Wow, it was a whirlwind of fintech news in the past seven days. Here are four stories that spiked on our fin-o-meter:

Wow, it was a whirlwind of fintech news in the past seven days. Here are four stories that spiked on our fin-o-meter:

________________________________

1. Stripe’s $80 million funding

_________________________________________

It’s not so much the amount of the funding, though that’s one of the biggest C-rounds we’ve seen in the space, rivaling Square’s $100 million round in June 2011. But the jaw-dropping aspect was the valuation, a reported $1.75 billion, double what PayPal just paid for Braintree, which is far bigger than Stripe.

But as PandoDaily’s Carmel DeAmicis and Michael Carney point out, it was favorable terms (2x liquidation-preference) that substantially boosted the valuation. Regardless of the funny VC math involved, it was a monster round for the small company.

Clear winners: Stripe founders and early investors

Potential winners: Other payment enablers who now have access to more funding

Potential losers: Square, which could have bought Stripe at a much lower valuation; PayPal; and other acquirers who now face an even stronger competitor

___________________________________________

2. T-Mobile teams up with Bancorp Bank & Blackhawk Network for branded prepaid card

___________________________________________

An interesting play by T-Mobile – turning their 7,500 locations into cash-handling mini-branches – is its new Mobile Money prepaid card. I’m not sure that’s the business I would have entered if I were in charge, but it will be closely watched. If it’s wildly profitable (unlikely), it could put pressure on the entire U.S. branch banking system. More likely, its success will be moderate and will fizzle out in a few years when T-Mobile finds more lucrative ways to deploy its real estate and sales staff.

An interesting play by T-Mobile – turning their 7,500 locations into cash-handling mini-branches – is its new Mobile Money prepaid card. I’m not sure that’s the business I would have entered if I were in charge, but it will be closely watched. If it’s wildly profitable (unlikely), it could put pressure on the entire U.S. branch banking system. More likely, its success will be moderate and will fizzle out in a few years when T-Mobile finds more lucrative ways to deploy its real estate and sales staff.

In any event, it will be closely watched by banks and non-bank retailers alike. (Potentially, T-Mobile could make more money reselling the consumer data from the effort, than from the prepaid business itself.)

Clear winners: Bancorp Bank (issuer) and Blackhawk (prepaid network)

Potential winners: T-Mobile (and other telcos that copy the strategy)

Potential losers: Wal-Mart, check cashing stores, and other players in the cash space

_________________________________________________________

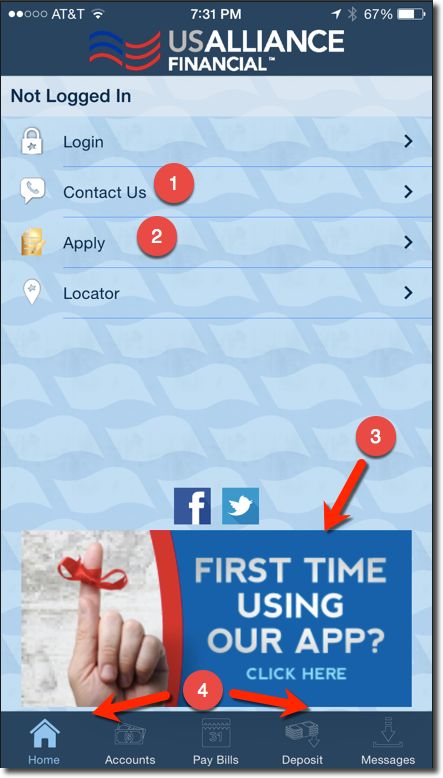

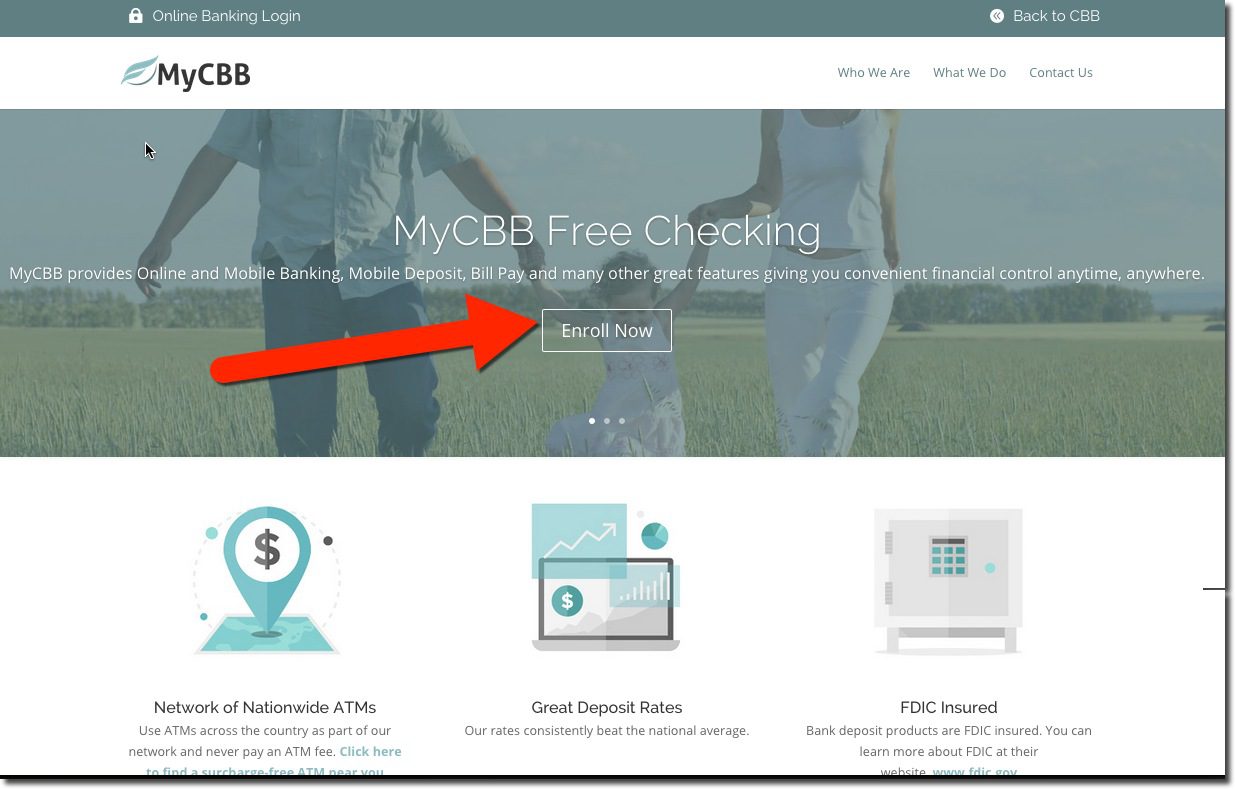

3. Mobile account opening (MAO) used by 1 of every 4 Andera-powered applications

_________________________________________________________

Andera, the online account-opening powerhouse, this week published a useful report (free with registration) analyzing account-opening metrics across its 500 clients. The stat that caught my eye was the number of mobile applications already being received, despite the newness of the channel for financial transactions. One in four Andera-processed financial product applications are received from tablets or smartphones, up from one in 25 three years ago. And three-quarters of the mobile volume is from smartphones.

Clear winners: Mobile leaders

Potential winners: Andera and other account-opening specialists

Potential losers: Bank branches, which will continue to be a major (albeit costly) source of new account applications

_______________________________________________________

4. Balanced Payments crowdfunds $50,000 to launch new feature

_______________________________________________________

I am a big fan of crowdfunding and expect massive growth (note 1), but I never thought I’d see it used by a fintech company to fund a new feature. But Balanced Payments, a Y Combinator-backed payment-startup serving online marketplaces, successfully raised more than $50,000 last week in about a day (Crowdhoster campaign). That surpassed its goal for adding a “push to debit card” (Techcrunch post).

It sounds too good to be true. But the startup used a clever incentive system for backers: prepaid fees. In other words, Balance customers could pledge a few thousand dollars for the feature, and then that money paid upfront would cover a given amount of transaction fees in the future. And the more that was pledged, the cheaper the transaction fees became. And there was a large incentive to pledge at the $10,000 level (see below).

Here’s the earnings table:

>> $1,000 pledge receives 1,000 prepaid transaction at $1 each

>> $2,500 pledge receives 3,333 transactions for $0.75 each

>> $10,000 pledge receives 40,000 transactions for $0.25 each

You could also toss in $25 for a T-shirt.

So far, there are 26 backers (25 if you don’t count my T-shirt pledge).

———-

Note: For much more on crowdfunding (debt and equity), see our May 2013 report (subscription).