- Customer engagement company JRNI has integrated with bank technology innovator Backbase.

- The integration will bring new appointment scheduling functionalities to users of Backbase’s Engagement Banking platform.

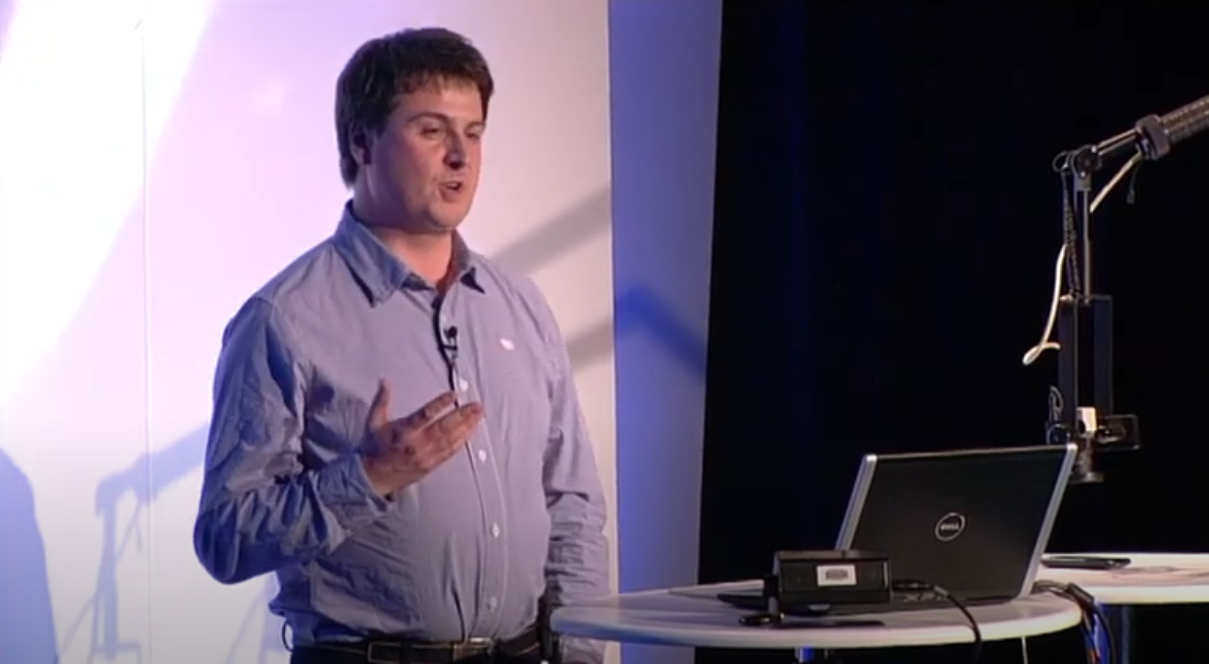

- Headquartered in Amsterdam, Backbase has been a Finovate alum since 2009.

JRNI, a leader in global customer engagement for financial services, has integrated with Backbase, adding new appointment scheduling functionalities to the Backbase Engagement Banking Platform.

“We believe that the banking experience is enriched by building trust through personal connections,” Backbase general manager of ecosystems Roland Boojien said. “This partnership aims to seamlessly provide convenient personal connections in banking and wealth management, effortlessly uniting customers and trusted advisors at their preferred time and location.”

Backbase’s Engagement Banking Platform provides financial institutions (FIs) with a range of digital solutions for customer onboarding, servicing, financing origination, loyalty, and more – all from a single platform. Courtesy of the integration, financial institution customers on the platform will be able to book both virtual and in-person appointments seamlessly and securely. JRNI’s Self-Scheduling Appointment booking solution will give FIs the ability to offer an end-to-end embedded experience that begins with initial customer contact and continues through the customer’s entire journey with ongoing relationship management and support.

The Self-Scheduling Appointment booking solution will be available as an out-of-the-box add-on integrated within Backbase’s Digital Assist offering. Digital Assist provides a unified solution that helps customer-facing teams at FIs resolve customer service issues quicker, as well as upsell additional products and services easier.

“Backbase Digital Assist helps make interactions more efficient, effective, and of higher value,” JRNI CEO Phil Meer said. “JRNI’s engagement capabilities complement Backbase’s offering to drive trusted connections and relationships. Backbase shares our vision and its global platform prioritizes customer engagement as a critical pillar.”

Founded in 2008 and based in Boston, Massachusetts, JRNI offers a customer engagement platform that helps companies improve both customer acquisition and retention, as well as promote brands, drive hyper-personalization, and better engage target audiences. The company’s enterprise-grade event management platform handles scheduling, queuing, and analytics to provide customers with a personalized experience whether in-person or virtual.

Headquartered in Amsterdam, Backbase has been a Finovate alum since 2009. Most recently demoing its technology at FinovateFall 2021 in New York, the company has won Best of Show on four separate occasions. With more than 150 customers and 2,000+ employees around the world, Backbase provides a platform that enables financial institutions to offer their customers the latest fintech innovations without having to abandon their existing core banking systems.

Backbase’s JRNI announcement comes just days after the firm announced that Malaysia’s Bank Muamalat Malaysia Berhad (Bank Muamalat) had agreed to a long-term partnership designed to “revolutionize” the bank’s digital Islamic Banking offerings. Also participating in the partnership is fellow Finovate alum, Mambu.