We recently caught up with Vivienne Hsu, Chief Communications and Marketing Officer with Sokin, a U.K.-based, global financial service provider and payments company. Originally slated for our Women’s History Month commemoration, our conversation includes both Hsu’s thoughts on “the State of Women in Fintech” and gender diversity in the industry, as well as her insights on Sokin, its contributions to fintech innovation, and what we can expect from the company in the future.

Joining Sokin in 2021, Hsu was previously co-founder and Partner at Anabasis Partners, an international marketing and communications advisory firm. Before that, Hsu spent more than seven years as an executive with Cognito, a London-based PR, marketing, and communications agency.

Can you tell us a little about Sokin and its place in the fintech industry?

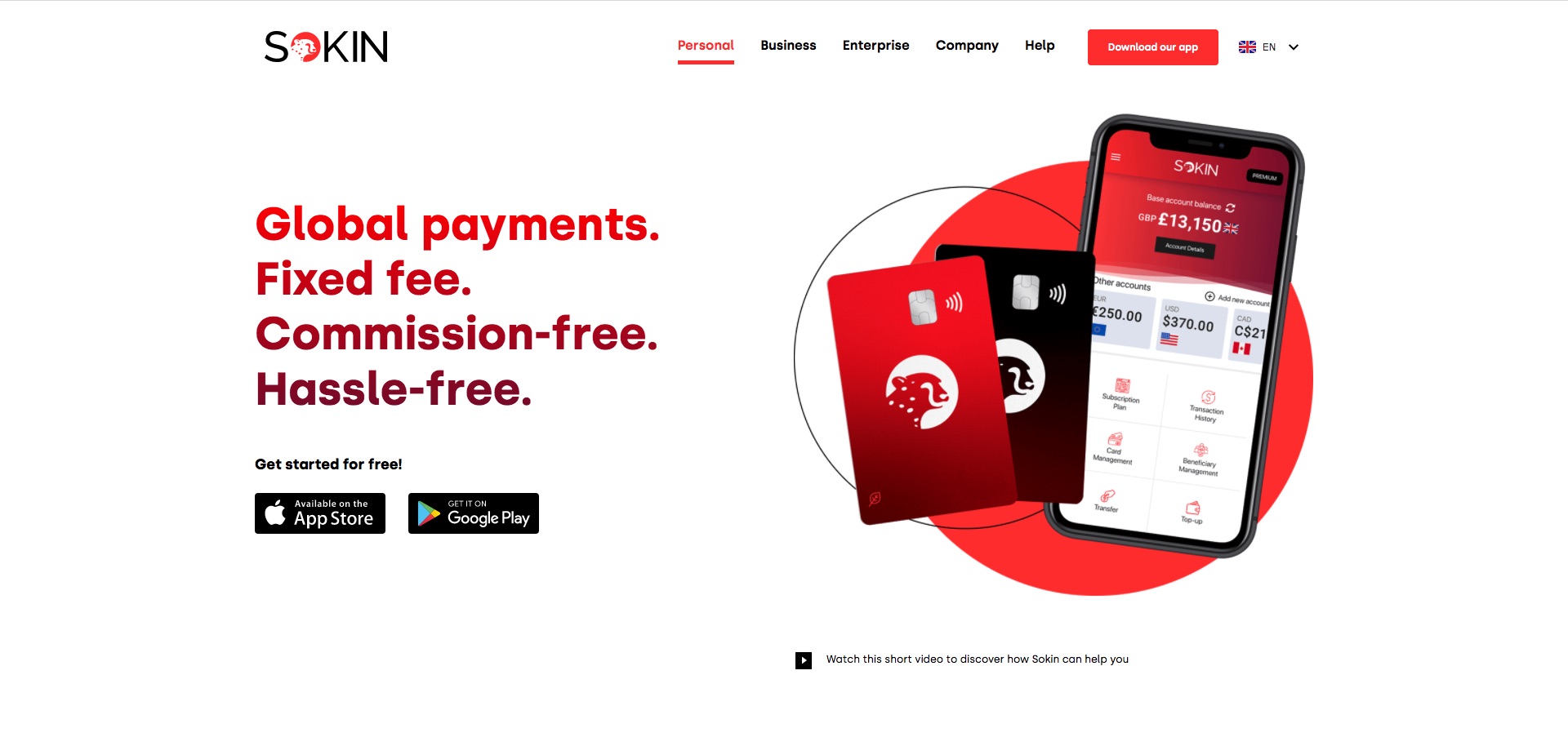

Hsu: Sokin is a global payments fintech that is the first to offer a consumer subscription model for unlimited transfers for a fixed fee. We believe in straightforward, transparent currency exchange and money transfers and allowing as many people and businesses to have access to the global payments ecosystem. We are ethically conscious and focused on the positive impact we can have as a business, putting financial inclusivity and eco-friendly innovation centrally to our purpose while working to democratize and simplify the global payments process.

How long have you worked at Sokin? What do you enjoy most about being a part of its leadership team?

Hsu: I’ve been with Sokin since January 2021 and enjoy being part of a very fast-paced business that is constantly growing, innovating, and evolving. I’m surrounded by hard-working and exceptionally talented people where I continue to learn so much. The leadership team is experienced, grounded, and strategic, but also fun which makes being part of it such a privilege.

What are the biggest responsibilities you have as CCMO? Are there any accomplishments as Sokin’s CCMO that you are most proud of?

Hsu: The biggest responsibilities I have as CCMO is to build the Sokin brand and keep our name front-of-mind within the global payments and innovation industry. We have an incredible story to tell – one that really holds people at its heart – and great products and services to get out to market with.

I’m immensely proud of the team we have built and how quickly we have managed to scale the Sokin brand globally. We’ve nurtured our flourishing sports club partnerships very effectively and continue to enter new markets at pace with an extremely exciting proposition.

How has the pandemic impacted the work you do as CCMO?

Hsu: The global pandemic changed how we work, but not what we need to do to deliver it. If anything, the change in working environment has forced us to innovate and collaborate in new and diverse ways. For example, as a global organization with a workforce across the world, we do not let time zones or geographies hold back progress.

Being able to build a good team culture and the creative spark is the only area which has been harder to achieve as our people are not always together. But overall, it’s not negatively impacted my role or the work we do at Sokin.

How would you characterize the “State of Women in Fintech and Financial Services” in 2022?

Hsu: The industry has improved, but there is still a lot of work to do. When I started out, it was not uncommon for only one or two women to have a seat in the boardroom. This, of course, has changed due to a shift in workplace attitudes and, as a result, we are seeing more women than ever moving up the ladder. However, this must only be seen as the beginning. It’s still not an equal men-to-women ratio, but it’s getting better.

Evidently, more attention and emphasis have been placed on supporting women in the finance industry over the years. I have seen more female leaders and experts working in finance and fintech compared to 10 years ago. It’s wonderful to see the glass ceiling starting to crack and I hope it grows in momentum.

What do you think the industry is doing right in terms of promoting gender diversity? What do we need to do better?

Hsu: I think fintech and financial services are having the conversation and pushing the agenda for gender diversity, which is really the first step. We need to get to a point where equality is part of a natural and organic system, not a forced issue as it is now – much like a box to tick.

I hope in the coming years we will not have to talk about gender diversity in the same way we do now, but instead it becomes something that’s actioned without question.

What can you do in your role as CCMO to help advance gender diversity?

Hsu: I think I can help in my role as a CCMO – and also as a senior female leader – by setting a good example, supporting, and mentoring others and driving a strong DE&I team and agenda at Sokin. Being part of a progressive and innovative company helps immensely, but also we have a culture where everyone’s opinion matters and can be shared which really can drive quick and necessary change.

It’s also about giving women the opportunities they need to succeed. The best way to create a rope ladder for other people to climb is to include them in your own journey. I’ve been exceedingly lucky to work with lots of incredible people over the years who did just that. By doing so, they pulled the best out of me which I did not see in myself. Before I knew it, I was involved in activities which, to me, seemed impossible, but those around me saw things differently. I will always be grateful for this, and I hope I can support the talent of today in the same way.

It may sound simple, but by doing so you naturally open opportunities and further responsibilities for those in your team. Providing an accessible platform to learn is fundamental in supporting others through their professional careers, especially in fast-paced industries such as fintech in which there are an plenty of chances opening every day. It’s about giving people both the confidence and, most importantly, access to pursue them.

Sokin is involved in multiple new initiatives. What excites you most about the direction of the company right now?

Hsu: I’m most excited about how the company is innovating and the way we are building our ecosystem and partnerships. It’s unlike any other organization I have worked! Sokin is at the forefront of several innovations such as taking payments into the metaverse and web 3.0, alongside what we can do with our existing and new partners.

Having only launched our Global Currency Account in August 2021, Sokin has rapidly expanded into 32 territories, and welcomed more than 120,000 Sokin customers with a further 175,000 currently on the global waiting list. At the end of 2021, we had transferred over $100 million around the world, delivered a multilingual app with five accessible languages, doubled the size of Sokin’s global workforce, partnered with five top-class football clubs including our first NFL team, and launched our exclusive sponsorship community, Sokin – Money Goals. To achieve this in a matter of months is astounding.

In short, we are leveling up global payments with the ambition to become the provider of choice for global transfers and currency exchange around the world. And I wholeheartedly believe we can and we will achieve this.