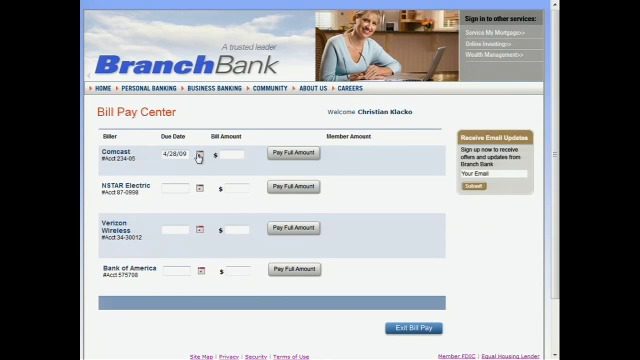

How they describe themselves: Micronotes provides an interactive direct marketing SaaS tool enabling Banks to enhance revenues from their online bill-payer user base. We partner with banks to transform online consumer bill-pay sessions into a communication exchange where customers save on their bills by interacting with the brands most relevant to their lifestyles. Micronotes sells to Brand & Marketing Managers of large consumer brands, and their agencies (advertising, interactive and media-buying). We deliver cost savings to banks, direct marketing ROI to large consumer brands and savings to consumers.

What they think makes them better: Everyone is looking for value and savings. Micronotes transforms the marketing dollars large consumer brands spend to connect with demographically appealing consumers into cash savings for online bill-payers. Only Micronotes does this with cash savings, in real time – not rewards or points, while they engage in a routine online activity. Banks get to reward their savings-minded customers by having Micronotes as part of their online bill-pay platform, which becomes a consumer-facing differentiator.

Contacts:

Bus. Dev. & Sales: Christian Klacko, SVP Field Operations, 617-401-2174

Press: Charla Jones, CMO, 617-688-0580

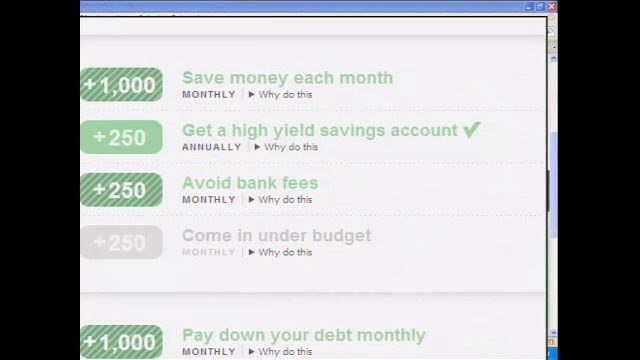

How they describe themselves: Mint.com is the nation’s leading online personal finance service, providing more than 1 million users a fresh, easy and intelligent approach to money management. And it’s free. Mint is tracking over $50 billion in transactions, $15 billion in assets and has identified more than $100 million in potential savings for its users. Mint.com takes less than five minutes to set up and Mint does the rest, securely downloading transaction data from more than 7,500 bank, credit card and investment accounts on a daily basis. Users never need to import or synch data. Patent-pending technology and proprietary algorithms categorize transactions; provide one view of all account activity; alert users to low balances, bank fees, upcoming bills, and unusual activity; and give personalized suggestions for significant savings opportunities.

What they think makes them better: Mint.com is rated top in its category by Kiplinger, Money, PC World and PC magazines, was named one of the 50 Best Websites of 2008 by Timemagazine, and has received two Webby awards, an American Business Award and accolades from the Wall Street Journal, BusinessWeek, TechCrunch, and Lifehacker, since its September, 2007 launch. The company was named one of 34 international Technology Pioneers by the World Economic Forum in 2008 and publishes an award-winning personal finance blog at http://www.mint.com/blog. Mint’s management team includes industry veterans drawn from Charles Schwab, eBay, Expedia, Intuit, PGP and other leaders in the finance, security and software industries.

Contacts:

Bus. Dev. and Sales: Anton Commissaris, VP of Bus. Dev., [email protected]

Press: Martha Shaughnessy, Director, Atomic Public Relations, [email protected], 415-987-0285

How they describe themselves: MoBank has developed what is recognised to be amongst the fastest, easiest to use, and most secure systems for mobile commerce and money management with a product launch on the Apple iPhone in March 2009. MoBank is integrated with twenty major online banks and a similar number of top‐tier ecommerce retailers.

What they think makes them better: MoBank ‘Convenient Transactions’ aggregates the whole of the e-commerce web and presents content in a format which is simple-to-use and visually compelling on a smartphone. Our technologies (patent pending) make mobile payments and money management a sinch. In short, MoBank is leading the world in bringing impulsive consumers and relevant retailers together to play all along commerce’s new frontier!

Contacts:

Bus. Dev.: David Rubin, General Manager, USA, [email protected], +44 7599 715469

How they describe themselves: Moneta is an online payment service, with a mission to deliver a superior, secure online shopping experience while supporting consumers’ goal to be financially responsible. Merchants benefit from lower transaction costs than traditional credit cards and access to new customers through bank marketing programs. Banks receive recurring revenue from Moneta transactions. Moneta is easily implemented, with no bank integration requirements.

What they think makes them better: Moneta’s unique bank-distribution method enables banks to benefit from consumers’ preference for non-credit payment alternatives. Moneta bank-branded payments address consumer security and convenience concerns with a one-step payment option completed on the merchant site. Consumer adoption is boosted through our Pay with Purpose™ give-back program.

Contacts:

Bus. Dev. & Sales: Raymond Keen, 678-398-4118, [email protected]

Press: Carol Kennemore Kleywegt, 678-398-4097, [email protected]

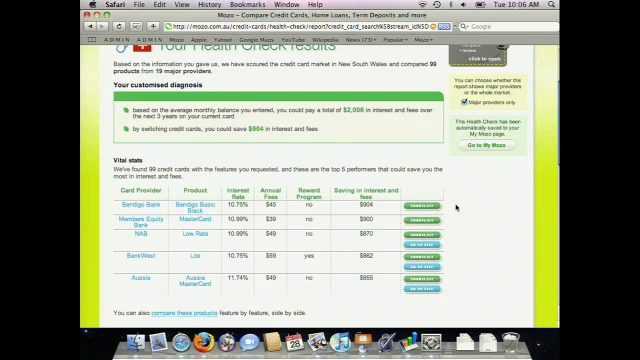

How they describe themselves: Mozo (short for Money Zone) is an Australian online comparison service that launched in October 2008. Mozo is powered by a database of financial products covering the Australian marketplace, and lets consumers easily compare the interest rates, fees and features of hundreds of different credit cards, loans and savings products. Results are personalized for the user, including calculations of financial savings from switching. Mozo has also developed Australia’s first customer rating system for banking products, so far featuring over 15,000 reviews from banking customers around Australia. Mozo is independently owned and our product data is 100 percent objective.

What they think makes them better: Mozo differs from other online comparison sites because of our interaction with users on a personal level. Firstly, we provide personalized results, including a financial “Health Check” service where users tell us their current product and financial situation, and our technology instantly compares hundreds of products to calculate the actual financial savings to be gained by switching. Secondly, we invite consumer involvement through our customer ratings system. Australians can rate their bank on six criteria and, in addition to publishing the individual customer reviews, we aggregate them up into “Australia’s favorite banks” as voted by thousands of real customers.

Contacts:

Bus. Dev., Sales and Press: Rohan Gamble, Founder and Managing Director, +61 419 621 544

How they describe themselves: NCore is a remittance relationship network builder providing remittance and e-banking solutions to financial institutions in Asia and the Middle-East. Challenges for banks in the remittance market include: 1) being locked in by the commercial and technological stranglehold of global money transfer organizations (MTOs), 2) frenetic competition and the global financial crisis exerting downward pressures on margins 3) continual challenges to provide seamless integration and interoperation with remittance partners. The VirtuaRemit Product allows remittance players to 1) disintermediate global MTOs, 2) empower banks to establish direct bilateral remittance links with remittance partners, 3) support the entire remittance value chain from origination, integration to distribution.

What they think makes them better: Most banks today deploy technology from the big money transfer organisations (MTOs); hence the lock-in effect. Traditional remittance systems don’t provide flexible mechanisms to integrate easily and quickly without having to incur significant software customization effort. VirtuaRemit allows banks to establish direct bilateral remittance relationships with remittance partners, thereby increasing fee based revenue margins. The VirtuaRemit remittance gateway switches, routes and processes remittance transactions between remittance partners and automates the remittance value chain using multi-channel remittance transaction origination, XGate remittance gateway middleware for straight through processing, and a distribution teller system for remittance payout.

Contacts:

Bus. Dev., Sales & Press: Nicholas See, CEO, [email protected], +6012-289-3921 or

Alexis Wan Ullok, Director/CFO [email protected], +6016-888-6696

How they describe themselves: Pennyminder provides tools that help small groups manage shared finances in a new and open way that has never really been possible before.

We are focused on three initial markets:

1) Consumer groups such as families, roommates, clubs, etc.

2) Financial institutions that are looking for a PFM platform that will allow them to reconnect with users who no longer come into branches to do their banking.

3) Working professionals and companies that track expenses on a per client basis or that help clients manage their finances.

What they think makes them better: The social networking and sharing features of Pennyminder allow us to map our real world financial relationships in a way that provides balance between shared responsibility and privacy. They give financial institutions a compelling platform that allows them to reconnect with their users, understand their needs better and thus present products and services that meet those needs.

Contacts:

Bus. Dev., Sales and Press: Vince Hodges, Founder, [email protected], 604-603-1741

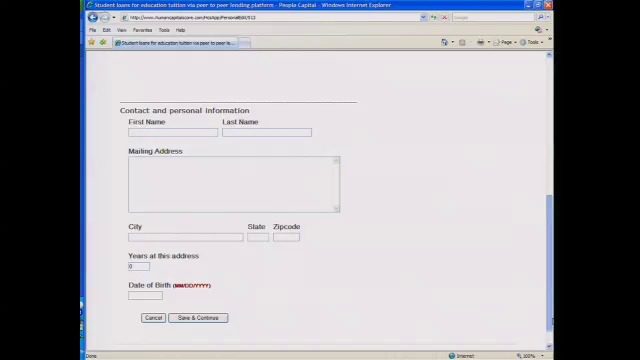

How they describe themselves: People Capital provides a peer-to-peer (p2p) lending platform to match students with college funding sources — be they individual investors, philanthropic/affinity groups or financial institutions.

Our patent pending Human Capital Score underwrites students without credit history, FICO scores or co-signers by projecting individual income levels and ability to pay indebtedness. We incorporate GPAs, standardized test scores, college and major to provide a true and unbiased, data-driven measure of the economic value of an education.

What they think makes them better:

- Our Human Capital Score measures income potential, unlike traditional measures.

- We maximize confidence in borrower authenticity, verifying student enrollment status and earmarking disbursements for schools.

- We provide institutional-quality credit risk and analytical tools for all lenders, plus the data and analytics for smart lending decisions.

- We give institutional lenders a new opportunity to create a unique portfolio of individually selected student loans — with all the underlying data.

Contacts:

Bus. Dev., Sales and Press: Al Alper, President, [email protected], 212-725-2295 x13

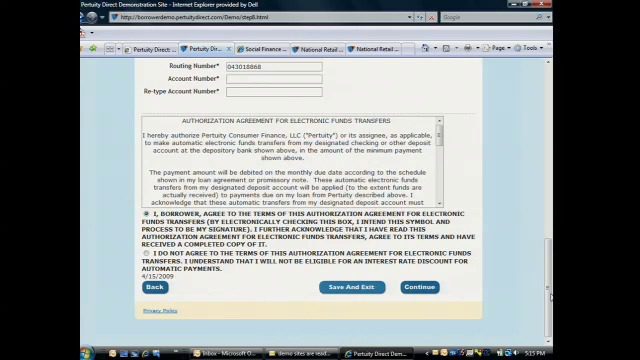

How they describe themselves: Pertuity Direct is a social lending network that brings peer to peer lending to the mainstream consumer through a unique model that delivers instant diversification, liquidity and simplicity – along with compelling interest rates for both borrowers and lenders. Pertuity is built on a community of borrowers and lenders, yet at its foundation is a financial services company with sound credit risk management practices. The heart of Pertuity’s model is aggregating borrower demand and lender supply, and working with a family of mutual funds that deploy capital efficiently.

What they think makes them better: Pertuity Direct is transforming the social lending space by combining social lending with the risk management of a regulated financial services company. Because lenders don’t need to select individual borrowers, perform credit and pricing assessments on their own, or bid on loans, it is a simpler and more intuitive process geared toward generating appeal among mainstream consumers. Lenders determine their asset investment, and then can track borrowers’ stories within the community. The mutual fund model gives lenders automatic borrower diversification, along with a liquidity option that gives them access to their money without having to wait for borrowers to repay their loans.

Contacts:

Bus. Dev. & Sales: Lisa Lough, [email protected], 703-942-5058 ext 225

Press: Ginger Lennon, Racepoint Group, [email protected], 781-487-4640

How they describe themselves: Portfolio Monkey develops investment tools to help investors optimize portfolios, assess risk, and develop investment/trading ideas. We help answer not just, “What is a good investment idea?,” but also, “What is a good investment idea for my portfolio?” Portfolio Monkey provides simple-to-use tools that do the heavy lifting to analyze correlation, evaluate risk, and produce recommendations.

Portfolio Monkey empowers (without overwhelming) average investors and traders with tools traditionally only accessible by professional investors. Portfolio Monkey also offers a suite of customizable tools that financial service providers can make available directly to their users.

What they think makes them better:

Portfolio Monkey provides the first consumer-focused tool for portfolio optimization. Portfolio Monkey’s proprietary models are based in part on modern portfolio theory and can be customized for individual preferences and market conditions. Portfolio Monkey’s flagship Optimization Tool is offered through a simple, web-based interface and is free for consumers.

Contacts:

Bus. Dev. & Sales: David Chen, Co-Founder, [email protected]

Press: Jay Liao, Founder, [email protected]

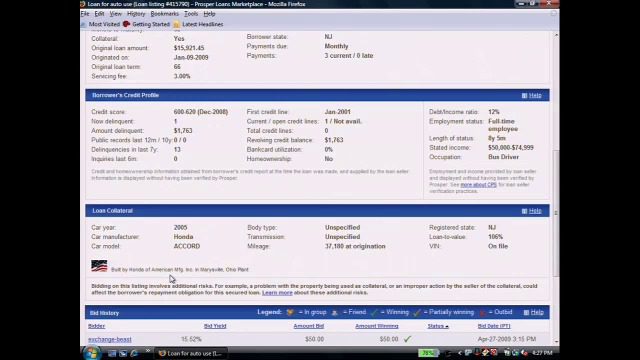

How they describe themselves: Prosper was created to make consumer lending more financially and socially rewarding for everyone. Prosper users list and bid on loans using Prosper’s online auction platform. Borrowers create loan listings and set the maximum rate they are willing to pay a lender. Prosper lenders set the minimum interest rate they are willing to earn and bid on loan listings they select. They can consider borrowers’ personal stories, endorsements from friends, and group affiliations. Then the auction begins as lenders can bid down the interest rate. Once the auction ends, Prosper combines the bids with the lowest rates into one loan to the borrower and handles all on-going loan administration tasks. Prosper generates revenue by collecting a one-time 2% to 3% fee on funded loans from borrowers, and assessing a 1% annualized loan servicing fee to lenders. Prosper’s marketplace platform is patent pending.

What they think makes them better: Prosper is the only auction-based people-to-people lending marketplace where borrowers and lenders – not the company – decide who gets funded and at what rate. Prosper is uniquely transparent. All Prosper marketplace data is made publicly available via a real time API, data downloads and robust performance tools.

Contacts:

Bus. Dev. & Sales: Klaudette Christensen, VP Bus. Dev., 415-593-5415, [email protected]

Press: Tiffany Fox, Communications Director, 415-593-5416, [email protected]

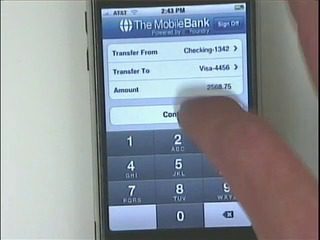

How they describe themselves: mFoundry provides a comprehensive mobile banking and payments solution for banks, credit unions, processors and operators. With specific programs for financial institutions of all sizes, the out-of-the-box platform supports full service mobile banking and mobile payments and serves as an ideal foundation for mobile wallets. The platform has been adopted by some of the largest banks, mobile operators and bank technology providers in the U.S. mFoundry is based in the San Francisco Bay Area and has been recognized as one of “10 Emerging Wireless Players to Watch” by IDC as well as the top “Tech Company to Watch” by Bank Technology News. For more information on mFoundry, please visit www.mfoundry.com.

What they think makes them better: mFoundry offers a cross-platform, cross-carrier solution running on Java, BREW, BlackBerry, iPhone and other platforms across all major US carriers. Our products have the richest security features available in the market and can support a bank’s specific security model.

Contacts:

Bus. Dev. & Sales: Carlo Cardilli, 415.324.5004, [email protected]

Press: Diane Hong, 415.944.8551, [email protected]