Courtesy of a just-completed Series A round, Cologne-based nextmarkets has raised $6.96 million (€6 million) in capital. The round featured participation from existing investors FinLab, Peter Thiel and Falk Strascheg, as well as new investors Axel Springer Media for Equity GmbH, Cryptology Asset Group PLC, and British hedge fund manager Alan Howard.

The Series A takes the company’s total equity to nearly $14 million. Howard commended the firm for its “impressive technology” which he said will add to the company’s future innovations to make a “lasting impact on the retail investment space.”

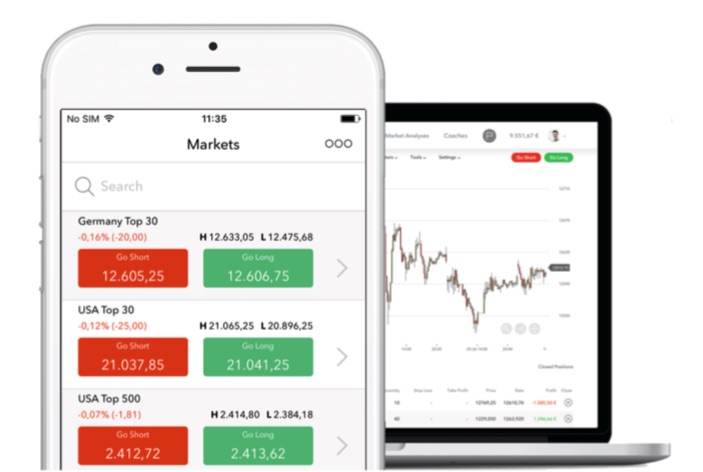

The funding news is only one headline nextmarkets has made this week. The company also launched its real-money offer, which enables customers to open real money accounts and participate in equity markets on the nextmarkets platform. The company plans to add crypto market options soon. Nextmarkets also announced that its subsidiary, nextmarkets Trading Limited, has obtained a Category 3 Investment Service License in Malta.

“With obtaining the license and going live we have taken a major milestone in our success story,” nextmarkets co-founder and CEO Manuel Heyden said. “From now on we will focus on dynamic growth in Europe and soon globally with our highly scalable, transactional business model.”

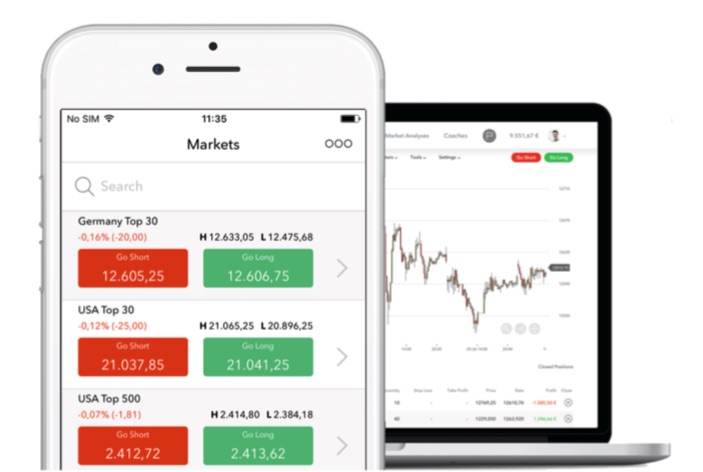

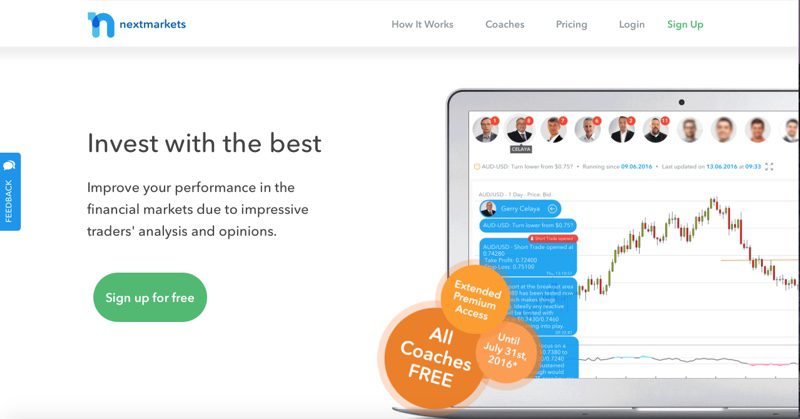

Founded in 2014 and headquartered in Cologne, Germany, nextmarkets demonstrated its technology at FinovateEurope 2015. A specialist in the field of curated investing, nextmarkets enables individual investors and traders to benefit from the expertise of 14 investment professionals who provide real-time trading insights via the web or smartphone on more than 1,000 markets, including equities, indices, foreign exchange, and commodities.

And with both ETF and crypto currency markets to be added soon, nextmarkets will make it even easier for traders and investors to remain vigilant for market opportunities – especially in sectors with which they are less familiar. “As an active investor, I always wonder who has the time to analyze the wide range of stocks and cryptos,” nextmarkets co-founder and CTO Dominic Heyden said. “Now I have my own investment professionals in my pocket and will be backed by them on the markets. If one of my coaches makes a profit in his bitcoin analysis, I do it on my account.”

The Heyden brothers have a history in social investing, having co-founded ayondo in 2008. Ayondo participated in FinovateEurope 2013, where the brothers – along with CMO Alexander Surminski – demonstrated the third edition of its social trading platform.