After an inspiring trip to FinovateEurope, being completely immersed in new technology such as voice/facial recognition, intuitive UIs, and hassle-free mobile payments, I was jolted back to reality when I came home and opened a letter from my bank.

After an inspiring trip to FinovateEurope, being completely immersed in new technology such as voice/facial recognition, intuitive UIs, and hassle-free mobile payments, I was jolted back to reality when I came home and opened a letter from my bank.

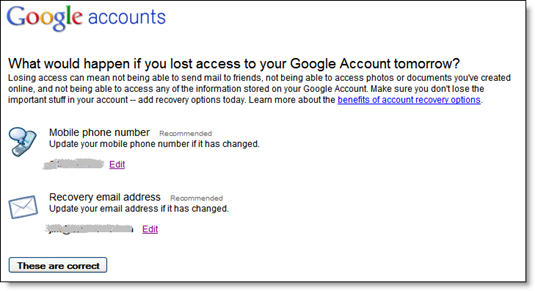

The bad news arrived in a plain-looking envelope, always a bad sign. I was told that Chase Bank was reversing a $6,000 check we’d deposited a week earlier.

I’ve seen some awful customer correspondence over the years, but this may be the topper. The bank would never send something this illegible to consumers (I hope), but I guess they think small business customers are savvy enough to understand the jargon and ignore the bad design and inconsiderate copywriting.

The bank is wrong. They can’t just grab $6,000 from a small business owner and make no effort to apologize or explain what’s going on.

Here’s the backstory:

- We deposited a check over the counter at a Chase branch that was made out in US Dollars, but drawn on a foreign bank.

- It was accepted with no questions asked by the teller and credited to our account with next-day availability.

- A week letter, the bank changed its mind, removed the money from our account, and sent the letter shown below.

I can understand putting a hold on the funds, but the utter lack of courtesy in communicating the issue is inexcusable. Ideally, the teller should have warned us about the hold period. But since that didn’t happen, the bank should have sent me an immediate email apologizing for the delay and explaining the situation in simple vocabulary.

Instead, I got an absolutely ugly letter (see below) that looks more like a Nigerian 419 scam than something a huge corporation would send.

Here are nine problems:

1. Mixed use of ALL CAPS and sentence case, bad spacing, and black & white logo, makes it hard to read, amateurish looking and potentially fraudulent.

2. "Convert Notification"

What does that mean? I’ve never heard the term before.3. "Batch – 3040743 p. 1"

Huh?4. Chase PO Box in Houston

I deposited it in a Seattle branch, why am I getting a letter from 1,900 miles away?5. "We are debiting your account"

Please no accounting jargon, just say that you took the money out.6. "We are converting your 6000.00 item to collection"

What? You are sending a collector after me? What did I do? And why is it called an "item"? And where is the $ sign?7. Reason: "Not eligible for immediate credit; new FX rate at PMT"

What? First off, stop with the abbreviations, FX and PMT. It won’t cost anything more to spell out the words. And even knowing the jargon, this particular "item" was written in dollars (but did come from an international company), so it’s a little hard to follow the logic here.8. "Industry standard for International Collections is 4-6 weeks"

What, I’m not getting the money for 4-6 weeks! Really? Why? Don’t you think we are good for it if it were to bounce. And why didn’t the person at the branch mention this in the first place?9. There nothing quite as user-friendly as a 16-digit alphanumeric confirmation number. It could at least have spaces or hyphens so I can read it.

Bottom line: This is mostly an off-topic rant about one poorly written letter. However, had the message been delivered to me electronically, it could have included links back to the original check, links to FAQs covering international deposits, or even a direct form to ask questions.

——————————

Chase letter "explaining" a deposit reversal (27 Jan 2012)

![clip_image002[10] clip_image002[10]](http://s3.amazonaws.com/finovate-archive/old/WindowsLiveWriter/NewOnlineBankingReportPublishedDeliverin_CD5E/clip_image002%5B10%5D_1.jpg)