Coinbase’s Crypto Futures

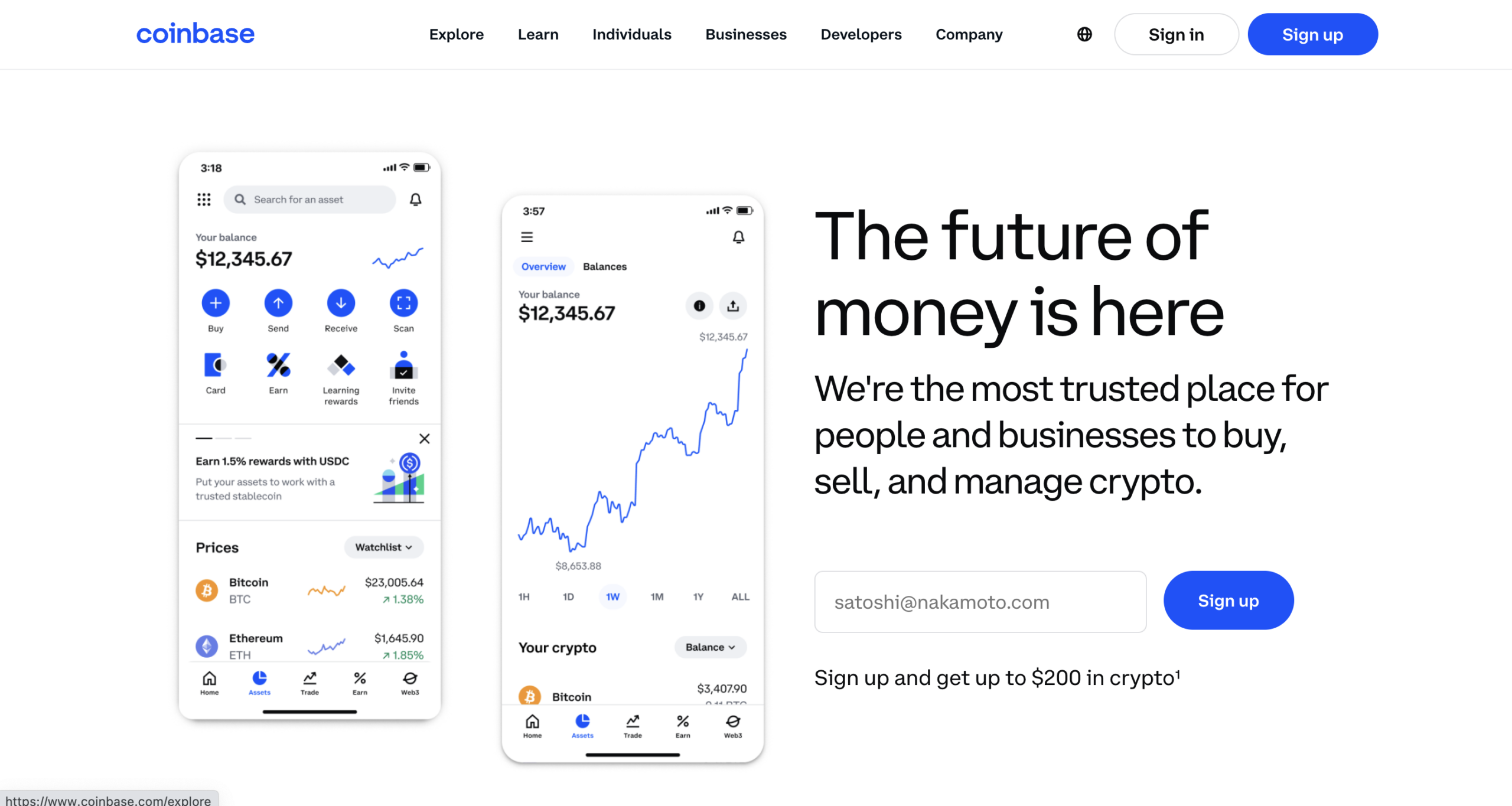

Courtesy of a just-secured regulatory approval from the National Futures Association, Coinbase’s U.S. customers will soon get the opportunity to trade futures contracts on cryptocurrencies. Coinbase’s Coinbase Financial Markets has been granted authority to operate as a Futures Commission Merchant (FCM) and offer eligible customers in the U.S. access to crypto futures trading on the Coinbase platform.

In a blog post at the Coinbase website, company Head of Institutional Product, Greg Tusar called the approval a “watershed moment” in the project to bring regulated cryptocurrency products to U.S. customers. The ruling comes as Coinbase is at odds with other regulatory bodies – such as the SEC – over its operating practices.

The ruling also comes at a time when the crypto derivatives market around the world has climbed to 75% of all crypto trading volume. Tusar called this market “a critical trader access point.” This is because crypto derivatives enable traders to participate with more leverage and less upfront capital, as well as give cryptocurrency holders the ability to express long and short positions, and hedge risk.

“Where regulations are clear and sensible, we will work with regulators to receive the authorizations needed to offer products that align with our purpose of using crypto to update the financial system to advance economic freedom and opportunity,” Tusar wrote.

Coinbase made its Finovate debut in 2014. The San Francisco, California-based fintech was founded in 2012.

eToro’s Crypto Trends

Social trading and investment platform eToro announced a new partnership to help its customers stay on top of the latest information about cryptocurrencies. The firm has teamed up with analysis company Reflexivity Research in a content partnership called “BTC etc.” that will provide a weekly overview of the cryptocurrency market as well as a monthly podcast. The weekly overview will focus on key trends. The podcast will feature experts from eToro, Reflexivity Research, and the broader cryptocurrency industry.

“As a crypto pioneer, we see it as our responsibility to provide accessible, timely, and relevant content for our users,” eToro Editor in Chief Mati Alon said. “As the market matures, cryptoassets deserve the same level of attention and coverage as other financial assets. We are excited to collaborate with Reflexivity to increase understanding of crypto.”

A Finovate alum since 2011, eToro has won Best of Show at each of its six Finovate appearances. The company offers trading and investing in stocks, options, and exchange-traded funds (ETFs), as well as cryptocurrencies. eToro offers 0% commissions, the ability to trade fractional shares, and a social network to enable traders and investors to benefit from the wisdom of the platform’s top performers.

EToro has become increasingly bullish on the prospects for cryptocurrencies. The company’s Global Markets Strategist Ben Laidler was quoted earlier this week highlighting three key developments that could put cryptocurrencies back on track by making it easier for institutions to participate in the market.

CBDCs Gain Ground in Brazil, Raise Doubts in Canada

The arguments for and against central bank digital currencies (CBDCs) got an international airing of sorts in recent days.

In Brazil, the country’s central bank has given its CBDC an official name – and logo. Commonly referred to as the “digital real,” the Brazilian Central Bank has decided to call its new digital currency, the Drex. The name refers to both the assets colloquial name, “Real Digital,” with an “e” for “electronic” and an “x” to represent a variety of notions including the concept of “modernity and connection.”

“Drex arrives to make life easier for Brazilians” a press release from the country’s central bank pronounced. “It will provide a secure and regulated environment for developing new businesses and more democratic access to the benefits of the economy’s digitization, both for individuals and entrepreneurs.”

Among the projected use cases for the digital currency are government benefit payouts, which would use a tokenized version of the currency. The bank also believes that the Drex will help accelerate digitalization in the financial sector and ultimately promote financial inclusion.

Meanwhile, some five thousand miles north, the concept of central bank digital currencies is getting a much cooler reception. A new report from the Bank of Canada cast a dim light on the prospect of mass CBDC adoption by Canadians. The blame was placed on the wide number of payment options Canadian consumers and businesses already have.

The staff discussion paper, “Unmet Payment Needs and a Central Bank Digital Currency,” envisions a hypothetical cashless environment, and then considers how a CBDC would solve unmet payment needs in such a society.

The report concludes that for a CBDC to benefit those who have unmet payment needs, the digital currency would first have to secure widespread adoption among the majority of the population. This would be necessary to ensure sufficient digital currency adoption by merchants. The challenge is that insofar as the majority of consumers “already have access to a range of payment options,” it would be unlikely for a significant enough number of these consumers to both widely adopt the digital currency as well as use the CBDC at scale.

The insights from the paper should prove valuable to those who support digital currencies, especially to the degree that digital currencies allegedly support financial inclusion. “The minority of consumers with unmet payment needs will be able to benefit from a CBDC,” the report writers conclude, “if the majority of consumers experience material benefits and therefore drive its use.”