The challenge of modernization remains a daunting one for many community banks and credit unions. Faced with the expense and risk of a “rip and replace” strategy on the one hand and a seemingly endless series of quick fixes, workarounds, and complex third-party relationships on the other, some financial institutions remain in a limbo of inaction.

To this end, the latest innovations from banking technology platform company Nymbus are a welcome development. In our interview with Nymbus CEO Jeffery Kendall, shared here, we talk about the current state of core banking systems, the innovative “sidecar” approach to core modernization that Nymbus offers, and the transition toward vertical banking which helps community financial institutions deliver differentiated solutions to a wider range of customers and members.

“We are a United States-focused banking technology platform. We work with community banks and credit unions (that) tend to be in the one to ten billion asset size; those are the customers we are able to help the most. We provide a full banking stack that allows them to run their core processing, their digital banking experiences, onboarding experiences … from one unified platform.”

Chairman and CEO of Nymbus since 2020, Jeffery Kendall has more than 20 years of experience in technology and financial services. He succeeded Scott Killoh, who founded the company in 2015. With Kendall as CEO, Nymbus has secured more than $123 million in funding courtesy of Series C and D rounds in 2021 and 2023, respectively. The company launched a Credit Union Service Organization (CUSO) in 2021, and has forged partnerships with financial institutions like PeoplesBank, VyStar Credit Union, and MSU Federal Credit Union.

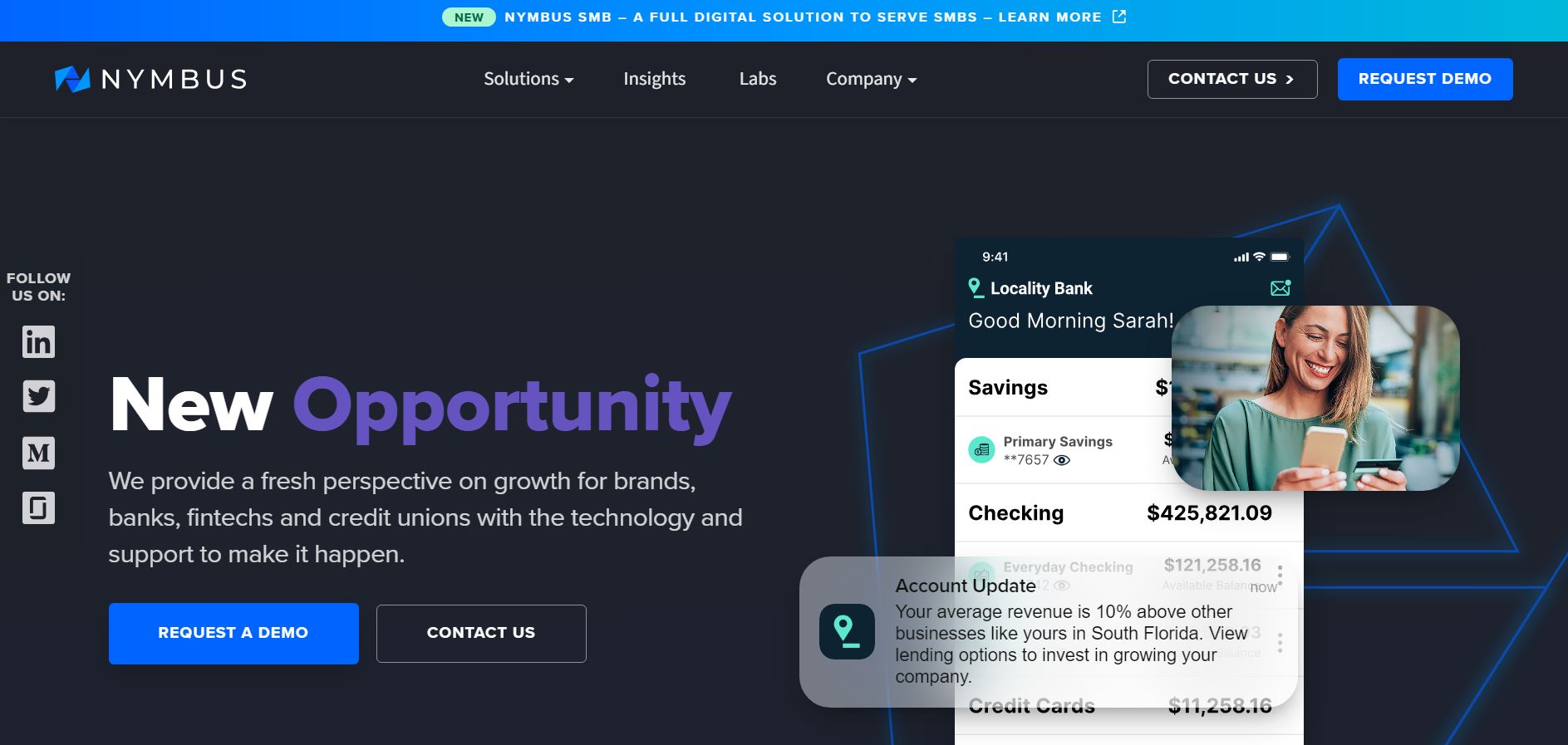

A leading provider of banking technology solutions for financial institutions, Nymbus offers a full-stack banking platform for US banks and credit unions that helps them accelerate their growth and enhance their market positioning. The company modernizes legacy core systems for both brick-and-mortar and digital-first institutions. Nymbus also supports vertical banking strategies and the launch of subsidiary brands with a sidecar core alternative. The company is headquartered in Jacksonville, Florida.