You may have seen the list of FinovateAsia demoing companies we released a few weeks ago. Here are more details on the 32 companies demoing November 14 at the MAX Atria @ Singapore Expo. Get your ticket here to be part of the crowd.

Stay tuned for our Sneak Peek series next month featuring a behind-the-scenes look at each company and chance meet the innovators.

Advanced Merchant Payments’ innovative loan management solution enables banks to offer profitable, unsecured, short-term loans to small businesses

ArthaYantra provides personal financial advice online to everyone irrespective of what they earn

Backbase brings social media to the bank, and the bank to social media

BehavioSec has extended its award-winning

BehavioMobile solutions to offer policy-based behaviour authentication

BellaDati is

the agile business data analysis with human touch

BlueKite’s international bill payment service improves an immigrants’ ability to care for family back home

BRIDGEi2i is a trusted partner that enables organizations to achieve accelerated outcomes by embedding analytics in their DNA

CustomerXPs Software is a leading product company offering real-time, Enterprise Fraud Management & CEM products to banks globally

i-exceed has created a

Unified Application Development Suite for smartphone, tablets, desktops and laptops across operating systems

IND Group is a leading innovator and developer of digital banking, PFM and payments technology

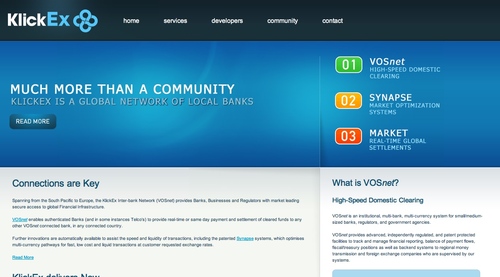

KlickEx is a Global Clearing System for commercial and central banks. The Clearing System extends to Retail, as well

Kofax is a leading provider of smart process applications that simplify the business critical

First Mile of information-intensive customer interaction

Luminous is a boutique innovation company that has become synonymous with innovative banking around the world

Mambu enables financial institutions to rapidly deliver state-of-the-art banking services through a cloud-first Software-as-a-Service solution

Matchi is a matchmaker for innovation

Mobexo is a scalable, value-added payment ecosystem that allows transactions to be executed between smartphones

Mobino enables mobile payments for 5 billion people, from any phone, no credit card required

Pangea Payments’ multiplatform solution will allow you to send money to anyone, from anywhere, at any time, using mobile and retail locations around the world

Red Zebra brings together consumers, banks and retailers, with targeted rewards based on spending patterns

SaaS Markets is the enterprise app store company for financial organizations looking to leverage cloud-based applications for their employees or customers

Serverside Group is the global technology leader in digital card designs and a provider of innovative artwork solutions that create meaningful results

SinoLending is the leading online lending platform in China

Smart Engine’s Multichannel Loyalty Platform benefits financial institutions, merchants, web shops and users

TIBCO Software creates real-time, event-enabled solutions for the 21st Century

Tootpay’s mobile payment solution works independently from network and operator. It is encrypted, using a standard mobile phone

TradeNet provides an equity trading customer channel for retail customers in emerging markets at $5 a month

TSYS focuses on people-centered payments

White Label Personal Clouds’ Website Welcomer eliminates username/passwords and enables seamless, private transfer of information between organisations

Yodlee is the platform for financial innovation, powering the world’s largest collection of transactional data