- Savings and purchase fulfillment platform SaveAway has introduced a suite of new features.

- The new functionality includes Custom Plans and Friends & Family Comments and Voting, which move beyond traditional anonymous reviews and blind gift-giving.

- SaveAway made its Finovate debut at FinovateFall 2016 in New York. Om Kundu is Founder and CEO.

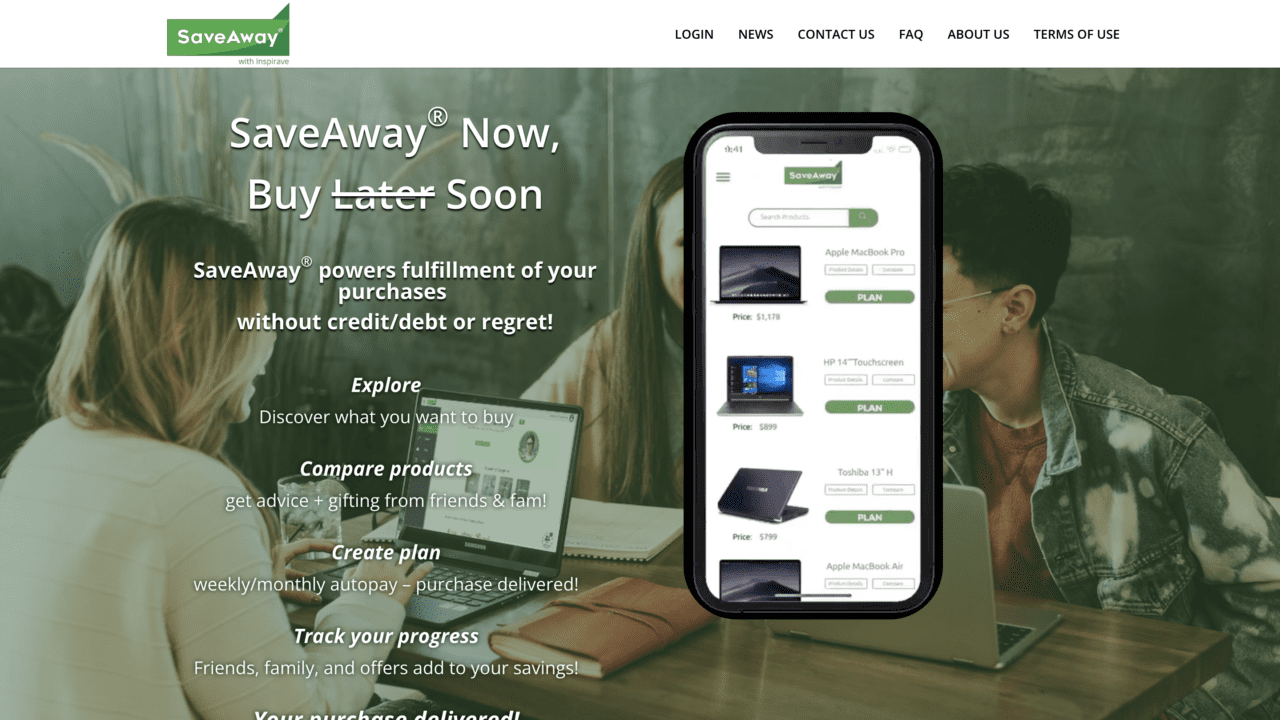

Goal-based savings and purchase fulfillment platform SaveAway introduced a range of new features. The new capabilities expand the platform’s core functionality to fulfill purchases without relying on credit or debt.

For years, SaveAway customers have been able to use the platform to establish a savings and purchase goal, set up autopay via their FDIC-insured SaveAway wallet, and then receive their item after the savings goal is met. With this announcement, SaveAway now enables users to purchase any product—not just those available via the SaveAway web app—simply by providing product details. This Custom Plans functionality expands access to a broader range of products and a wider network of retail partners and brands. It also makes it easier for users to set purchase goals that are better aligned with their personal preferences.

The company also announced Friends & Family Comments and Voting capabilities. This functionality lets users invite friends, family, and other members of their own “trusted circle” to comment, advise, and vote on a user’s potential purchases. Not only can they provide feedback on prospective purchases, but friends and family also can contribute financially toward the purchase. This functionality takes e-commerce beyond traditional anonymous reviews and blind gift-giving by integrating both the opinions and support of those who know and care about the consumer and their personal finances.

“SaveAway triages these first-of-its-kind capabilities to make the path to purchase more memorable and responsible, rather than one that relinquishes agency to the slippery slope of credit/debt/regret,” company Founder and CEO Om Kundu said in a statement. “Buyers and sellers can thus join the community of those who SaveAway to realize their purchase goals, while retailers recapture lost sales previously perceived as abandoned carts, affordably and sustainably.”

SaveAway’s announcement comes as the company ramps up its outreach efforts through campaigns such as “$25 for ’25,” a referral program that rewards new users and those they refer when they sign up for SaveAway and complete a savings and purchase plan. The company also announced its program to encourage content creators, influencers, and early adopters to try and test the platform. Lastly, SaveAway has enhanced its “Monitor Your Plan” page, boosting ease of use and transparency by making the content more intuitive and informative.

Founded in 2014 and headquartered in New York, SaveAway made its Finovate debut at FinovateFall 2016. At a time when Buy Now Pay Later platforms are gaining prominence, SaveAway offers an alternative for those looking to limit or reduce their reliance on credit and debt. More than simply a better way for consumers to “save for what matters,” SaveAway enables consumers to leverage the wisdom (and, potentially, the discretionary cash) of friends and families to promote financial wellness and to build a generation of smarter savers and smarter spenders.