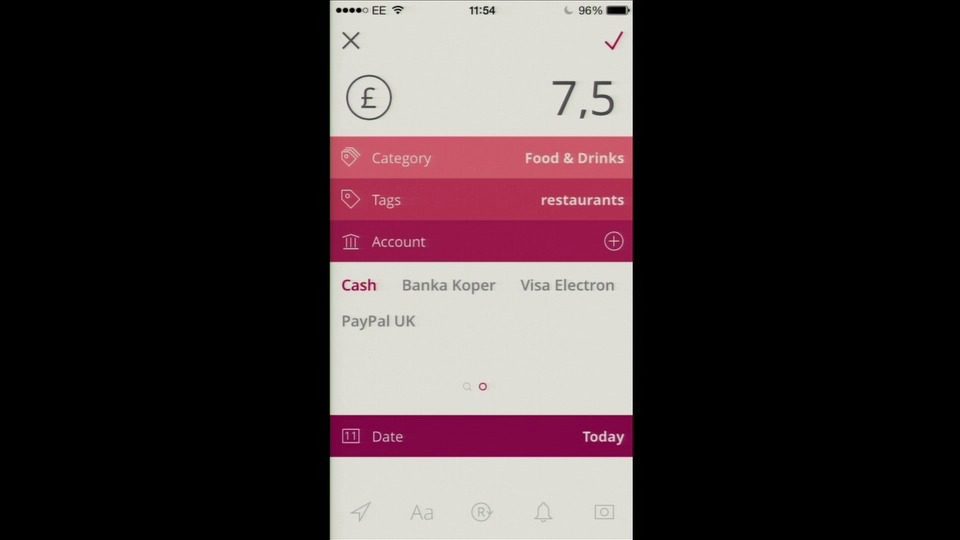

How they describe themselves: The Moneyer is the future of online Personal Finance Management, now. Through a combination of a highly advanced budget book, planning tools, a collaborative workspace and social network the platform occupies a unique position which is defined by our continuous pursuit of innovation. The Moneyer is and will always remain the most advanced personal finance management platform in existence.

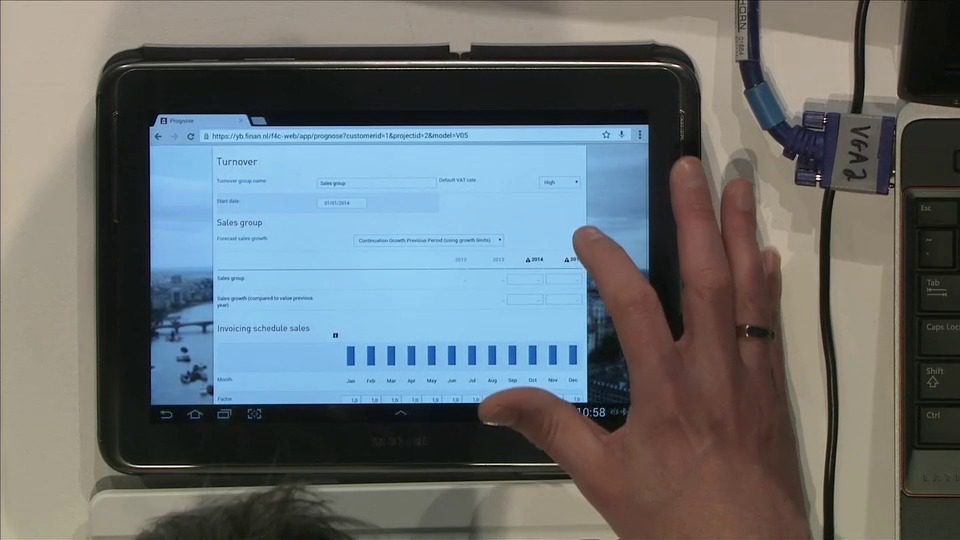

How they describe their product/innovation: Finance is often a highly personal matter, but there are many cases thinkable where a person or organisation needs to share financial information with others. The Moneyer offers the possibility to invite other users (member and non-members) on an existing financial dashboard. Thereby creating a collaborative workspace where groups of people can view and work with shared data.

Product Distribution Strategy: Direct to Consumer (B2C), through financial institutions, licensed

Contacts:

Bus. Dev. & Press: Erik Driessen, CEO, [email protected]