Earlier this year, Finovate Senior Research Analyst Julie Muhn predicted that the continued rise of mortgagetech would be one of the biggest fintech success stories of 2017.

Today, with news of a $100 million investment in Blend, a startup that specializes in making the mortgage process easier for bother lenders and borrowers, it looks like her prediction is right on track.

“We’ve found a great partner in Greylock,” Blend CEO and founder Nima Ghamsari wrote at the company blog this week, “not only because they’re one of the top venture capital firms in Silicon Valley, but also because of their history of success in helping take technology companies to the next level.” Joining Greylock in Blend’s Series D round were Emergence Capital, Lightspeed Ventures, Nyca Partners, and 8VC. The funding brings the company’s total capital to more than $160 million and gives Blend an estimated valuation of $500 million.

Blend plans to use the additional funding to grow its staff, expand beyond the United States, and explore opportunities to bring its technology to other lending products. “The opportunity for our technology in the $40 trillion consumer lending market is huge, but the industry won’t change overnight,” Ghamsari wrote. “To realize our goals, we need to continue scaling and bringing together the best talent, partners, and backers to get us to the next level.”

Blend’s dramatic funding announcement comes with news that the company has partnered with Wells Fargo and U.S. Bancorp. Both banks will use Blend’s technology to speed the mortgage application process and better compete with rivals like Quicken Loans. U.S. Bancorp believes Blend will enable them to reduce the mortgage application process by as many as five days and that the timeline will eventually be “sliced in half.” Wells Fargo, which began working with Blend “late last year,” expects to introduce its new, Blend-supported, mortgage product nationwide in 2018.

Founded in 2012 and based in San Francisco, California, Blend demonstrated its Data-Driven Mortgage solution at FinovateSpring 2016. The company has tripled its user base since January 2016 and processed more than $30 billion in mortgage applications this year alone. Last month, the company launched its native mobile app, making it easier for loan officers to manage requests and applications from their mobile devices. A member of CB Insights’ Fintech 250 list, Blend was featured in our look at tech trends driving mortgagetech earlier this year, “Digitization, Data, and Automation.” For more about the company, also check out our interview with Blend CTO Eugene Marinelli.

Mark Rockefeller (CEO & Co-Founder), Mickey Konson (COO & Co-Founder) demo at FinovateEurope 2015

Mark Rockefeller (CEO & Co-Founder), Mickey Konson (COO & Co-Founder) demo at FinovateEurope 2015

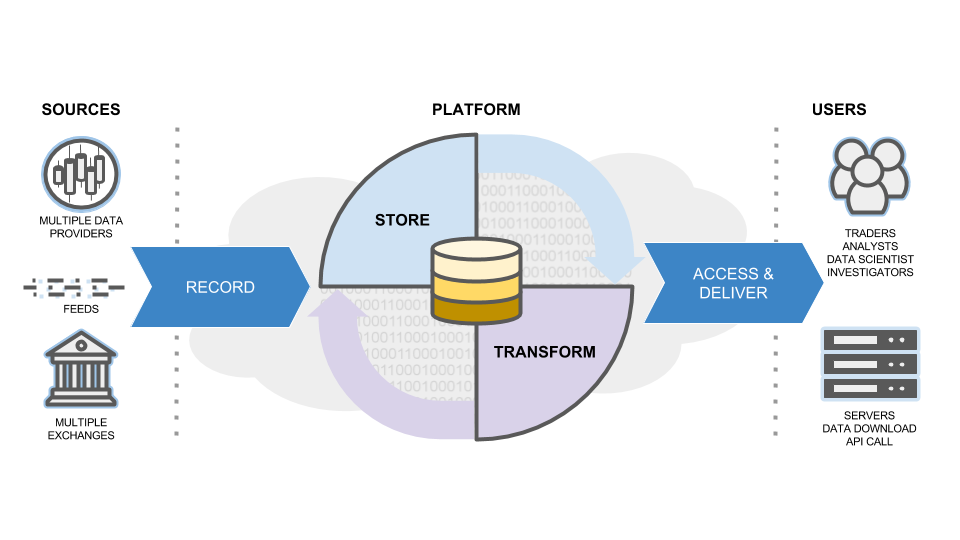

TickSmith’s TickVault data flow diagram

TickSmith’s TickVault data flow diagram