How important are mobile users to your sales efforts? 76% of Facebook’s ad revenue is from mobile (and it was considered by many to be a mobile laggard a few years ago).

How important are mobile users to your sales efforts? 76% of Facebook’s ad revenue is from mobile (and it was considered by many to be a mobile laggard a few years ago).

Prospective customers are already visiting your website from their smartphones in massive numbers. Are you making a good first impression? Does the UI work across key devices? And more importantly, is there an easy-to-find path to mobile purchase?

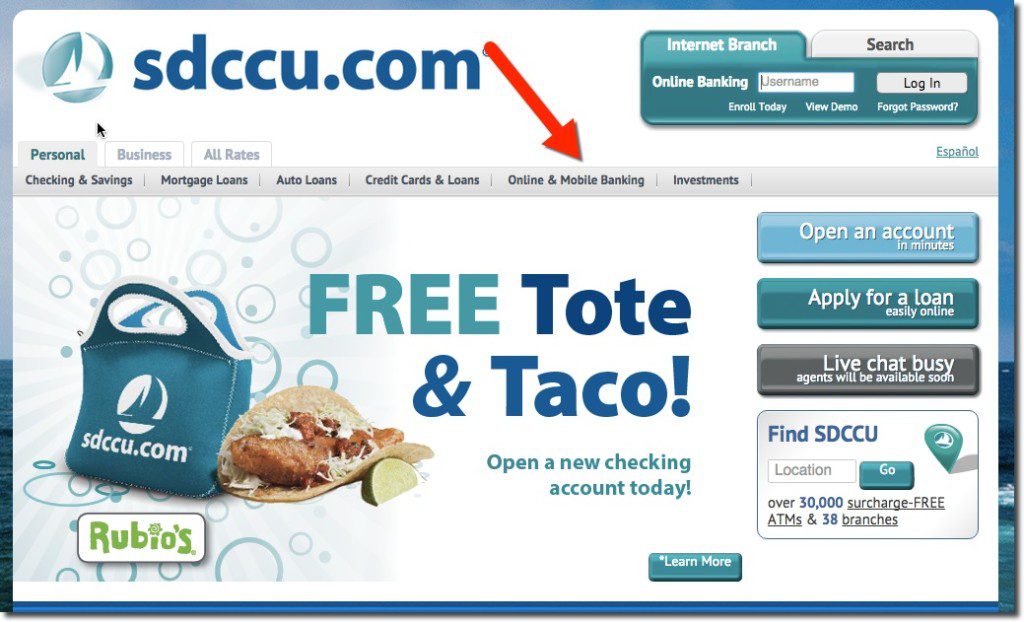

This afternoon, I visited 20 leading banking and personal finance sites (as a proxy for popularity, I used the 20 most downloaded free finance apps in the U.S. Apple App Store, see list in footnote). And it was like a trip back in time before (desktop) websites had adopted browser-design standards. By the numbers:

- Excellent: 19 of the 20 had mobile-optimized sites (Laggard = Navy Federal Credit Union)

- Satisfactory: 14 of 18 had a visible link for login (2 required a native app to login)

- Needs work: 11 of 20 had a visible link to download the native app (including the 3 below)

- Needs work: Only 3 of 20 used an initial “pop-up” screen that prompted download of the app, then the user needed to find a link to the non-app site

- Needs work: 12 of 20 made a visible attempt to sell something

- Fail: 6 of the 20 made a pretty marginal first impression, including several of the biggest financial institutions in the U.S. and the world: American Express, Chase, Citibank, Mint, PNC, Wells Fargo

My favorites (from this sample of 20, see footnote):

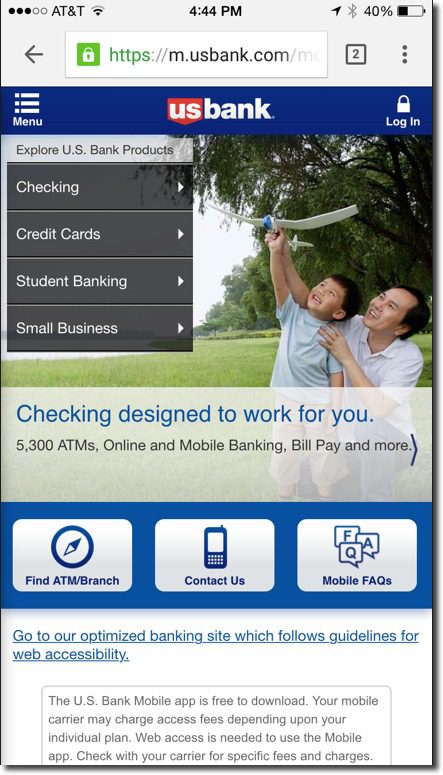

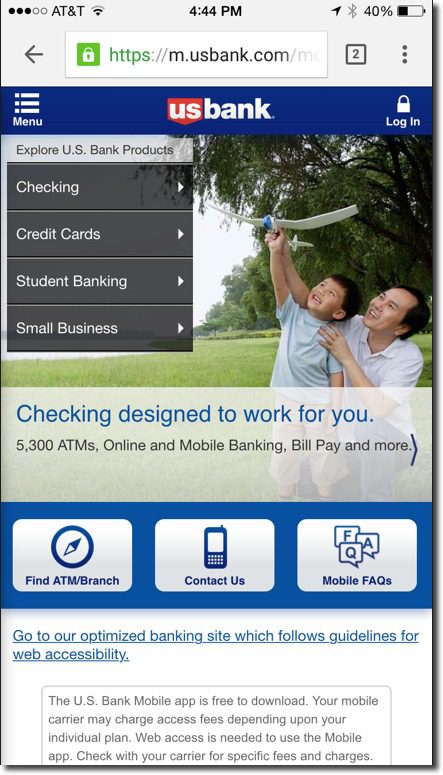

Bank: US Bank

Nice, engaging layout with clear path to more info, but missing a link to download the app

Runner-up: TD Bank

Easy-to-find customer service, login, location, but missing app-link

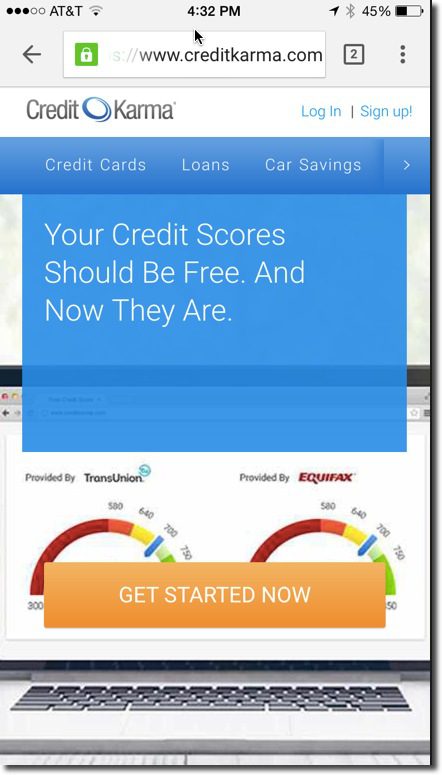

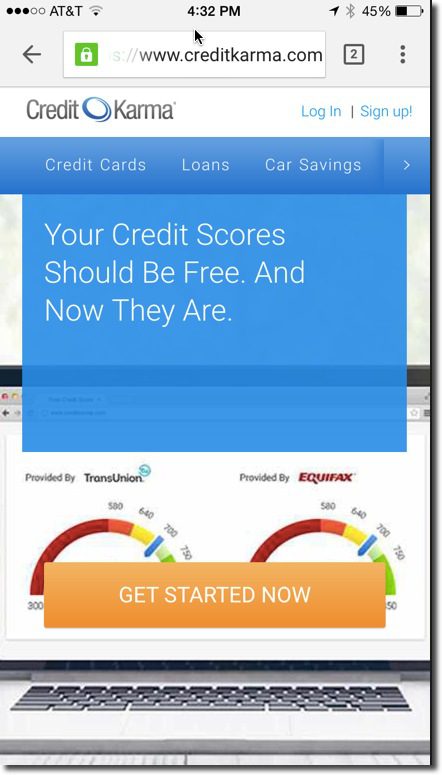

Favorite non-bank: Credit Karma

Good branding, clear get-started button, but no link to native app

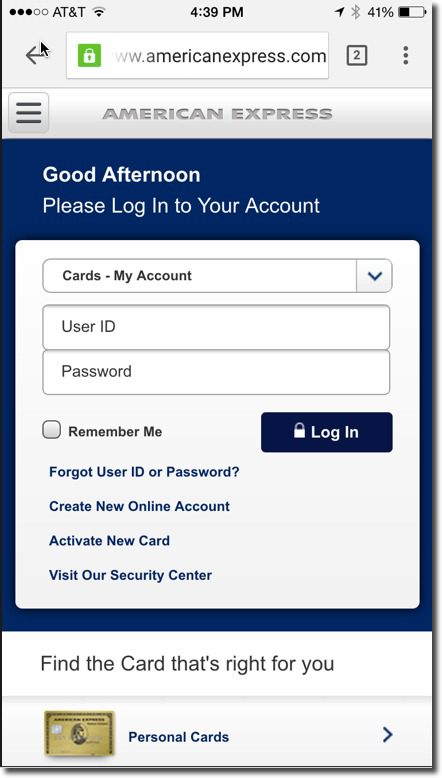

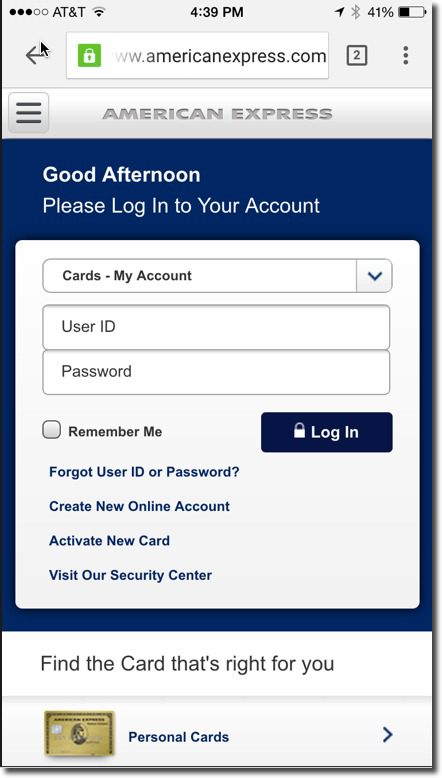

Least favorite FI: American Express (lots of competition for this one)

Too much emphasis on logging in, easy-to-miss card-finder at bottom

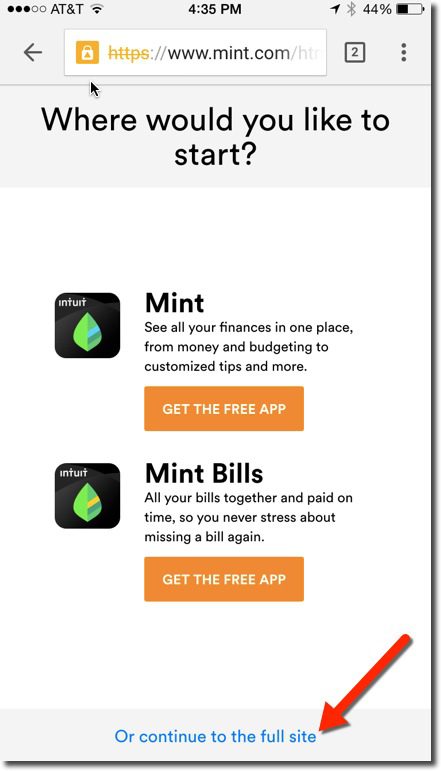

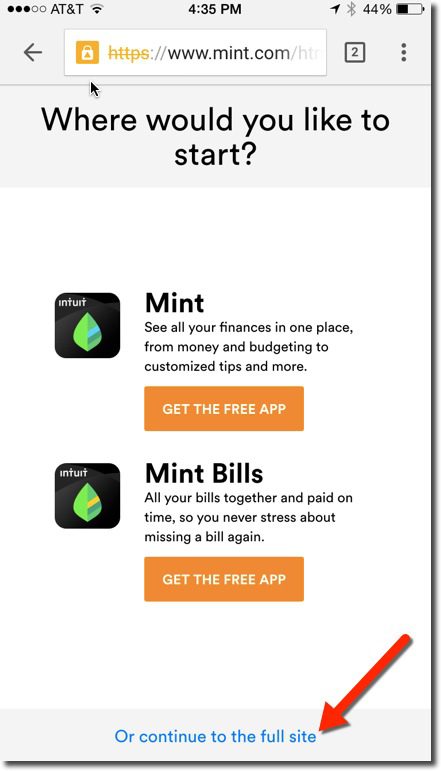

Least favorite non-FI: Mint

Straightforward app link, but needs to better engage new user before offering the two choices; not very graphically interesting

——–

Top 20 apps (in order at U.S. App Store, 5PM Pacific 31 Aug 2015): Chase, BofA, Wells Fargo, PayPal, Capital One, Venmo, Credit Karma, Square, Mint, Acorns, GEICO, Citibank, Discover, American Express, USAA, Progressive, US Bank, Navy Federal, TD Bank, PNC Bank

#RockChalk (for Karl, Joe and Mary)

Today begins our FinDEVr Preview blog series. On 6/7 October in San Francisco, 60 companies will present their latest developer tools, tips, and integrations. Register today and don’t miss out.

If you’ve been keeping up with the blog, you’ve seen enough

If you’ve been keeping up with the blog, you’ve seen enough