As we begin helping

FinovateEurope 2014 presenters polish their demos for the show on February 11 and 12, we thought we’d take some time to catch up with last year’s best of show winners to see what they’ve been up to over the past 12 months.

Here are last year’s winners, in alphabetical order:

Who they are: A retail bank leader in France and Europe, with 11,600 branches worldwide, 160,000 employees and 54M customers.

What they demoed: The

Credit Agricole Store, a European app store where financial apps are co-created between clients and developers thanks to the opening bank APIs.

Demo video

What they’ve been up to:

- Celebrated the second year of its social media bank and attracted 3k banking customers.

- Harnessed banking and insurance expertise to support the cooperative group Agrial in its first listed private bond placement.

Who they are: an IT company that develops complex and innovative solutions for the banking and finance industries.

What they demoed: The

BANKTRON e-channels management platform that provides front-end users elegant, safe, and secure financial products and services.

Demo video

What they’ve been up to:

- Was recognized as Lithuania’s most advanced high-tech sector company in the elections of the Knowledge Economy Company 2013.

- Released a mobile banking app for Medicinos Bankas.

- One of the DNB Group’s Internet banks implemented BANKTRON and its newest adaptive interface.

Who they are: mBank is a financial sector innovator that offers a full range of retail and SME financial products. Efigence specializes in online banking platforms, currency trading tools, PFM tools and social and financial data aggregation tools.

What they demoed: Their online banking transactional site and implementation of Facebook and real-time consumer gratification.

What they’ve been up to:

- mBank, along with Accenture, picked up a Best of Show award at FinovateFall 2013

- mBank announced a new transactional service, new logo, premium offer for affluent customers.

- Efigence-powered Alior Currency Exchange awarded Innovation of the year 2012 title

- Efigence-powered Alior Bank won the prestigious Golden Bank 2012 title

Who they are: They offer white-label PFM and next generation online banking solutions to retail banks.

What they demoed: Their To buy or Not to buy, a white-label module for mobile banking applications. It uses PFM functionality to empower and influence consumers at the point of sale or when considering buying something.

What they’ve been up to:

- Promsvyazbank in Russia launched Meniga-powered PFM-Service

- Raised $6.5 Million (€5 Million) to further develop PFM and online banking

- BRE Bank launched its “new mBank”based on Meniga´s PFM solution

Who they are: A neobank focused on the mobile experience and aimed at both banked and underbanked consumers.

What they demoed: Their mobile banking experience along with how CredScore and their Spend, Save, Live tools will help consumers ma

nage and improve their financial health

- Launched their Android app

- Updated the iOS app

- Received $2 million investment from Life.SREDA

- Expanded the beta sign ups for the bank

- Debuted Money Pulse to help users manage day-to-day finances

Who they are: A solution that provides a platform for kids under the age of 18 to make transactions online with parental controls.

What they demoed: An e-commerce solution that enables kids to manage and spend money within a parent-controlled environment

What they’ve been up to:

- Rebranded as Oink

- Launched new iOS mobile app

- Contracted with Marvelous USA to provide its payment system on their site

- Expanded to a quarter of a million users

- Signed its first UK partners, Toy Galaxy and Toadstool

- Won The National Parenting Center’s 2013 Seal of Approval under the Websites category.

- Partnered with epay

- Received Excellence in Best Practices Award from Frost & Sullivan

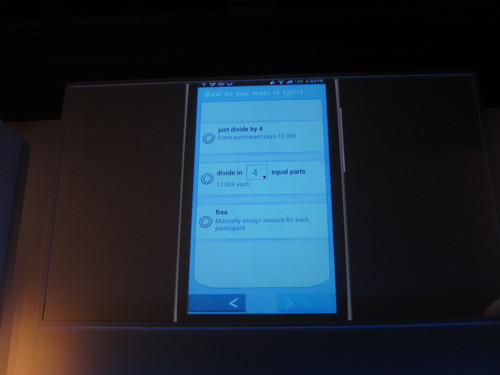

Who they are: The creator of a social payments app that helps users track and split joint expenses on-the-go.

What they demoed: Their app that helps groups manage shared finances by giving them an easy option to repay one another

What they’ve been up to:

- Launched Android app

- Presented their solution to the Bavarian Ministry of Economics

Who they are: SumUp offers an easy way for small businesses and sole traders to accept card payments securely, even on-the-go. Using only a portable card reader and an app for iOS and Android, merchants can accept card payments on their mobile device.

What they demoed: Their mobile point of sale system

What they’ve been up to:

- Expanded to Latin America with launch of m-payments service in Brazil

- Cut its transaction fee across Europe

- Received investment from BBVA Ventures to aid in expansion to South America

- Launched plug-and-play POS technology

- Received multi-million Euro investment from Amex and Groupon

- Launched in Russia and partnered with Svyaznoy Group

- Partnered with Revel Systems to facilitate card payments

- Began supporting AmEx in some European markets

To be a part of the action at this year’s FinovateEurope, get your ticket here to watch a full two days of demos and vote for who you think should win Best of Show.

This post is a part of our live coverage of FinovateEurope 2013.

This post is a part of our live coverage of FinovateEurope 2013.