While some European fintechs are exiting the U.S. market, consumer payment services firm Klarna is doubling down. The Sweden-based company announced it is adding its Pay Now option to its U.S. payment services.

The Pay Now tool does exactly what it implies. Instead of using Klarna’s signature buy now, pay later (BNPL) payment structure, it allows users to pay immediately and in full at retailers where Klarna is accepted. This move offers U.S. shoppers more options when paying with Klarna at the point of sale. Users can now pay in full using Pay Now or pay over time with Pay in 4 and Pay in 30 solutions which allow users to split a purchase into four interest-free payments or pay over the course of 30 days, respectively.

“Consumers continue to reject double digit interest rates and fee-laden revolving credit, while simultaneously seeking more choice, control and flexibility in how they shop and pay both online and in store,” said Klarna Co-founder and CEO Sebastian Siemiatkowski. “With the introduction of ‘Pay Now’, Klarna now offers U.S. consumers the choice to pay immediately and in full, alongside our sustainable interest-free services.”

As a result of adding the Pay Now option, U.S. retailers can now offer Klarna users a more well-rounded payment experience. By offering the option to pay in installments or pay immediately, consumers will be more likely to choose Klarna as a payment option regardless of whether or not they want to use a BNPL tool or pay in full immediately.

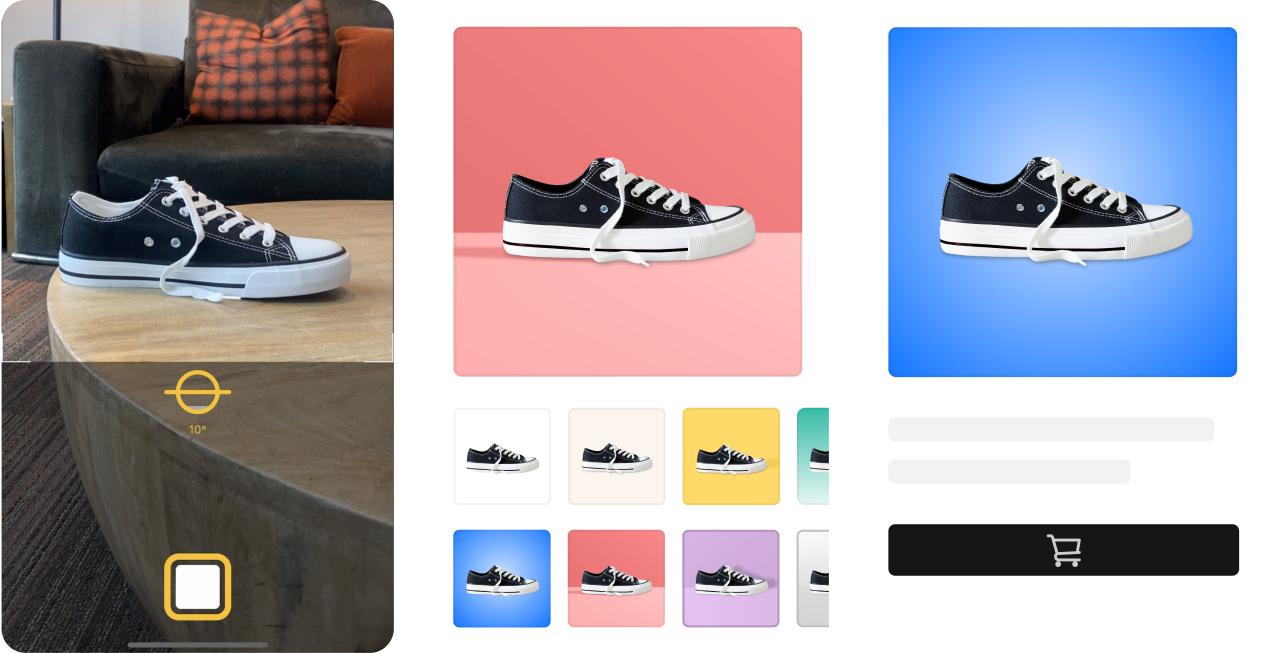

Klarna also announced it will launch its physical debit card to the U.S. market. The company wasn’t specific about timing but said it plans to introduce the new product “very soon.” Klarna refers to its debit card as a “tangible extension of the Klarna app experience” because it allows users to pay for their purchases over time and connects to the Klarna app to help users track their purchases. The card is also integrated with Klarna’s loyalty program, Vibe, which offers users rewards, deals, and discounts.

The past year has been quite an active one for BNPL companies. Klarna almost doubled its U.S. customer base this year, now reaching 21 million customers. “By launching ‘Pay Now’ and introducing the Klarna Card in the US, we are continually developing our services to meet consumers’ changing needs,” added Siemiatkowski.

Across the globe, the company counts 90 million active customers in 19 countries who make two million transactions per day at Klarna’s 250,000 merchants, including big brands such as H&M, IKEA, Expedia Group, Samsung, ASOS, Peloton, Abercrombie & Fitch, and Nike. Since it was founded in 2005, Klarna has raised $3.7 billion. The company now has a valuation of $45.6 billion and 4,000 employees.