How they describe themselves: Qapital is pioneering a unique value proposition with the combination of PFM, Safe Balance, and event-based Savings & Goals in one integrated application.

All of this delivered through building a compelling user experience on top of smart logic and best-of-breed commercial third-party API’s and platforms.

Qapital is currently live in the Swedish market and closed beta in the US with launch scheduled for Q4 2014.

How they describe their product/innovation: Qapital for iPhone − a unique app that provides answers to the following three questions:

- How much money can I spend?

- How am I spending my money?

- How can I achieve the things that really matter to me?

The knowledge contained in the PFM transaction data is leveraged to create smart and inspiring ways to show how much you are able to spend as well as how to achieve your goals through savings.

Here are some examples of the smart and inspirational features:

- You’ve spent less on taxis than usual this month; do you wish to transfer the surplus to your ski trip goal?

- Tax yourself a dollar toward your new guitar every time you buy a beer.

- Yes, you can afford that sweater if you skip five coffees at Starbucks!

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions, licensed

Contacts:

Bus. Dev., Press & Sales: George Friedman, CEO, [email protected],

+46 70 432 6737

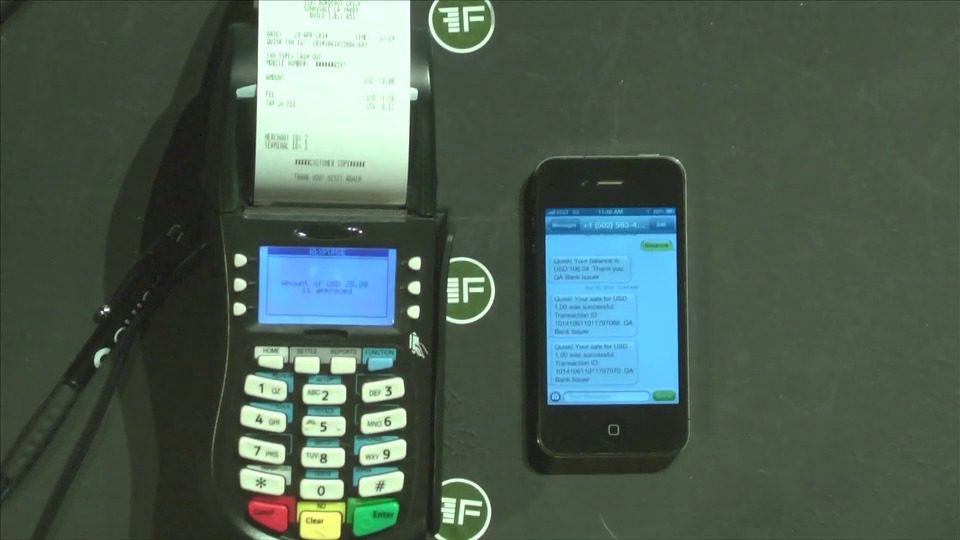

How they describe themselves: Quisk is a global technology company that partners with financial institutions and others to digitize cash and provide safe, simple and secure financial services and cashless transactions for anyone with a mobile phone number. Quisk is the quick and easy way for everyone to use money.

Deploying patent-pending, cloud-based technology, the Quisk platform not only works with any mobile phone number on any type of mobile phone, but also leverages existing Point-of-Sale (POS) infrastructure. Quisk headquarters are in Silicon Valley with additional offices in Louisville, KY and Dubai, U.A.E. Learn more at quisk.co.

How they describe their product/innovation: Quisk is the first company to be sanctioned by a central bank for an all-digital bank account with complete and secure banking functionality. Quisk is demonstrating various use cases from its cloud-based digital services and transaction-processing platform. The patent-pending Quisk technology utilizes the consumer’s mobile phone number and secured PIN to create and access a new type of payment account, domiciled at a bank or other financial institution. Quisk enables special transaction processing and balance limits to facilitate compliance with Know Your Customer (KYC) and state-of-the-art risk management.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions

Contacts:

Bus. Dev. & Sales: Bill Baustien, SVP US Sales, [email protected]

Press: Dan Glessner, CMO, [email protected]

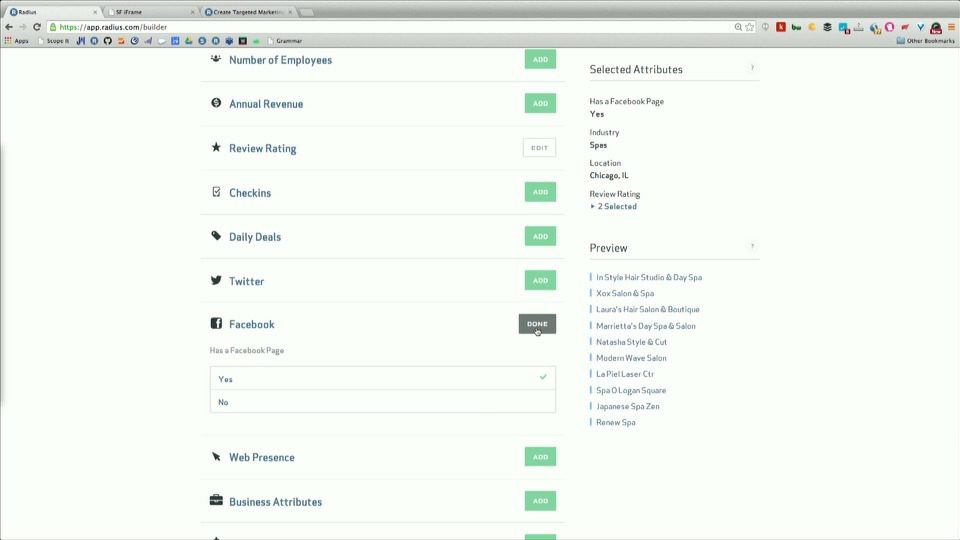

How they describe themselves: Radius: The Modern Way to Market to Small Businesses.

Unlock your best SMB customer segments, create targeted lead lists, and measure campaign successes.

Employing Big Data technology to deliver insights on more than 27 million US businesses, Radius helps modern marketers identify their ideal small business customer segments, launch highly targeted marketing campaigns, and measure results in real time.

How they describe their product/innovation: With Radius, you can connect your prospect and customer data to our living, breathing database of 27 million SMBs in the United States. Analyze your customers based upon hundreds of business attributes to define your best market segments. Once you’ve defined your best customers, create look-alike lead lists, deploy campaigns, and measure conversion.

Product Distribution Strategy: Direct to Business (B2B)

Contacts:

Bus. Dev.: John Metcalf, Bus. Dev., [email protected]

Press: Darren Waddell, VP Marketing, [email protected]

Sales: Tom Mills, VP Sales, [email protected]

How they describe themselves: Realty Mogul is crowdfunding for commercial real estate – a marketplace for accredited investors to pool money online and buy shares of real property like office buildings, apartment buildings and retail shopping centers. Realty Mogul gives thousands of investors tools to browse investments, do due diligence, invest online and have 24/7 access to an investor dashboard to watch how their investments are performing. Realty Mogul partners with private real estate companies to source quality deal flow and curate all the investments. For these real estate companies, they have access to a broader capital pool and tools to do investor reporting, investor communication and distributions.

How they describe their product/innovation: Realty Mogul is crowdfunding for real estate, the world’s largest online marketplace for real estate investing. Investors are empowered by investor dashboards that standardize and streamline real estate investments across different real estate companies, countless geographies, real estate property types and the entire real estate capital stack. These dashboards allow investors 24/7 access to watch how their real estate investments are generating passive income for them.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B)

Contacts:

Bus. Dev.: Jilliene Helman, CEO, [email protected]

Press: Jay Samit, Chairman, [email protected]

Sales: Austin Fan, VP Investments, [email protected]

How they describe themselves: Red Giant is dedicated to giving you the control you deserve over your everyday spending. We know that better-informed people make smarter purchasing decisions, and making wiser decisions every day puts you in a stronger financial position over time. We have approached everyday financial management in an entirely new, proactive way − bringing you the right information in an easy-to-use form at exactly the right time. Using innovative, patented technology and user-centered design we have taken ordinary payment cards and added intelligence, flexibility, and security that have never before been available to consumers.

How they describe their product/innovation: Red Giant’s groundbreaking service gives you financial control and security you have not had until now. Red Giant keeps your debit card locked until you are ready to use it. And when you want to make a purchase you just use the mobile app to unlock your card with the touch of a button.

When you unlock your Red Giant card it works just like any other card, only better. You get instant receipts, immediate balance updates, and a real-time picture of your actual spending compared to your goals − right on your smartphone.

You can use your Red Giant physical card anywhere standard cards are accepted. Red Giant Digital cards − shown securely in our mobile app − let you separately control your online purchases.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions

Contacts:

Bus. Dev., Press & Sales: Robert Sears, CEO, [email protected]

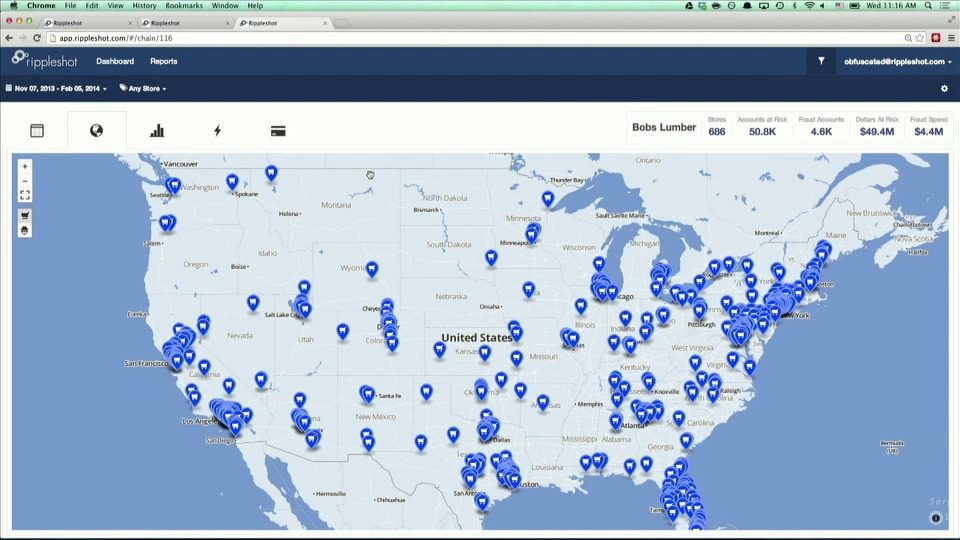

How they describe themselves: Rippleshot protects consumer credit information and the integrity of the merchant payment network by proactively detecting credit card data breaches through a cloud-based solution. Rippleshot’s technology monitors point-of-sale terminals 24/7 to quickly detect a data breach and pinpoint when and where the breach occurred. Our risk management and analytics platform helps issuers and merchants mitigate fraud, stop losses, protect brand reputation, and safeguard the consumer payment experience.

How they describe their product/innovation: Rippleshot technology scans credit card transactions across the entire payment network profiling merchant transactional behavior and looking for suspicious patterns. When fraudulent activity occurs on the network, Rippleshot can quickly sort through hundreds of millions of credit card transactions to quickly identify the compromised point of purchase that all the fraudulent cards have in common. Since fraudulent spending with compromised cards takes place over weeks and months, quick detection helps banks reissue cards and stop fraud before it occurs, thereby saving over 25% in potential fraud losses.

Contacts:

Press: Canh Tran, CEO & Co-Founder, [email protected]

Sales: Lucas Ward, COO & Co-Founder, [email protected]

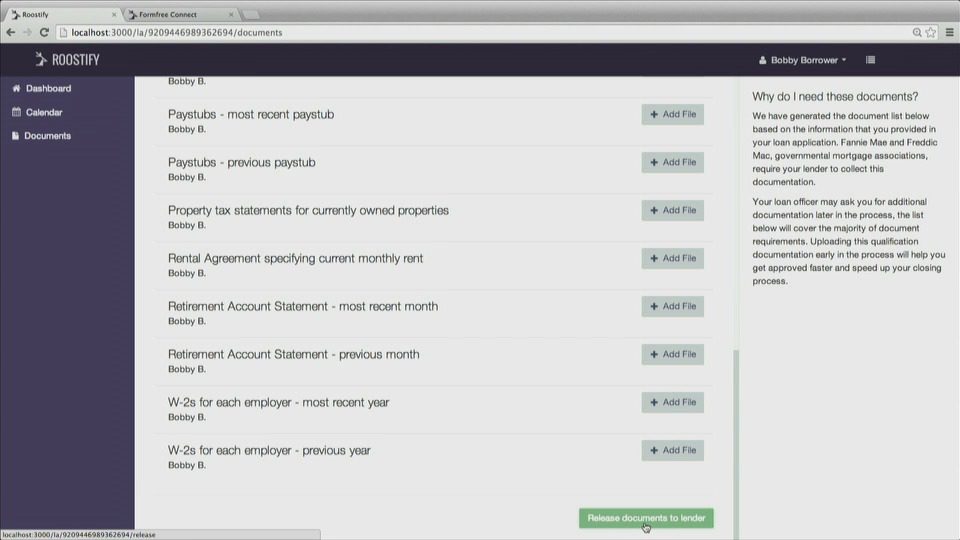

How they describe themselves: By accelerating and demystifying the home loan and closing processes and increasing the accountability of everyone involved, Roostify helps lenders process loans faster and reduce risk while creating a better, less stressful experience for people who are buying homes.

Roostify was founded by three technologists frustrated with their individual home buying and re-financing experiences who believed there was a more efficient and open way to complete transactions. Drawing on the expertise of real estate and mortgage banking veterans, Roostify provides a new web and mobile service that benefits agents, lenders, and home buyers. Roostify is headquartered in San Francisco, California and is backed by private investors.

How they describe their product/innovation: Roostify offers a web and mobile service designed to enhance home financing, making it easier for buyers and lenders to navigate the frustrating and time-consuming process to apply for and close a mortgage. Developed by technology, real estate, and mortgage banking experts, Roostify’s secure interface allows borrowers to easily apply for a mortgage and all parties involved to share and track information, documents, and transactions seamlessly – leading to a faster and smoother mortgage closing.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions, through other fintech companies and platforms

Contacts:

Bus. Dev. & Press: Richard Berman, Marketing, [email protected]

Sales: Rajesh Bhat, CEO, [email protected]

How they describe themselves: SaveUp is a financial services leader engaging Millennials and Gen Y in personal finance through the use of positive behavioral economics and gamification. SaveUp’s “gummy vitamin” approach to financial services is working to help consumers rebuild millions of dollars in savings and reduce debt post-recession. With application in financial services such as banks, credit unions, and PayPal, as well as in the student loan and employer markets, SaveUp is demonstrating that helping consumers succeed financially can be great business for everyone.

How they describe their product/innovation: SaveUp is the first rewards program for saving money and reducing debt with the opportunity to win life-changing prizes and merchant-funded rewards. SaveUp is the “gummy vitamin” of personal finance generating unprecedented engagement with personal finance among Millennials. Six months after signing up, the average user links 6 – 8 accounts, and of these 20% are daily active users and 60% monthly actives. SaveUp users are engaged to learn about new financial products, seek financial guidance from CFPs, access financial education, and make better financial decisions. Personalization is based on data. SaveUp is a highly flexible, customizable platform that drives engagement and retention in different financial service verticals. SaveUp is premiering the iPhone app at FinovateSpring 2014.

Product Distribution Strategy: Direct to Consumer (B2C), through financial services channels including: banks, credit unions, digital wallet, prepaid, student loan, and employee wellness

Contacts:

Bus. Dev., Press & Sales: Christian DeHoyos, Partnerships Manager, [email protected]

How they describe themselves: SmartAsset uses patent pending technology to provide personalized, automated answers to life’s biggest personal finance questions. Aggregating data from more than 130 sources and partners, SmartAsset is the Web’s first personal finance platform designed to empower people with the data and analytical tools they need to make significantly better financial decisions. SmartAsset currently helps people answer 79 questions on topics like home buying, going back to school, retirement planning and more. Founded in 2011, SmartAsset is based in New York and funded by Y Combinator, Javelin Venture Partners, North Bridge Venture Partners and many others.

How they describe their product/innovation: SmartAsset is launching its mobile application at FinovateSpring 2014. For Apple and Android, SmartAsset mobile users will have all of the functionality afforded by our web application at their fingertips.

Product Distribution Strategy: Direct to Consumer (B2C), Business to Business to Consumer (B2B2C), through financial institutions, through other fintech companies and platforms

Contacts:

Bus. Dev. & Sales: Michael Carvin, CEO, [email protected]

Press: Michael Carvin, CEO, [email protected] &

AJ Smith, Managing Editor, [email protected]

How they describe themselves: Spreedly is a credit card vault in the Cloud that provides all the benefits of tokenization without ever having cards locked into any payment gateway or third-party service. Our credit card vault allows businesses to securely tokenize and store credit card information in the Cloud for single and repeat transactions across any of our 50+ supported payment gateways. Launched in March 2013, we’re a seven-person angel-funded startup in Durham, NC. Our more than 150 customers include SaaS commerce platforms, billing and booking solutions, fintech payment services, and mobile and marketplace offerings.

How they describe their product/innovation: Prior to today, Spreedly could take a stored card and pass it against a Spreedly integrated payment gateway. With today’s announcement three new things are happening. Firstly, customer’s can create their own end points to which they want to pass cards. No more relying on Spreedly to do the work. Secondly, those end points can be more than just payment gateways. Think of it as an industry API for consuming card data (hotel, ticketing, restaurant, and transportation). And thirdly, customers can use Spreedly to automatically update cards across 60+ gateways, which means no more lost revenue from lost or expired cards.

Product Distribution Strategy: Direct to Business (B2B)

Contacts:

Bus. Dev.: Justin Benson, CEO, [email protected], 919-335-3570

Press: Lacy Williams, [email protected], 206-915-8771

Sales: Brendon Prebble, [email protected], 919-717-0459

How they describe themselves: Millions of people spend $100 to buy an iPod but have never had a shot at owning $100 of Apple stock. We make stock ownership easy, affordable, and fun so anyone can collect their favorite brands and build wealth for their future. Stockpile is tapping into that “pride of ownership” gene we all have and changing the face of stock ownership forever.

How they describe their product/innovation: For the first time ever, people are able to give a Gift Card of Stock for birthdays, graduations, Bar Mitzvahs, Christmas, and other occasions. Pick a company and dollar amount (say $50 of Apple) and pay with your credit card. The recipient gets their stock by entering a claim code and either logging into their Stockpile account or signing up for one.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B)

Contacts:

Partnerships: [email protected]

Press: [email protected]

How they describe themselves: We bring basic mobile and online banking products closer to consumers’ lives. Our innovative, lifestyle-focused benefits enhance basic banking services, connecting better with how consumers use their mobile phones and the web every day. The payoff to our financial institution clients is higher retention of their best customers, more engaged customers, and significantly more fee income by smartly fixing the unprofitability of shallow customer relationships – all while delivering benefits that are extremely relevant and rewarding to customer lifestyles.

How they describe their product/innovation: BaZing delivers non-banking benefits like 300,000+ local and national merchant discounts, cell phone insurance, and roadside assistance via customizable and easy-to-integrate mobile and online platforms. In today’s consumer marketplace, there are millions already paying for these money-saving and personal protection-oriented benefits, proving these benefits are worth paying for. BaZing uses this fee worthiness to provide a customer acceptable fee-based mobile and online banking solution. BaZing’s innovation and financial productivity enhances commoditized mobile and online banking, undifferentiated consumer checking products.

Product Distribution Strategy: Through financial institutions, through other fintech companies and platforms

Contacts:

Bus. Dev., Press & Sales: Mike Branton, Managing Partner, [email protected], 919-349-2001