How they describe themselves: Intuit Inc. is a leading provider of business and financial management solutions for small and mid-sized businesses; financial institutions, including banks and credit unions; consumers and accounting professionals. Its flagship products and services, including QuickBooks®, Quicken® and TurboTax®, simplify small business management and payroll processing, personal finance, and tax preparation and filing. ProSeries® and Lacerte® are Intuit’s leading tax preparation offerings for professional accountants. The company’s financial institutions division, anchored by Digital Insight, provides on-demand banking services to help banks and credit unions serve businesses and consumers with innovative solutions. More information can be found at www.intuit.com

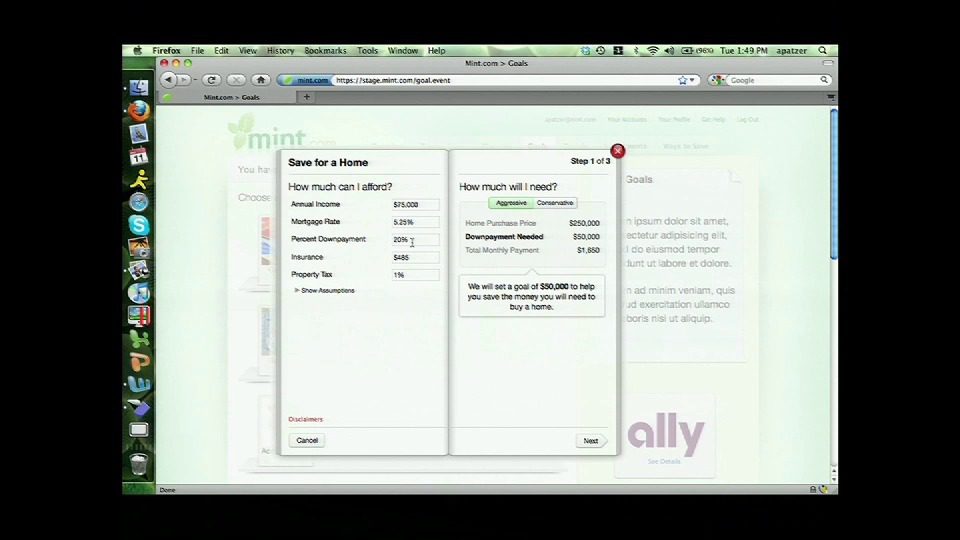

What they think makes them better: Mint.com is a leading online personal finance service from Intuit Inc., providing over 2 million users a fresh, easy and intelligent way to manage their money. And it’s free. Launched in September 2007, Mint.com has quickly grown to track nearly $200 billion in transactions and $50 billion in assets and has identified more than $300 million in potential savings for its users.

Contacts:

Bus. Dev.: Carrie Cronkey, Director, Business Development and Strategy, [email protected]

Sales: [email protected], 888-344-4674, Option 6

Press: Martha Shaughnessy, VP, Atomic PR, 415-593-1400 x235, [email protected]