The year continues its blistering pace with 28 companies worldwide raising new funds this week, the biggest number since we began tracking in July 2014. In total, $332 million was invested with the majority being equity (only $19 million was identified as debt in public comments).

The year continues its blistering pace with 28 companies worldwide raising new funds this week, the biggest number since we began tracking in July 2014. In total, $332 million was invested with the majority being equity (only $19 million was identified as debt in public comments).

Four Finovate alums made up 40% of the weekly total:

Year-to-date fintech companies have raised $450 million in new equity, 67% more than the $270 million raised in the first half of January 2015. In addition, another $350 million in debt has been added to startups’ balance sheets this year, compared to zero in 2015. So the combined YTD debt and equity total of $800 million is triple the 2015 total. Finally, the number of deals is up 63% (52 compared to 32 in 2015).

Here are the deals by size from 9 Jan to 15 Jan 2016:

Starling

Startup digital bank

Latest round: $70 million

Total raised: $70 million

HQ: London, England, United Kingdom

Tags: Consumer, credit, deposits, mobile, banking

Source: Crunchbase

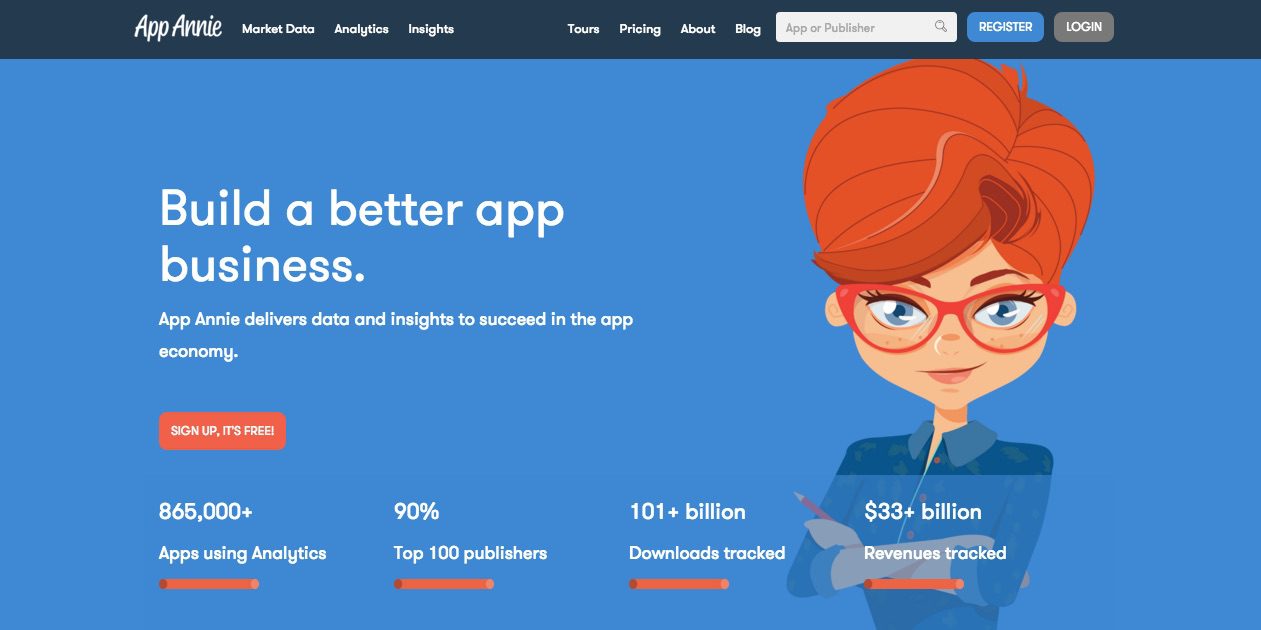

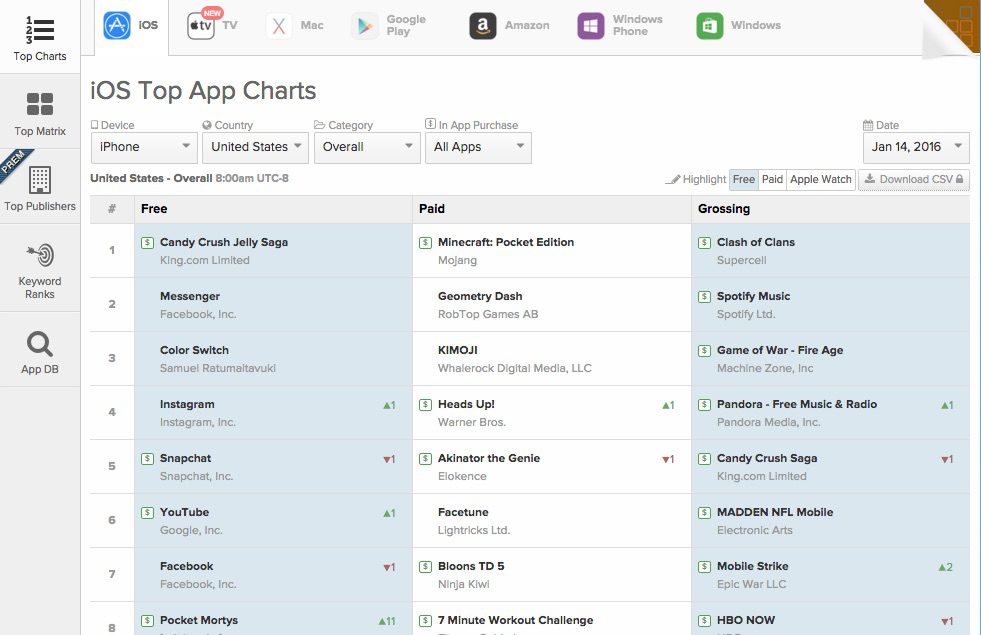

App Annie

Mobile analytics

Latest round: $63 million Series E (mostly equity)

Total raised: $157 million

HQ: San Francisco, California

Tags: Mobile, app development, Silicon Valley Bank (lender), Finovate alum

Source: Finovate

Duanrong

Person-to-person lender

Latest round: $59 million Series B ($153 million valuation)

Total raised: $69 million

HQ: Bejing, China

Tags: Consumer, credit, lending, loans, underwriting, investing, P2P, person-to-person

Source: Crunchbase

Taulia

Financial supply chain management

Latest round: $46 million

Total raised: $136.7 million

HQ: San Francisco, California

Tags: SMB, invoicing, payments, accounts receivables, accounts payable, Finovate alum

Source: Finovate

RealtyMogul

Online marketplace for real estate investing

Latest round: $18.4 million ($1.5 million equity, $16.9 million debt)

Total raised: $63.4 million (including $16.9 million debt)

HQ: Los Angeles, California

Tags: Consumer, SMB, credit, lending, loans, underwriting, investing, P2P, commercial mortgages, investment property, Finovate alum

Source: FT Partners

PolicyGenius

Person-to-person student loan lender

Latest round: $15 million Series B

Total raised: $21.05 million

HQ: Brooklyn, New York

Tags: Consumer, insurance (life, pet, renters, disability), quotes, lead gen

Source: Crunchbase

Ping++

Integrated payment processor

Latest round: $10 million Series B

Total raised: Unknown

HQ: Shanghai, China

Tags: Enterprise, B2B2C, payments, mobile, SDK, API, developers, credit/debit cards

Source: Crunchbase

Mambu

SaaS banking platform

Latest round: $8.73 million Series B

Total raised: $13.1 million

HQ: Berlin, Germany

Tags: Enterprise, digital banking platform, Finovate alum

Source: Finovate

FINCAD

Derivative risk management

Latest round: $7 million Debt

Total raised: Unknown

HQ: Surrey, British Columbia, Canada

Tags: Enterprise, investing, trading, risk management, security, compliance

Source: Crunchbase

Symbiont

Blockchain technology for securities

Latest round: $7 million

Total raised: $7 million

HQ: New York City

Tags: Enterprise, investing, cyrpto-currency, blockchain

Source: Crunchbase

FinanceFox

Mobile insurance brokerage

Latest round: $5.5 million

Total raised: $5.5 million

HQ: Berlin, Germany

Tags: Consumer, insurance, policy management, mobile

Source: Crunchbase

Unwired

Mobile banking app developer for financial institutions

Latest round: $4.8 million

Total raised: $9.4 million

HQ: Austin, Texas

Tags: Enterprise, B2B2C, mobile banking, digital banking

Source: Crunchbase

Vericred

Health insurance information provider

Latest round: $3.1 million Seed

Total raised: $4.2 million

HQ: New York City

Tags: Consumer, insurance, health care, comparison shopping, API, developers

Source: FT Partners

Moneybox

Millennial saving & investing app

Latest round: $3 million Seed

Total raised: $3 million

HQ: London, England, United Kingdom

Tags: Consumer, savings, investing, youth

Source: Crunchbase

Questis

Financial coaching as an employee benefit

HQ: Charleston, South Carolina

Latest round: $2.8 million

Total raised: $6.3 million

Tags: Personal financial management, advice, PFM, retirement planning, employee benefits, insurance

Source: FT Partners

Coindrum

Exchange unwanted foreign coins for shopping vouchers

Latest round: $2 million

Total raised: $2 million

HQ: Dublin, Ireland

Tags: Consumer, payments, hardware

Source: Crunchbase

Lift Credit

Online consumer lending

Latest round: $1.8 million Debt

Total raised: Unknown

HQ: Provo, Utah

Tags: Consumer, credit, lending, loans, underwriting

Source: Crunchbase

FI Navigator

Data analytics for financial services companies

Latest round: $1.5 million

Total raised: $1.5 million

HQ: Atlanta, Georgia

Tags: Enterprise, BI, metrics, analytics, big data

Source: Crunchbase

Minkasu

Mobile payments platform

Latest round: $1 million Seed

Total raised: $1.75 million

HQ: Milpitas, California

Tags: Consumer, payments, mobile, wallet

Source: Crunchbase

Investly

Person-to-person small biz lending platform

Latest round: $653,000

Total raised: $673,000

HQ: Tallinn, Estonia

Tags: SMB, credit, lending, loans, underwriting, investing, P2P, business loans, crowdfunding

Source: Crunchbase

CapitalPitch

Startup capital raising platform

Latest round: $600,000 Seed

Total raised: $600,000

HQ: Sydney, Australia

Tags: SMB, capital, crowdfunding, equity, investing

Source: Crunchbase

ResiModel

Multi-family lending management

Latest round: $500,000

Total raised: $1.4 million

HQ: New York City

Tags: SMB, enterprise, commercial lending, non-residential real estate, underwriting, investing

Source: Crunchbase

Charity Bank

Digital bank serving non-profits

Latest round: $364,000

Total raised: Unknown

HQ: Tonbridge, England, United Kingdom

Tags: Consumer, non-profit, credit, deposits, savings accounts

Source: Crunchbase

TransferFast

Funds transfers between banks

Latest round: $164,000

Total raised: $164,000

HQ: Tallinn, Estonia

Tags: Consumer, payments, interbank transfers, banking

Source: Crunchbase

Sestertium

Person-to-person student loan lender

Latest round: $160,000

Total raised: $160,000

HQ: Udine, Italy

Tags: Consumer, investing, gamification, crowdsourcing

Source: FT Partners

Facepay

Mobile payments

Latest round: $50,000 Angel

Total raised: $150,000

HQ: California

Tags: Consumer, payments, mobile

Source: Crunchbase

Transaction Network Services (TSN)

Data communications for financial services firms

Latest round: Not disclosed Private Equity

Total raised: Unknown

HQ: Reston, Virginia

Tags: Consumer, credit, lending, loans, underwriting, investing, P2P, student loans

Source: FT Partners

W.A.G. Payment Solutions (Eurowag)

Vehicle fleet payment solutions

Latest round: Not disclosed

Total raised: Unknown

HQ: Boston, Massachusetts

Tags: Consumer, credit, lending, loans, underwriting, investing, P2P, student loans

Source: FT Partners

Germany

Germany Ireland

Ireland The Netherlands

The Netherlands

United Kingdom

United Kingdom

The year continues its blistering pace with 28 companies worldwide raising new funds this week, the biggest number since we began tracking in July 2014. In total, $332 million was invested with the majority being equity (only $19 million was identified as debt in public comments).

The year continues its blistering pace with 28 companies worldwide raising new funds this week, the biggest number since we began tracking in July 2014. In total, $332 million was invested with the majority being equity (only $19 million was identified as debt in public comments).

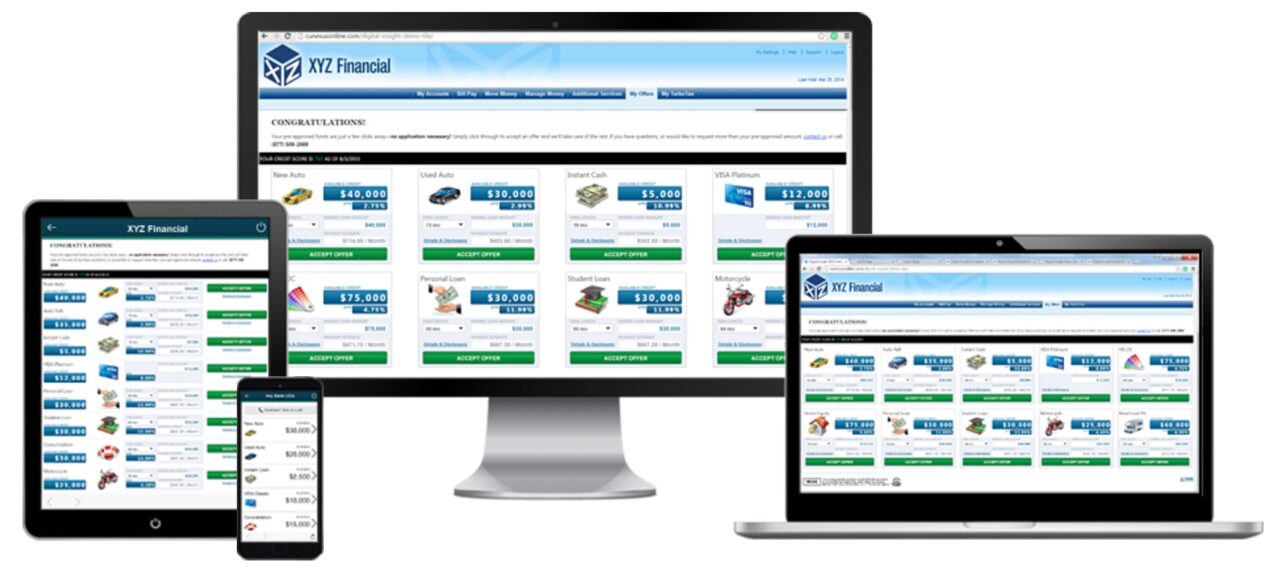

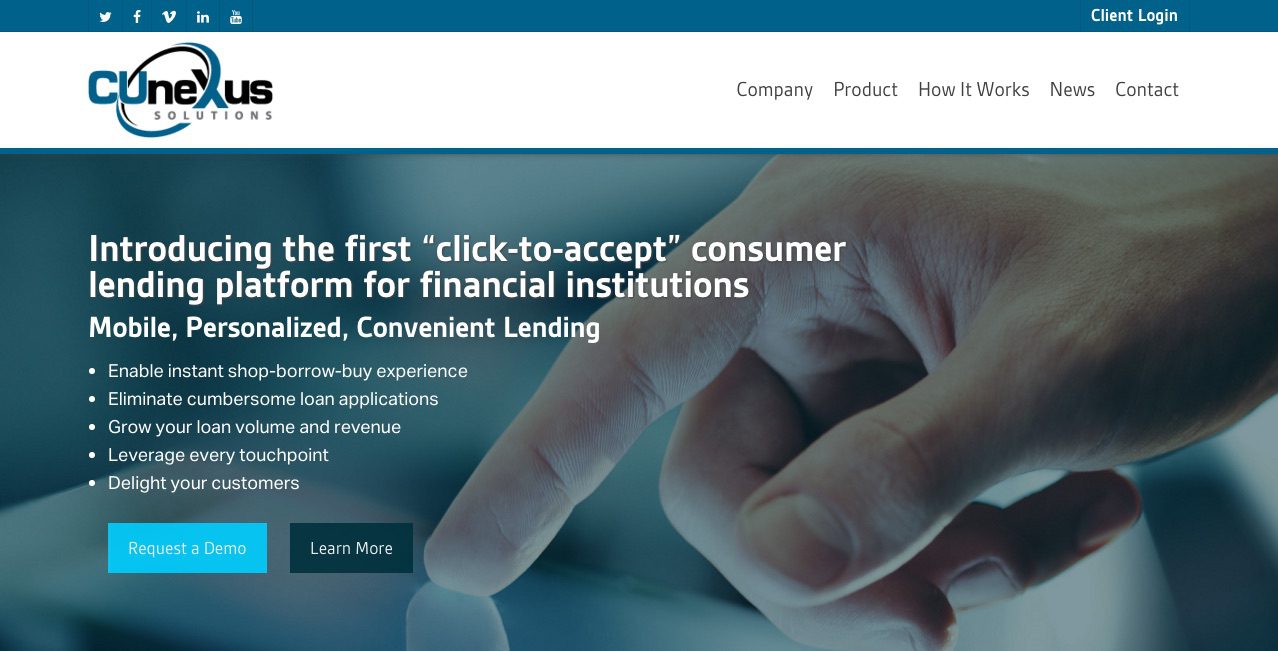

CUneXus

CUneXus