeCentral Portal, which provides an attractive and secured environment for users to aggregate and discover web destinations. SafeCentral empowers users to visit over 15,000 secured websites, enter personally identifiable information, and feel secure in the fact that their personal data, identity and assets are safe.

What they think makes them better: Our competitors occupy similar space in that they develop products and services to protect against ID theft; however our approach is vastly different. Our competitors products & services protect usage of your personally identifiable information (once a breach has occurred), the technology behind SafeCentral creates an environment that protects your information at the onset of an online transaction before you enter any valuable personal information by locking down the desktop.

Contacts:

Business Dev. & Sales: Doug Brunt, CEO, [email protected], 561-575-3200

Press: Corey O’Donnell, VP Mktg., [email protected], 561-575-320

How they describe themselves: BlingNation and its payment clearing network BlingLink provide innovative mPayment solutions to financial institutions and prepaid card providers. With BlingNation, financial institutions and prepaid providers can offer their customers secure solutions for mPayments and P2P payments including real-time access to their accounts and the ability to make and receive payments in real time using public Id’s. BlingLink’s open architecture allows a wide range of devices and platforms to access the network, and its flexible nature enables prepaid providers and financial institutions to customize solutions.

What they think makes them better:

BlingNation gives users the ability to:

- Know account balances in real-time, all the time

- Gain immediate access to transferred funds in real-time on mobile devices, at POS, and at ATMs

- Perform payments with bank issued card or mobile devices

- Send money to anyone (p2p) easily and instantly using email addresses or mobile phone numbers

- Access the conveneince of tap-and-go payments (where available)

BlingNation allows Financial Institutions and Prepaid Providers to:

- Offer mPayments immediately via multiple mobile interfaces

- Increase revenue through new products and bundling

- Maintain higher deposits

- Reduce transaction costs

- Communicate in real-time

- Access a Two way channel for marketing and alerts

- Reduce fraud by decreasing customer reaction time to unauthorized transactions

BlingLink Features and Benefits:

- Secure certified platform

- PCI compliant

- Front-end agnostic

- Works with public IDs

- Real-time transaction processing and settlement

- Two-way communication channel between Prepaid Providers and end users

- Enables secondary revenue stream through merchant offers

- Two-way marketing offers & cross selling capabilities

Contacts:

Press: Chelsea Simons, [email protected], 650-529-4101×109

Bus. Dev. & Sales: Meyer Malka, [email protected], 650-529-4101

How they describe themselves: Founded in April 2006, BoulevardR.com provides unbiased, actionable and comprehensive advice to help people reach their financial goals. Designed to make financial planning engaging, BoulevardR.com walks users through a step-by-step process that makes independent advice accessible for the non-rich. The advice, which is prepared by a qualified Certified Financial Planner™ and documented in a Boulevard R Roadmap, outlines users’ next steps for a secure future, as well as strategies to grow their savings. BoulevardR.com then keeps their Roadmap up-to-date as their situation changes.

What they think makes them better: Unlike banks and brokerages that sometimes promote their products first and put their customer’s interests second, Boulevard R is an advice-only service without the conflicts of interests. The visual interface is backed up by serious technology and draws from the best practices used by leading independent financial planners and behavioral economists. Instead of just offering advice on investing, Boulevard R provides a comprehensive analysis, while also providing community features like Ask a Planner, Tips and Groups.

Contacts:

Business Dev. & Press: Matt Iverson, CEO, [email protected], 415-250-6727

Sales: Jon Iverson, Chairman, [email protected], 707-481-1845

How they describe themselves: Cake is the leading online social network for investing based upon real portfolios, actual performance and trades. Cake is the next evolution in the investment industry by improving the way 90MM Americans now involved in the stock market manage their $10T in assets by making it easy to communicate with one another. Anyone can use Cake to complement the traditional ways they track their investments since Cake does not require members to move their assets and it’s free to join. Cake Financial helps investors turn the “wisdom of crowds” into trusted, contextual and actionable guidance. All safely, securely and anonymously. All in one place. All for free. It’s Cake.

What they think makes them better: Cake is all about what investors are really doing using actual brokerage account data. Cake has built a patent-pending data aggregation platform that lets anyone link an unlimited number of brokerage accounts to Cake. With upwards of 10 years of historical investment performance. Cake lets members follow and communicate with as many other members as they want- all for free. Cake is not a brokerage firm- keep your accounts where they are. We do not collect assets nor make money from trades. Cake is made to work wherever you have your portfolio.

Contacts:

Bus. Dev.: Steven A. Carpenter, CEO, [email protected]

Press: Erica Friedman, [email protected]

How they describe themselves: ClairMail optimizes any mobile phone for 2-way customer interaction. As the only solution that supports a mobile phone’s existing software and standard capabilities – including messaging, mobile web and client applications – ClairMail empowers bank customers to easily access secure information, conduct transactions and get no-hold customer service. Additionally, ClairMail’s Actionable Alerts™ enable financial institutions to deliver complete service to customers as an alternative to expensive channels like call centers and IVR. ClairMail offers a turnkey, standards-based offering that seamlessly integrates with bank systems of record, delivers the fastest time to value and removes the friction from customer interactions.

What they think makes them better:

ClairMail offers the only solution to deliver 2-way mobile banking functionality across the “Triple Play” of all mobile user interface types – messaging, mobile web and client applications – on one platform with a single implementation. ClairMail’s 2-way services include actionable alerts, account management, fund transfers, multifactor authentication, mobile payments and no-hold customer service, which enable banks to decrease costs by reducing usage of more expensive customer interaction channels such as IVR and call centers. ClairMail also provides banks with revenue-generating opportunities with the introduction of services like Credit on Card and Mobile Lockbox.

Contacts:

Bus. Dev.: Bob Adamany, VP Mkt. Dev., [email protected], 913-897-6202

Press: Gavin Skillman, [email protected], 917-445-9499

Sales: Mark Uicker, VP Sales, [email protected], 415-884-7282

How they describe themselves: ConfIdent Technologies is a privately funded online security innovation company headquartered in Portland, Oregon. Principals Joel Norvell and Luke Sontag are majority shareholders and are active in the management of the company.

The management staff includes CTO Scott Blomquist, an 8-year Microsoft veteran who shipped four versions of the Windows operating system and served as lead developer for the Windows Live multimedia search team. The management team also includes Mitchell Savage over Business Development. Savage brings experience and knowledge from three prior startups and graduate studies in international business.

Technology: The company’s flagship technology, RecognitionAUTH™, is an innovative login system that eliminates passwords and is effective against prevalent forms of hacking. Without additional hardware, the system provides a method of giving the user a one-time access code at the last minute just in time for login.

Contacts:

Sales & Business Development: Travis R. Phipps, Business Process Manager, [email protected], 918-796-8558

Press: Mitchell Savage, EVP, [email protected], 918-796-8555