How they describe themselves: NCore is a remittance relationship network builder providing remittance and e-banking solutions to financial institutions in Asia and the Middle-East. NCore’s remittance platform allows banks and remittance companies to:

- Dis-intermediate global money transfer organisations and to wrest back control of the technical delivery platform

- Establish direct bilateral remittance links with foreign remittance partners thereby increasing profitability

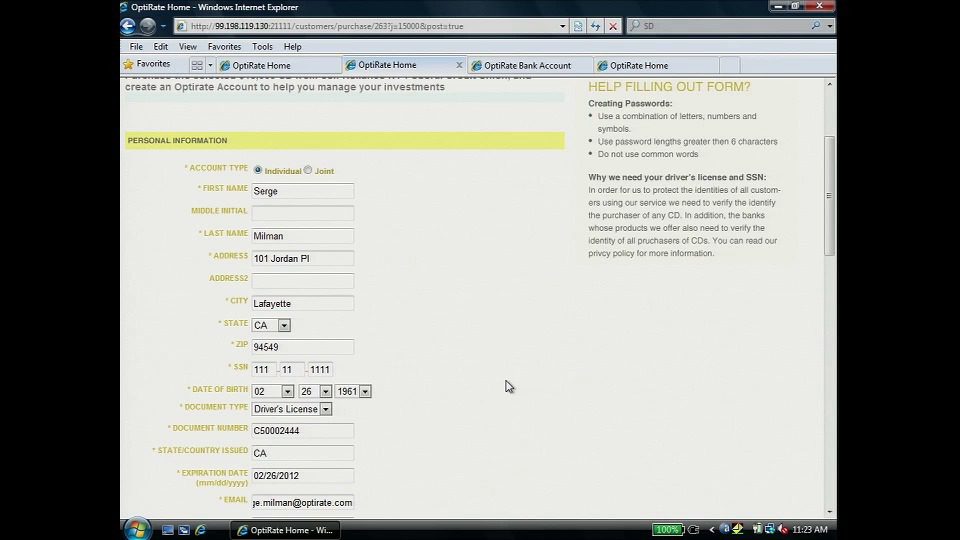

- Process international money transfer transactions from the points of remittance origination, straight through processing integration and payout distribution

- Be in control of defining its own remittance product features, customer experience and strategic partners

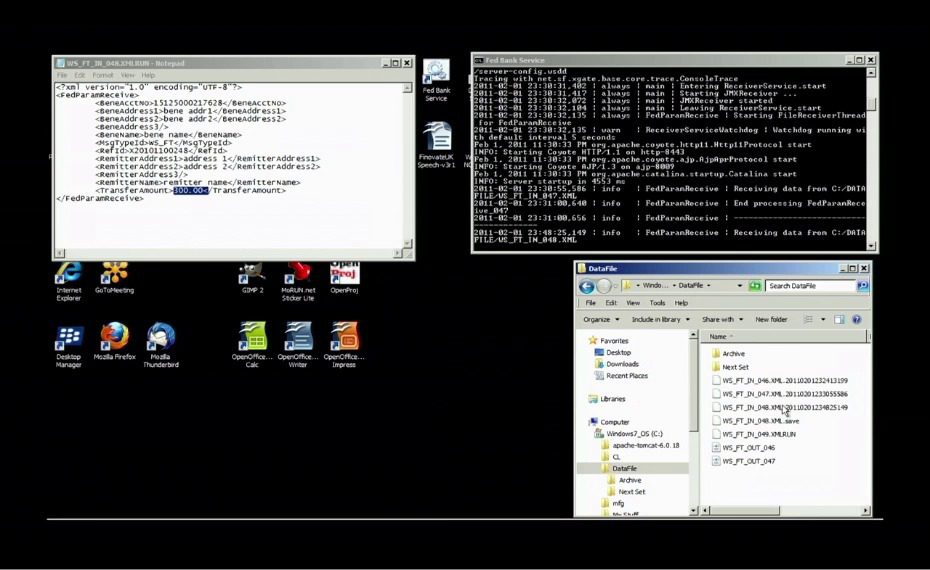

How they describe their product/innovation: NCore together with its local Indian partner Praxeva have entered into a strategic partnership with Federal Bank of India. Together with our strategic partner, NCore will demo the capability of Federal Bank to inter-operate quickly and seamlessly with foreign remittance partners to receive and process India bound remittances in an online real-time fashion. The service will allow the foreign remittance partner not only to take advantage of the straight through processing capability of Federal Bank but to also leverage off the bank’s large presence and foot-print in Southern India.

It is NCore’s objective to look for strategic foreign remittance partners (banks and/or remittance companies) who are looking to serve the NRI (Non Resident Indian) community in their respective countries by way of a bilateral remittance tie-up with Federal Bank.

Contacts:

Bus. Dev.: Nicholas See, CEO, NCore Systems, [email protected],

Rohan Timblo, CEO, Praxeva, [email protected],

Surendran A., Head of Int’l. Banking, Federal Bank, [email protected]

Press, Sales: Nicholas See, CEO, Ncore Systems, [email protected], Rohan Timblo, CEO, Praxeva, [email protected]