HCE (host card emulation) experts and providers.

Presentation

Host Card Emulation

Overview of SimplyTapp’s HCE solution and offering.

Finovate is part of the Informa Connect Division of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

HCE (host card emulation) experts and providers.

Host Card Emulation

Overview of SimplyTapp’s HCE solution and offering.

Sekur.me eliminates user IDs and passwords securely by turning your phone into your digital identity. It also brings the convenience of Single-Click eCommerce purchases to smartphones, where tiny keyboards make it hard to type. Checkout and pay in 9 seconds.

Want to be secure? Eliminate passwords!

If you don’t have a password, it cannot be stolen. See a live demo of a patented disruptive technology taking security to the next level, while making login safer and simpler. And see how it can be used to secure payments and reduce shopping cart abandonment for eCommerce and mCommerce.

Tradier is a financial services cloud provider that offers a groundbreaking solution to serve platform providers, developers and investors. The Tradier solution features an innovative set of fully hosted APIs, modules and “out of the box” tools that are leveraged by a growing list of providers.

An API Like Never Before – Do What Matters and the Rest Is Already Done

Have you ever tried to build a financial market app? It is painful and just about impossible. Too many data, trading, platform and process barriers. Tradier has done all that heavy lifting for you. An API that abstracts the pain and delivers the gain.

How they describe themselves: SAS Games is the developer of the award-winning TiViTz education-based strategy games used by more than 400,000 students and 10,000 teachers nationwide. TiViTz is adaptable to multiple platforms, themes, subjects, skill levels, and languages. The TiViTz games have proved effective in engaging kids and preparing them for exciting TiViTz Tournaments. SAS Games has partnered with Cal Ripken, Jr. and Ripken Baseball to develop TiViTz Tournaments nationwide hosted by Major League Baseball teams and with McDonald’s to implement TiViTz Tuesdays starting in Florida. The company has now developed a fully automated, easy-to-use, patent-pending, game-based fundraising tool that helps children raise significant funds for their college savings accounts.

How they describe their product/innovation: The TiViTz College $avings Game-a-thon is a market disruptive tool that complements existing financial savings vehicles and provides a solution for families to offset potential student loan debt and help cover the cost of higher education. The Game-a-thon (where students solicit pledges online from friends and family for playing TiViTz games) is similar to a Walk-a-thon fundraiser, only fully automated from pledge solicitation to fund deposit into a savings vehicle. The Game-a-thon is positioned to fundamentally change the way families think about affording college and to significantly empower children to take responsibility for and contribute to their own advanced education… all while improving their math skills and financial literacy.

Product distribution strategy: Direct to Consumer (B2C), through financial institutions, through other fintech companies & platforms, licensed

Bus. Dev.: Siobhan Mullen, Founder & CEO, [email protected], 321-690-3386

Stephen Scully, Founder & President, [email protected], 321-690-3386

Press: Rob Volmer, Crosby Volmer International Communications, [email protected], 202-232-6575

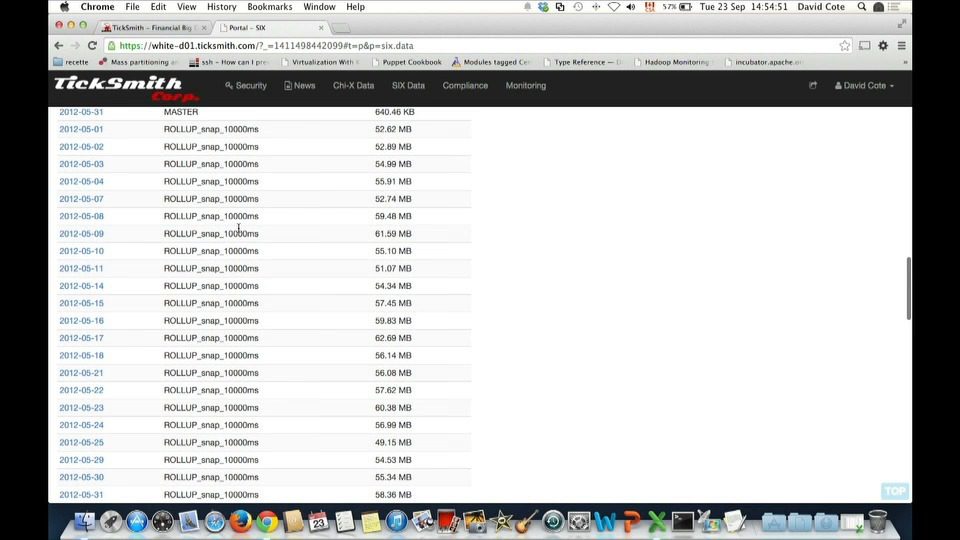

How they describe themselves: TickSmith is a Montreal-based fintech company that was founded by seasoned financial technology experts who saw a need for better data management solutions. TickSmith has built the first commercial platform for financial big data, providing financial institutions untold new opportunities to work with large quantities of financial data.

How they describe their product/innovation: TickSmith is presenting its TickVault and FIXVault financial big data platforms. TickSmith’s platforms provide specific solutions to participants in the brokerage and trading ecosystem, from exchanges to financial institutions, vendors, and regulators. Offered as cloud services and managed platforms, these solutions are disrupting financial data management practices and providing new opportunities to exploit financial data. TickSmith’s customers and partners use these platforms as data distribution portals, add ons to trading networks, management and analytics tools, and in compliance applications.

Product distribution strategy: Direct to Business (B2B), through other fintech companies and platforms

Bus. Dev.: Francis Wenzel, CEO, [email protected], 514-463-6682

Press: Ray Graber, [email protected], 781-221-0018

Sales: Linda Biagi, Partner Global Sales, [email protected], 646-765-8358

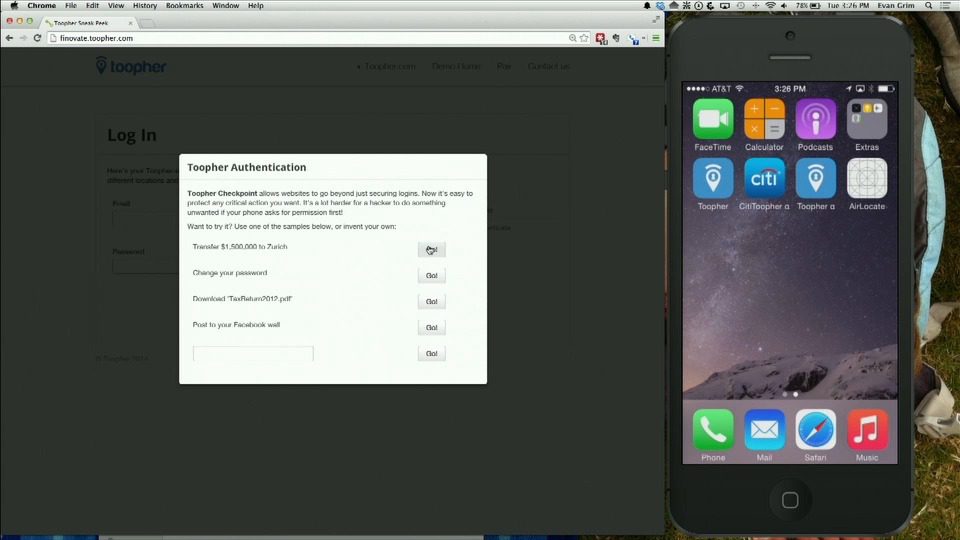

How they describe themselves: Toopher is the most secure, most usable form of two-factor authentication available today. Using the location awareness of a mobile device, Toopher can automate the user’s normal behaviors in locations they deem safe like home or work. Toopher has two solutions: for internal facing use cases, Toopher protects a financial institution’s workforce, and for external facing use cases, Toopher protects the financial institution’s customers and their accounts. Toopher goes beyond just logins and maps onto any critical action including account provisioning, money transfers, deposits, and withdrawals.

How they describe their product/innovation: Toopher Access will allow clients to provide their customers with invisible authentication for logins and critical actions. Toopher Touch incorporates biometrics into the authentication process and Toopher Halo offers seamless deauthentication based on powerful geofencing technology. When the user leaves a specified geofence, Toopher will log them out automatically, ensuring full session security.

Product distribution strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed

Contacts:

Bus. Dev. & Sales: Brian Panteledes, Sales Director, [email protected]

Press: Laura Beck, PR Coordinator, [email protected]

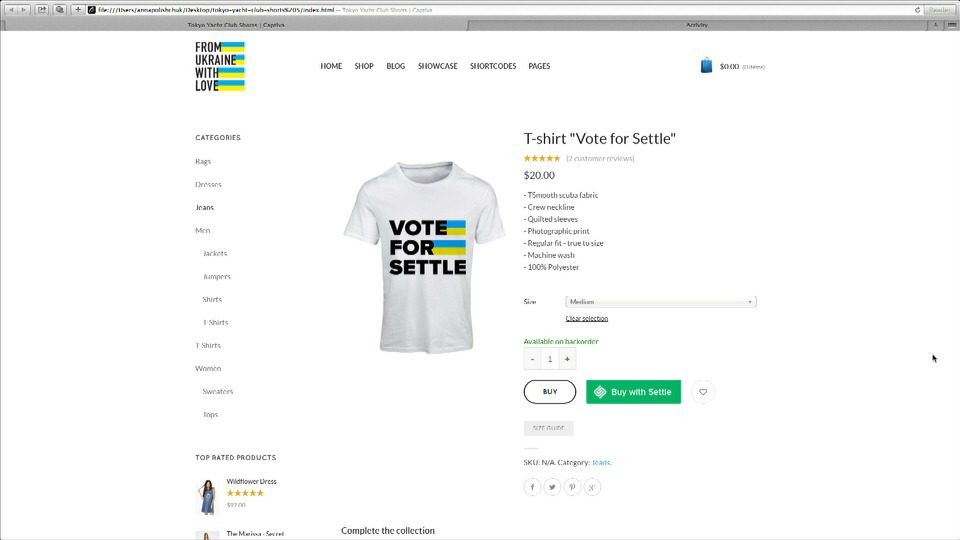

How they describe themselves: Combining mobile payments and a loyalty scheme in one app, Settle makes it possible to both order and pay through a smartphone. It allows clients to make preorders, pay, carry out P2P cash transfers, and get personalized offers. Merchants receive a Settle tablet and an accompanying app that enables them to accept and manage orders, view guests’ profiles, and monitor their activity. The back office system shows detailed analytics and offers tools for communication with customers. The technology provides significant benefits to merchants including faster turnarounds, higher tips for servers, and more targeted marketing to customers based on their paying behaviour. Currently working at restaurants, online and offline retail, and fuel stations.

How they describe their product/innovation: The Settle technology comes in 3 forms: 1) Customer app that allows users to make orders, pay, get loyalty bonuses and offers from establishments, and carry out P2P transactions, 2) A Settle tablet with an accompanying app that enables accepting and managing orders, viewing customers’ profiles and offering personalized customer service, 3) A merchant dashboard with a smart analytics of sales, staff performance, and a rich customer CRM. Settle provides its POS solution for merchants and can be integrated into merchant’s existing POS system as well. Settle can offer white label solutions for bank apps and provide small personal loans.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions

Bus. Dev. & Sales: Stas Matviyenko, CEO, [email protected]

Denis Gulagin, CFO, [email protected]

Press: Victoria Mikhailenko, [email protected]

How they describe themselves: SelfScore.com is a consumer analytics company working on a disruptive idea that will supplement FICO scores using our “scoring as a service” and “data as a service” models. Financial metrics are often used to inform a wide array of business decisions today. However, scores such as FICO are limited in their scope and are regularly misapplied in a variety of situations. Simply put, creditworthiness is often misused as a substitute for credibility. Going forward, SelfScore is able to measure consumers in better ways using more information.

How they describe their product/innovation: SelfScore.com is a consumer analytics service that uses a proprietary algorithm to combine online profiles, phone and sensor data, psychometric questions, and 360 degree feedback from one’s network to provide insights to users and contextual information to businesses. We believe that with new advances in the social web and smartphones, it is now possible to attain a complete, timely, and accurate picture of consumer behavior that benefits both consumers and businesses.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed

Bus. Dev. & Sales: Kalpesh Kapadia, CEO & Co-Founder, [email protected],

650-796-1184

Press: Pat Nicholson, CMO, [email protected], 408-410-6823

How they describe themselves: Sender is a young startup that was founded 1 year ago. The main product is the Smart Contact List – Sender Application – the first messenger for businesses enabling direct chat communication with customers.

Sender has only 1 but very large and demanding customer – PrivatBank (Ukraine) – 1 of the top 8 largest banks in Eastern Europe, serving more than 35M customers. PrivatBank is not just a bank, but the largest IT company in Ukraine. PrivatBank has won “Best of Show” twice at Finovate (2011 & 2014) for demoing cutting-edge innovations. This time PrivatBank acts as a partner and as the first customer of the incredible service, Sender.

How they describe their product/innovation: People communicate with each other via chats with similar interfaces. Businesses communicate with people via Apps with various unique interfaces and UX.

Sender:

Sender is like Google’s Search Bar with endless possibilities. It is the first messenger for businesses enabling direct chat communication with customers. Instead of tons of applications, use Sender – the last and only App.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through other fintech companies and platforms

Bus. Dev.: Max Popov, [email protected]

Press: Egor Avetisov, [email protected]

Sales: Kristina Chaykovskaya, [email protected]

Maria Gurina, [email protected]

How they describe themselves: The amount of data on the web is exploding. Thinknum allows analysts to access this data when building valuation models. Users can collaborate within their team or with anyone in the world to analyze financial securities.

How they describe their product/innovation: There are many financial technology corporations that specialize in writing data to users. However, as financial analysts, we saw firsthand how there is no software to manage and leverage the content we created. So we built Thinknum, enabling analysts to take advantage of collaboration tools and cloud computing to build better financial models.

Product distribution strategy: Direct to Business (B2B), through financial institutions

Bus. Dev. & Sales: Justin Zhen, Co-Founder, [email protected], 917-251-6176

Press: Justin Zhen, Co-Founder, [email protected], 917-251-6176

How they describe themselves: Top Image Systems (TIS) is a public company quoted on the NASDAQ (TISA) stock exchange with offices in most regions of the world. The company is known for intelligent document and mobile capture solutions that automate document and data processes, which extend across industry sectors. In recent years, TIS has invested in R&D to develop a mobile imaging platform and various mobile capture applications, which has resulted in several products including check deposit and bill payment applications. Interest has been significant, especially in financial services.

How they describe their product/innovation: We’re demonstrating an integrated part of omni-channel approach to capturing the necessary information in the enrollment and account opening process. Showcasing the flexible and extensible Mobile SDK and Webservices APIs in MobiFLOW™ on the server, the demo shows a sample bank application that a retail or commercial banking officer might use on a tablet while wearing Google Glass to capture information off of documents typically used in the account opening process. While showing only a few examples, we are also discussing how Google Glass leverages the same technology in TIS’ in-market mobile phone and tablet solutions, allowing a user to easily switch between these devices for the best user experience.

Product distribution strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed

Bus. Dev.: Jim Charanis, Mobile Solutions Director, [email protected]

Press: Chelsea Camille, Field Marketing Manager, [email protected]

Sales: Avi Mileguir, EVP & GM, [email protected]

How they describe themselves: It is a payment system that provides a secure, chip-based debit card, a card reader that connects to any smartphone or tablet, and an app for managing transactions. Sr. Pago enables individuals and small businesses to have access to banking related services without having to formally enter the regulated banking system in Mexico. While it is available to consumers and small businesses in Mexico with traditional bank accounts, it sees the greatest opportunity for impacting the “unbanked” population in Mexico. The unbanked segment comprises approximately 70% of the population.

How they describe their product/innovation: With Sr. Pago, small businesses and individuals can both accept card payment for services they render and then have that money loaded onto a card that can be used anywhere MasterCard is accepted. It seeks to provide a secure ecosystem for a population that has been subjected to the high fees associated with check cashing, the inconveniences of using convenience stores to perform basic banking functions, and the security risks of carrying cash for everyday transactions.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B)

Press: Ashley Waters, Account Executive, [email protected]