Digital ID verification company IDVerse will help embedded finance platform FutureBank enhance its onboarding processes with fast and secure digital identity verification (IDV). The new partnership will let FutureBank customers to use IDVerse software and also allow IDVerse customers looking for a middleware platform to connect their API credentials take advantage of FutureBank’s technology.

An integration platform for core banking providers that features embedded financial services, FutureBank operates as a middle layer between banks and third-party providers. As such, the company helps banks and fintechs launch new solutions faster, more efficiently, and more securely. IDVerse brings not only its Identity Service Provider status to FutureBank – status that comes with 20 certifications from the U.K.’s Digital Identity & Attributes Trust Framework (DIATF). The identity verification specialist also offers technology to help businesses combat the problem of deepfake accounts, a problem made all the more challenging by the way fraudsters are exploiting tools like generativeAI.

“Generative AI is breeding many different fraud types,” FutureBank CEO Sergio Barbosa said. “With ChatGPT, fraudsters can create very authentic documents and profiles for people at a low cost.” Barbosa called cybercrime “the third biggest economy in the world.”

Adding to Barbosa’s sentiments, IDVerse General Manager EMEA Russ Cohn underscored the challenge of deepfakes. Cohn agreed that “synthetic media is becoming the new tool of choice for fraudsters looking to make money” and added: “Our fully automated identity verification system can offer FutureBank customers a reliable solution to spot deepfake accounts that fraudsters are increasingly trying to create.” Cohn explained that IDVerse’s technology can detect subtle shifts and patterns in a person’s face that the unaided human eye cannot see, such as the way a person’s heartbeat slightly changes the color of their skin. These “natural yet invisible patterns,” Cohn said, enable IDVerse’s technology to distinguish real human images from deepfakes.

IDVerse’s platform also features Zero Bias AI-tested technology that leverages generative AI to train deep neutral networks to resist race, age, and gender-based discrimination.

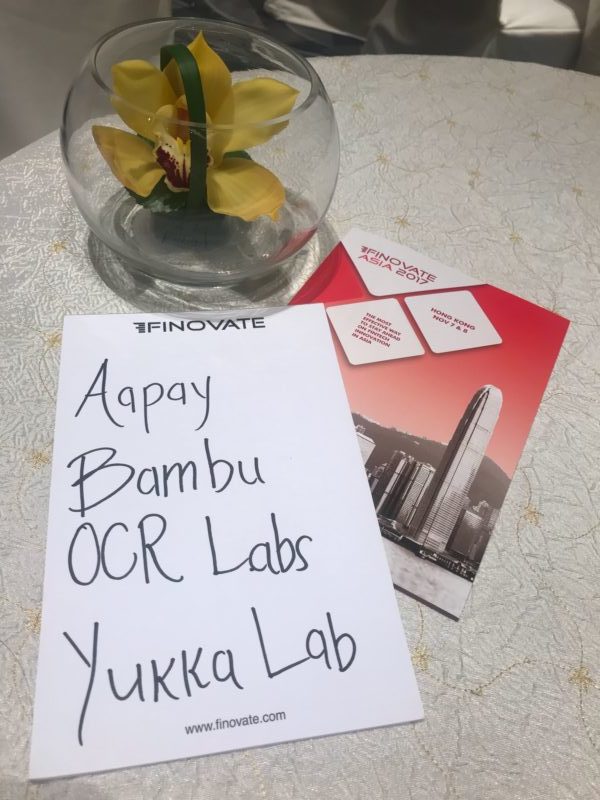

Introducing itself to Finovate audiences in 2016 as OCR Labs Global, the company rebranded as IDVerse earlier this year. Founded in Australia in 2018, IDVerse is headquartered in London, and maintains offices in North America, Asia, and Europe. The company provides identity verification services in more than 220 countries and territories.

IDVerse has raised $45 million in funding from investors including Equable Capital and OYAK. This year, the company has forged partnerships with fellow Finovate alum Experian, bank verified digital identity service provider OneID, and cryptocurrency platform Coinmetro. John Myers is CEO.

AApay Technology

AApay Technology OCR Labs

OCR Labs YUKKA Lab

YUKKA Lab