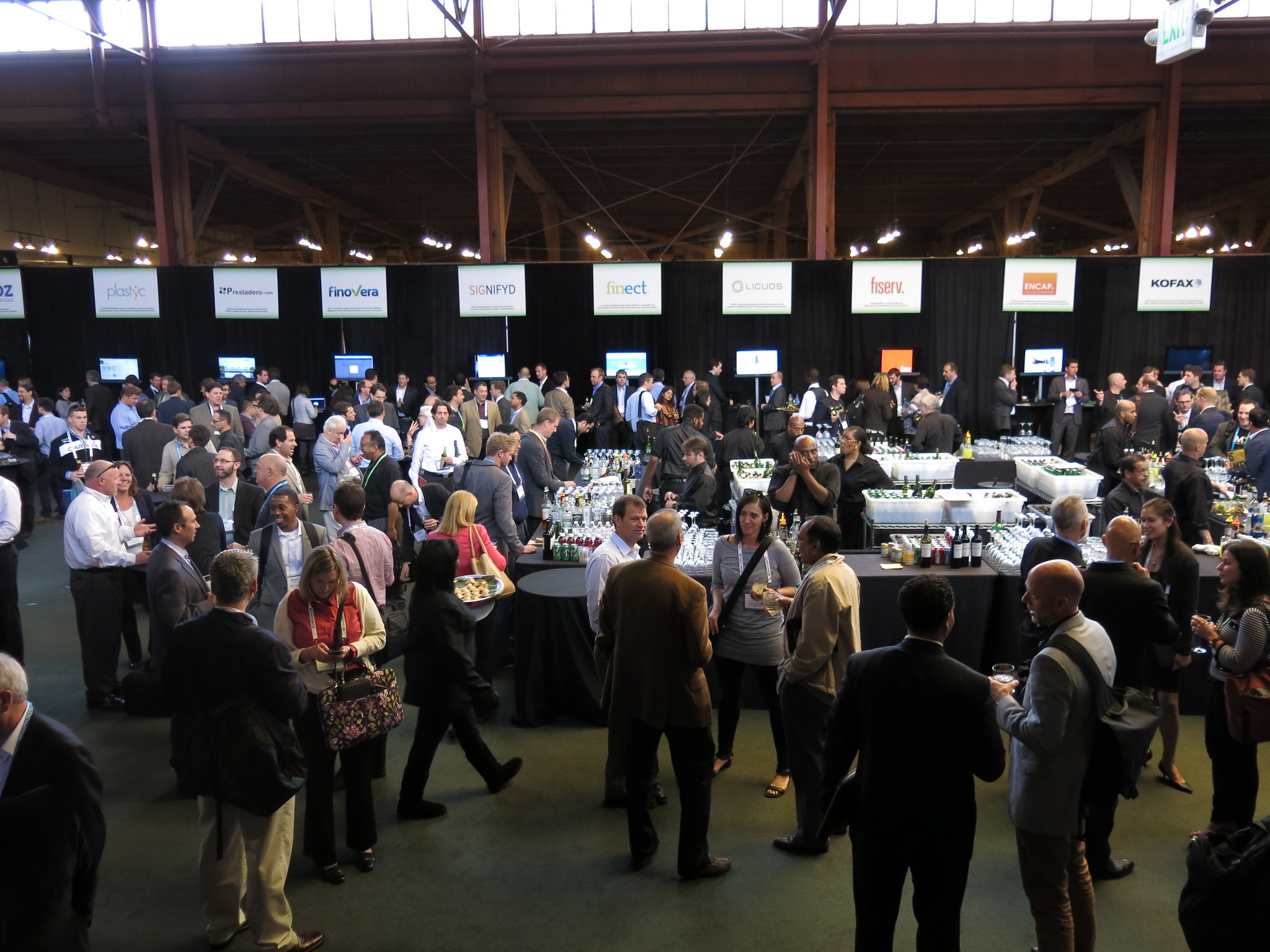

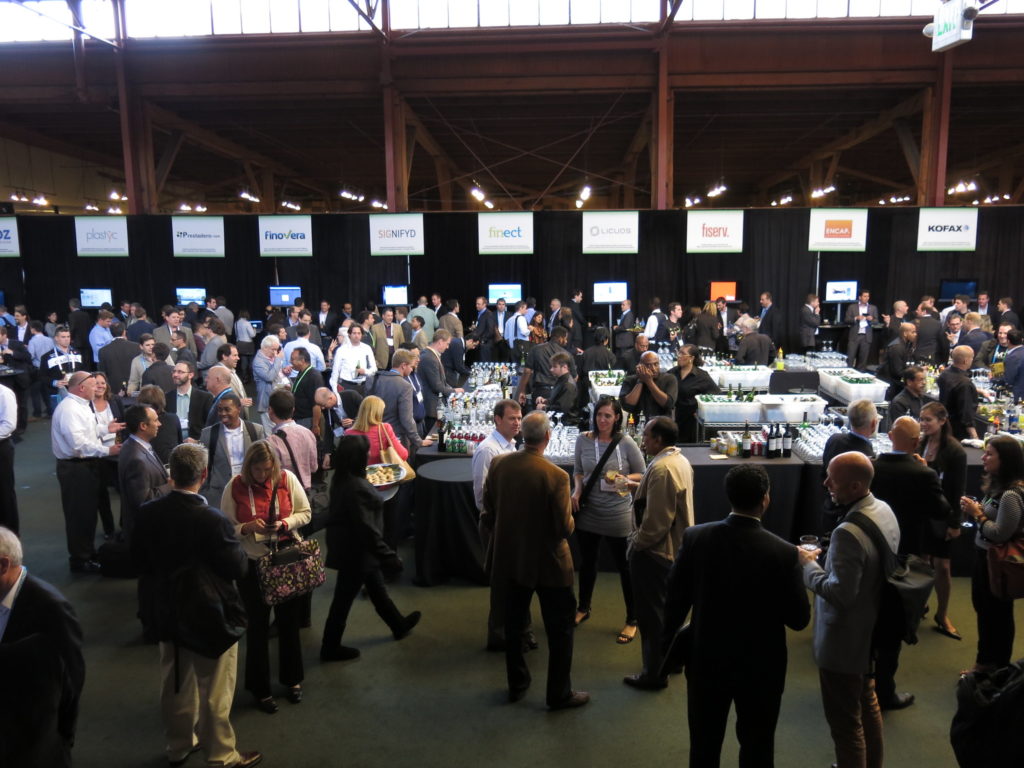

FinovateSpring is right around the corner! Our week of live fintech demos, insightful discussions, and passionate debates is one of the best – and most entertaining – ways to get up to speed on everything you need to know about the state of fintech today.

With a special, pre-show Summit Day on Tuesday, May 7, FinovateSpring begins on May 8 and runs through Friday the 10th. Our annual spring conference will be held at the Hilton San Francisco Union Square, where we’re looking forward to a fun and informative four days focused exclusively on fintech innovation.

Here are a few things to keep in mind as you plan your trip to the Bay Area.

Get Your Tickets Here!

Save your spot at FinovateSpring by visiting our registration page and picking up your ticket today.

Registration for both the main, three-day conference, as well as for our special Summit Day on Tuesday, May 7, is quick and easy. Discounts are available for groups, representatives of governmental/regulatory agencies, startups, and attendees registering for both the main conference and the Summit Day. Check out our registration page for more details.

Back at the Bay

FinovateSpring returns to San Francisco for the first time since 2013. This year our spring conference will be held in the heart of the city at the Hilton San Francisco Union Square on O’Farrell Street. The venue is less than an hour away from the main Bay Area airports, as well as shops, restaurants, and a variety of entertainment venues.

Live Demos and Deep Dives

FinovateSpring begins Wednesday morning, May 10, and continues through Friday afternoon. The first two days of the conference will feature our presenting companies as they demonstrate their latest technologies live on our stage.

On Friday, we will invite the fintech experts to take over and have them put into context the innovations that have been on display over the past few days. We’ve prepared a full day of keynote addresses, debates, fireside chats, and panel discussions on a wide range of critical trends and themes in fintech.

Check out a preview of our Friday morning main stage agenda, as well as our afternoon breakout streams on Community Banking, Digital Payments, Digital Banking, and Digital Lending.

This year we will also feature a special, pre-FinovateSpring Summit Day on Tuesday. This Summit Day consists of two tracks: one focusing on the evolving role of the customer experience in fintech and the other examining the rise of artificial intelligence as an enabling technology in the industry. We’re looking forward to the conversations with and insights from our speakers in both of these tracks.

With all we’ve got planned for FinovateSpring next week, we are thrilled to be back in San Francisco for this year’s conference. If you’ve got any questions about the event, check out the FAQ section on our FinovateSpring page or contact us directly.