StreetShares has landed $23 million in equity funding, bringing the company’s total investment to $43 million. This comes just months after the military veteran-focused lending platform closed $10.3 million for its “shark tank meets eBay” approach to small business lending last August.

Today’s Series B round was led by Rotunda Capital Partners, with additional contributions from existing investors, including veteran-focused venture firm, Stony Lonesome Group. In a press release, Mark Rockefeller, CEO of StreetShares said, “This injection of capital allows us to continue to provide red-carpet treatment to our very special members— the veteran entrepreneurs, small business owners, government contractors, and impact investors—that make up our country’s next Greatest Generation.”

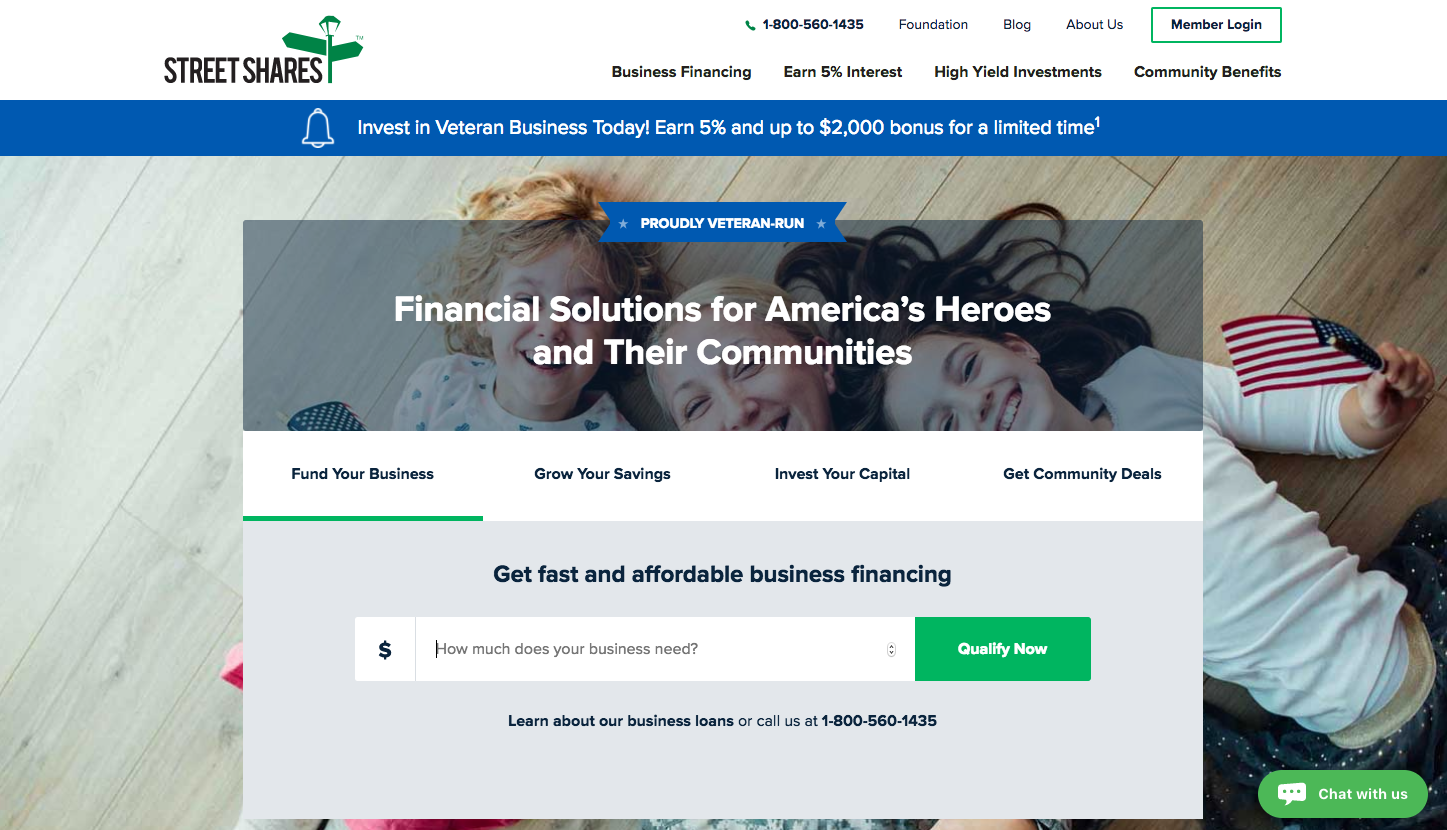

The StreetShares platform enables small business owners to pitch their loan requests to a community of investor members. Founded by military veterans, StreetShares is focused on offering financing for small businesses run by military veterans and their families, but serves non-veteran run small businesses, as well. The company offers loans with terms ranging from three to 36 months and lines of credit from $2,000 to $100,000. Investors can lend from $25 to $100,000 in Veteran Business Bonds and earn 5% interest.

StreetShares COO Mickey Konson said that the funding is a “huge step” in the company’s growth. He continued, “StreetShares is proud to fuel this special class of great American small businesses, and our partnership with Rotunda demonstrates that we are just getting started.”

At FinovateEurope 2015, the company’s CEO and co-founder Mark Rockefeller and COO and co-founder Mickey Konson showcased the StreetShares platform. The company began leveraging Title IV (Regulation A+) of the JOBS act in 2017 to allow unaccredited investors to lend to small businesses. It is now one of only a handful of P2P lending platforms open to unaccredited investors.