- Digital banking platform HMBradley forged a strategic partnership with banking technology provider Thought Machine.

- HMBradley will leverage Thought Machine’s Vault Core solution to offer new and more personalized financial products to its customers.

- U.K.-based Thought Machine made its Finovate debut at FinovateEurope in 2018.

Fintech platform HMBradley announced a strategic partnership with banking technology provider Thought Machine this week. Courtesy of the collaboration, HMBradley will be able to clear its waitlist and begin opening new accounts for the first time in nearly a year and a half. To this end, HMBradley also has teamed up with New York Community Bank (NYCB), a division of Flagstar Bank, who will maintain the customer deposit accounts.

“With Thought Machine’s cutting-edge technology, we can quickly create and build the products we’ve imagined, and with NYCB’s long-standing reputation as a stable and successful financial institution, we can exceed customer expectations at scale,” HMBradley co-founder and CEO Zach Bruhnke said. “This will result in an unparalleled customer experience with more personalized tools and benefits for our customers.”

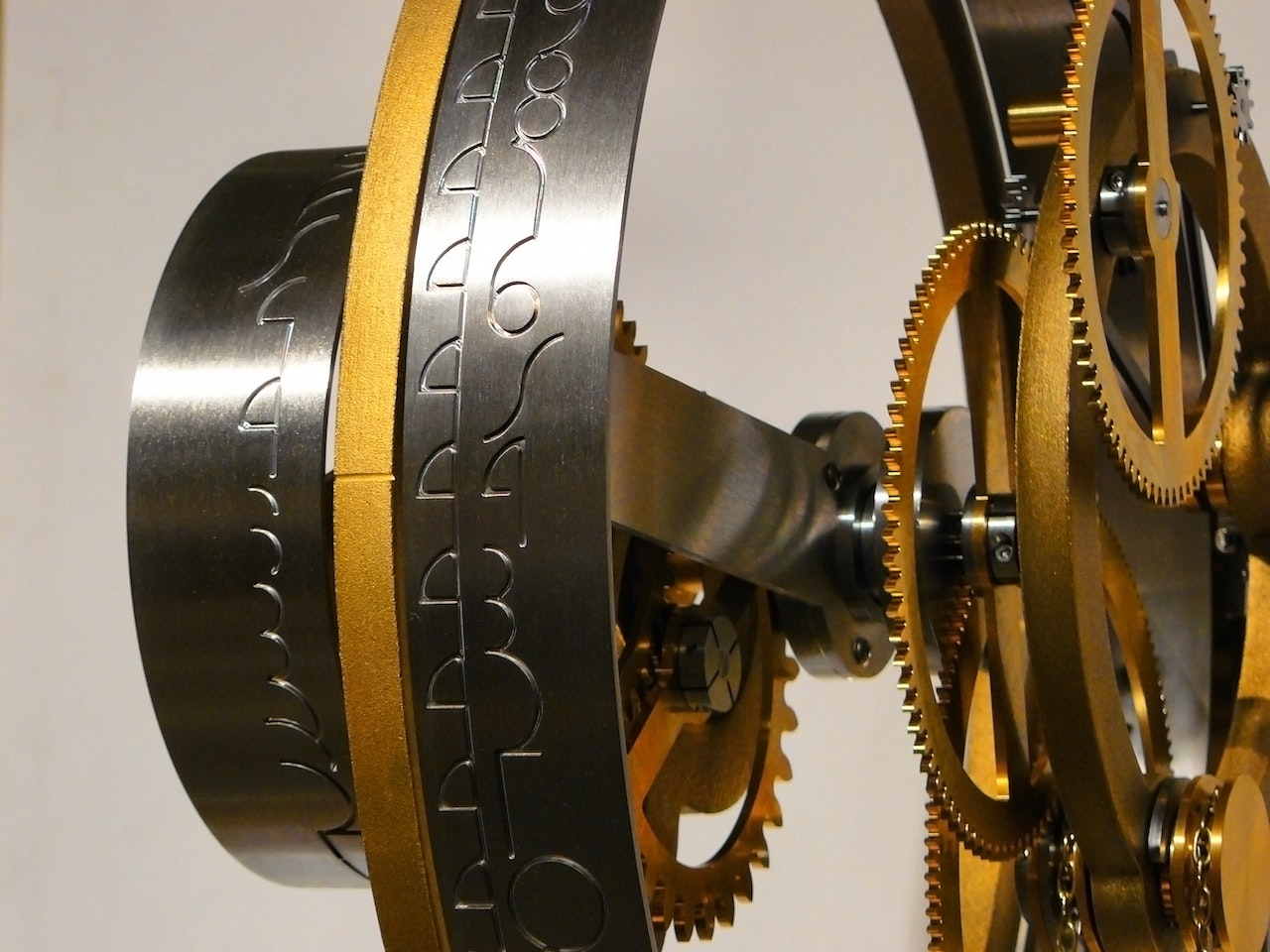

The adoption of Thought Machine’s configurable, cloud-native core banking platform Vault Core has enabled HMBradley to transition away from overnight batch transaction processing to real-time ledger capabilities. Features like Thought Machine’s smart contract technology gives HMBradley the ability to respond to market demands in real time, as well as enhance the customer experience with more personalized solutions and actionable insights into their financial status.

“By running on Vault Core,” Thought Machine CEO Paul Taylor said, “HMBradley will undoubtedly grow and improve its service in ways customers never imagined. We look forward to supporting HMBradley as it bakes power and efficiency into its operations and rolls out innovative new features with speed.”

Thought Machine’s partnership with HMBradley comes less than a month after the company announced that U.S.-based Arvest Bank was launching a new loan offering using Thought Machine’s core banking technology. Thought Machine and Arvest Bank have worked together since the fall of 2021, when the $26 billion financial institution brought Thought Machine on board to help drive its digital transformation strategy. Laura Merling, the bank’s chief transformation and operations officer, praised Thought Machine’s Vault Core for its ability to enable the bank to “build, launch, and manage any financial product through its Universal Product Engine” which offers “highly personalized, targeted products to specific customer segments.”

Founded in 2014 and headquartered in London, U.K., Thought Machine made its Finovate debut at FinovateEurope 2018. The company has raised more than $562 million in funding according to Crunchbase, from investors including Temasek Holdings, Intesa Sanpaolo, and Nyca Partners.