For a second year in a row, Finovate is commemorating Black History Month by showcasing those Black and African-American founders and executives who demoed their company’s fintech innovations on the Finovate stage in 2022.

Ariam Sium – VP of Product with FinGoal

Sium not only leads Product at FinGoal, the self-described “Listener. Thinker. Doer” also led FinGoal to a Best of Show award at FinovateSpring last year. In her role at FinGoal, Sium said that she uses the tenets of focus and value to govern each product decision made in the rapidly changing world of fintech.

FinGoal most recently demoed its technology at FinovateFall in September. The Boulder, Colorado-based company offers an insights platform that helps financial institutions better understand their customers.

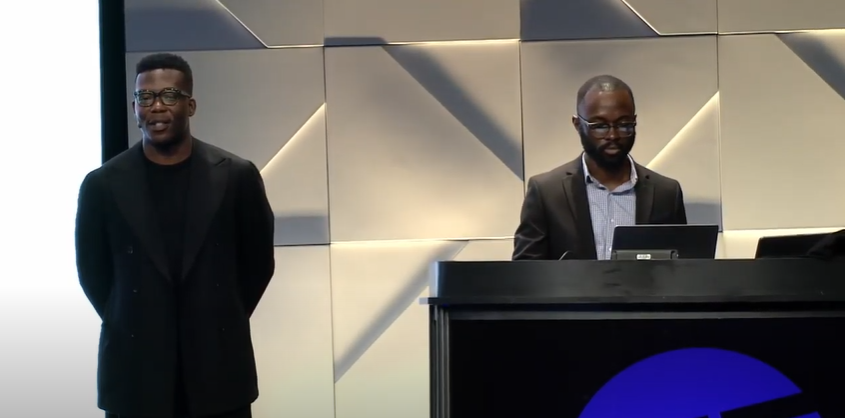

Joseph Akintolayo – CEO and Founder of Deposits

Akintolayo is a “builder of ethical products that solve complex problems in fintech, insurtech, and social enterprise.” As CEO and founder of Deposits, Akintolayo heads a startup that offers banks, brands, and communities a plug and play solution to deliver financial services such as payments and lending, without requiring coding experience.

Deposits made its Finovate debut at FinovateFall in September. The Dallas, Texas-based company was founded in 2021.

Samuel Ailemen – Director of Mobile and Identity at Deposits

As Director of Mobile and Identity at Deposits, Ailemen helped lead the company’s demo at FinovateFall 2022. A fraud prevention expert who is “building cool stuff everywhere”, Ailemen leverages his talent as “a software engineer who loves research” to solve real-world problems using new technologies.

Nathan Gibbons – Chief Experience Officer at QuickFi

Gibbons oversees the customer experience at QuickFi, a company that provides “nearly instant,” self-service 24/7 term financing to business equipment buyers. Demoing the company’s technology at FinovateFall last year, Gibbons and colleague Jillian Munson earned QuickFi its first Finovate Best of Show award.

A C-suite executive with QuickFi since 2018, Gibbons previously spent more than 11 years as Project Manager and later Vice President with First American Equipment Finance. QuickFi was launched by founders of First American Equipment Finance in 2018.

Michael Duncan – CEO and Founder of Bankjoy

Founder and CEO of Bankjoy, Duncan demoed his company’s Business Banking Platform at FinovateFall 2022. The company he launched in 2015 offers a range of modern banking technology solutions, including mobile and online banking, as well as a banking API.

Before founding Bankjoy, Duncan spent more than four years as a Programmer/Analyst and later Software Development Manager at Michigan First Credit Union.

Michael Broughton – CEO and Co-founder of Altro

Broughton co-founded and is CEO of Altro, a solution that helps consumers build credit through non-traditional recurring payment processes such as rent and even monthly subscriptions to services like Netflix. Altro’s app is free-to-use, and helps increase financial literacy while boosting existing credit and helping stabilize credit histories. The company made its Finovate debut last May at FinovateSpring.

Broughton is also Vice Chairman of the Board of Directors for the USC Credit Union (since 2017), and was both a Scout at Sequoia Capital and a Thiel Fellow at The Thiel Foundation.

Christen Wright – Head of Product at Spave

As Head of Product at Spave, Wright was part of the three-person demo team that won Best of Show at the company’s Finovate debut last May at FinovateSpring. Spave is a financial wholeness solution that enables users to easily save and donate as they purchase products and services. The Spave app provides purchase tracking and analysis, goal setting, group giving, and more.

Wright has a diverse background, having served in senior management roles at AT&T and Delta Air Lines. A member of 100 Black Men of Atlanta, a mentoring and empowerment organization for African American youth, Wright is a graduate of the University of Georgia’s Terry College of Business, where he earned an MBA.

Anthony Heckman – as Director of Sales at unitQ

Heckman was part of the founding team at unitQ, a company that turns customer insights into data-driven decisions for firms ranging from Chime to fellow Finovate alum Klarna. At FinovateSpring 2022, Heckman led the company’s live demo of its unitQ monitor, which serves as a centralized, searchable, repository for customer feedback.

Heckman founded TWC Advisors in October of last year. The firm specializes in providing go-to-market and sales support to early-stage, high-growth, VC-backed startups.