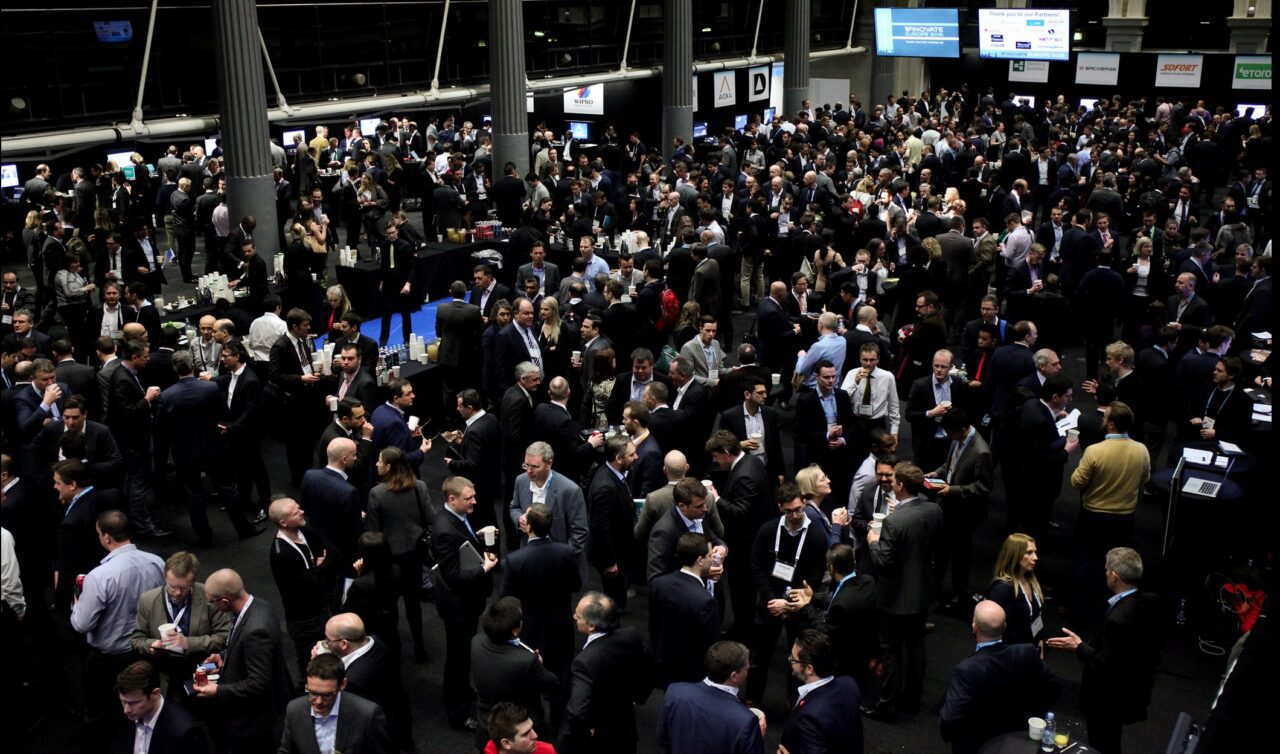

This week’s touch of autumn rain here in the Pacific Northwest is a welcome reminder that—when fall is just around the corner—our annual NYC conference is just a couple weeks away. FinovateFall tickets are on sale now, so pick up yours while you still can and join the 1,500-person gathering in Manhattan, 16/17 September.

This week’s touch of autumn rain here in the Pacific Northwest is a welcome reminder that—when fall is just around the corner—our annual NYC conference is just a couple weeks away. FinovateFall tickets are on sale now, so pick up yours while you still can and join the 1,500-person gathering in Manhattan, 16/17 September.

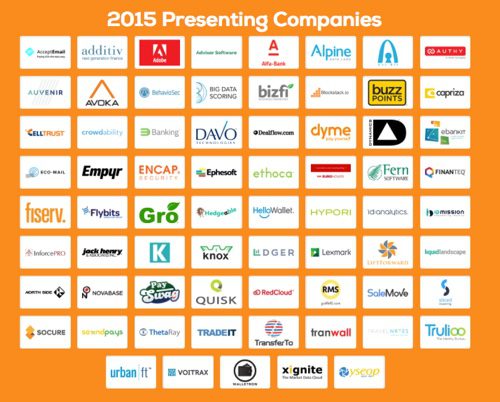

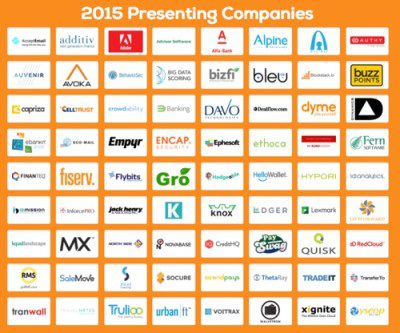

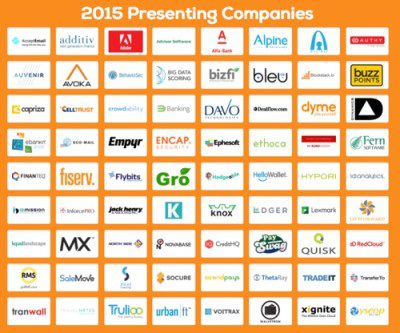

To whet your appetite for two days of fintech innovation, we’re releasing the full and final lineup of presenting companies for FinovateFall 2015. Here are a few brief introductions, but be sure to check our our Sneak Peek series to learn more about the innovators and entrepreneurs who will take the stage at the New York Hilton Midtown in just a few weeks.

- AcceptEmail serves today’s consumers with online, real-time email payments. Market segments include insurance, banks, telecom, utilities, and property management.

- additiv develops and implements digital innovations and business models for financial services providers.

- Adobe is changing the world through digital experiences. Content built and optimized with Adobe products is everywhere you look.

- Advisor Software is a cloud provider of sophisticated wealth-management and digital investment advice APIs and apps for financial services enterprises.

- Alfa-Bank offers a wide range of products and operates in all sectors of the financial market, including corporate and retail lending.

- Alpine Data Labs is a predictive analytics company focused on making analytical insights more accessible to the business.

- ArcBit aims to lever bitcoin and blockchain technology to connect you to the global Internet economy.

- Authy delivers proven fast-to-implement, highly scalable and reliable 2FA with an intuitive user experience and a powerful API.

- Auvenir is a smarter way to audit financial statements. Using cutting-edge technology, Auvenir is setting the new standard in compliance and assurance.

- Avoka’s digital business platform for frictionless sales-and-service solves the “buy” problem for financial institutions, government, and education.

- BehavioSec enhances security without affecting user experience. It is currently deployed at 20+ retail banks with 500+ million transactions a year.

- Big Data Scoring helps lenders harness big data to make better credit decisions.

- Bizfi consists of three synergistic product silos comprising aggregation, funding, and a participation-market for institutional investors.

- Bleu’s vision is to change the payment experience and create new platforms for mobile transactions.

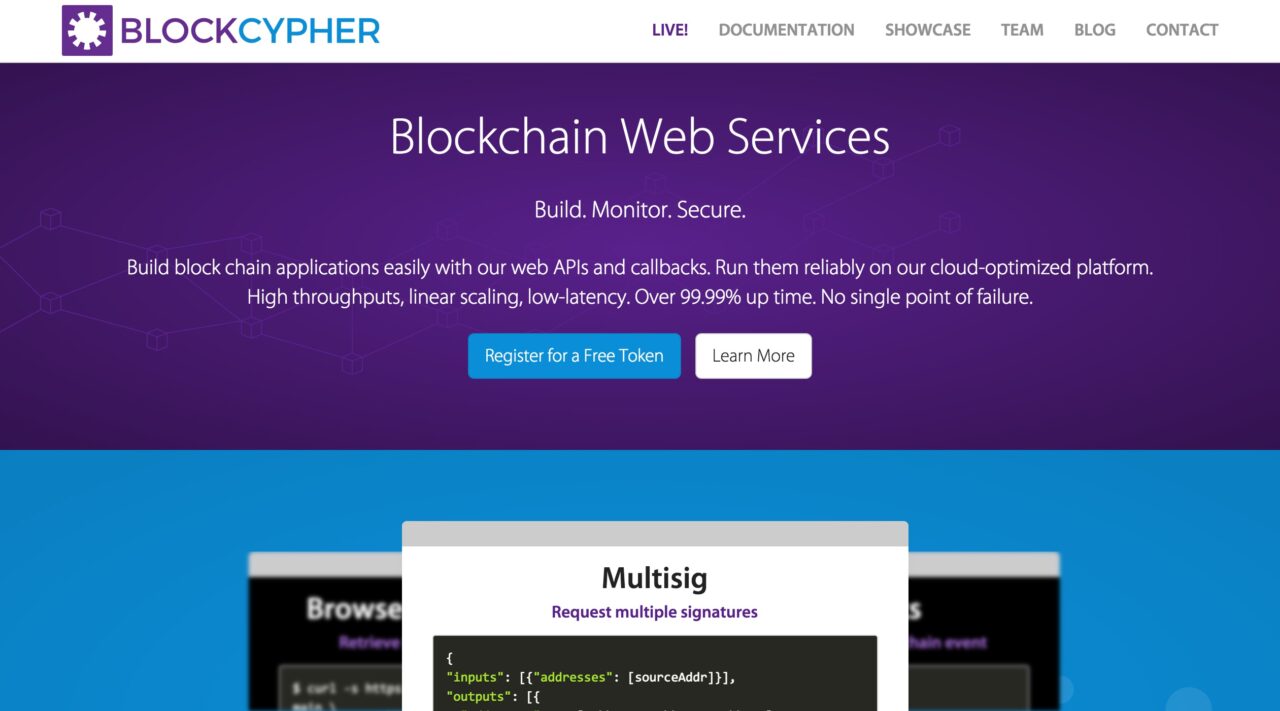

- Blockstack.io is an enterprise-software company selling private, enterprise blockchains for financial services and other enterprises.

- Buzz Points partners with community banks and credit unions to reward consumers for buying and banking locally.

- Capriza modernizes businesses by simplifying and mobilizing the most critical business workflows and disrupts the speed and economics of going mobile.

- CellTrust provides mobile solutions that deliver seamless, secure mobile workflows to support enterprise collaboration, productivity and compliance.

- Crowdability is the world’s first independent provider of education, research, and data on the emerging equity crowdfunding market for retail investors.

- D3 Banking provides innovative banking services from a single digital platform, lowering the cost and complexity of IT infrastructure.

- DAVO Technologies solves pain-points in the payor/payee relationship by optimizing any recurrent payment cycle, compressing time.

- Dealflow is building the largest channel for online capital formation.

- Dyme turns spenders into savers using the power of text messaging.

- Dynamics Inc. designs, manufactures, and personalizes intelligent battery-powered payment devices and advanced payment platforms.

- ebankIT is an omnichannel banking software company that delivers the latest innovative solutions in financial technology.

- Eco-Mail helps businesses solve the digital mail dilemma for both outbound and inbound mail with our patented, exchange-based platform.

- Empyr’s online-to-offline ad platform generates revenue for online publishers, including banks and fintech companies, from offline advertisers.

- Encap Security makes the world’s only authentication solution purpose-built for enabling omnichannel financial services.

- Ephesoft Smart Capture solutions classify documents and extract meaning from their content. Make better financial decisions with better data.

- Ethoca provides collaboration-based technology solutions that close the information gap between card issuers and commerce merchants.

- Euronovate is a leading company in digital transformation and biometric identity-management solutions.

- Fern Software provides social savings and loans software to FIs in more than 30 countries. Serviced out of offices in Europe, Asia, and the Americas.

- FINANTEQ began transforming mobile trends into financial technology prior to ‘era of iPhone’ and continually provides innovations in mobile space.

- Fiserv is a leading global provider of information management and electronic commerce systems for the financial services industry.

- Flybits is the context-as-a-service software platform in the cloud. Flybits provides better mobile apps, sooner, and for less: Get agile as you tailor your app strategy.

- Gro Solutions is dedicated to helping banks and credit unions grow by providing innovative digital customer-acquisition solutions.

- Hedgeable is the first private banking platform for millennials.

- HelloWallet works with employers to provide independent, personalized financial guidance to employees through web and mobile-based software.

- Hypori provides mobility solutions with Virtual Mobile Infrastructure. We can remote Android onto any mobile device and allow access to any unmodified app.

- ID Analytics is a leader in consumer risk management with patented analytics, proven expertise, and real-time insight into consumer behavior.

- IDmission provides a cloud-based platform enabling identity-initiated customer onboarding and engagement for financial services companies.

- InforcePRO is the only end-to-end post-sale life insurance policy software solution.

- Jack Henry & Associates is a leading provider of technology solutions and payment processing services primarily for the financial services industry.

- Knox Payments offers account verification and fraud guarantee to online merchants, and a single sign-on solution for consumers paying online.

- Ldger offers a user-driven marketplace credit-structured finance platform to power data-rich modeling, automated transaction execution, inventory discovery and aggregation.

- Lexmark creates enterprise software, hardware and services that remove the inefficiencies of information silos and disconnected processes.

- LiftForward operates white-labeled marketplace loan platforms which provide loans to small businesses and high-yielding debt products to investors.

- LiquidLandscape is a San Francisco based fintech startup with operations in London and New York. We recently graduated from the Barclays/Techstars Fintech Accelerator Program.

- MX

- New Kapitall Holdings provides millennials and the like-minded with the financial tools they need to live life to the fullest.

- North Side enables customers to speak or type to access your existing applications and databases, and clarify intent through conversation.

- Novabase has been making people’s lives simpler and happier through technology for 25+ years.

- Ormsby Street is an award-winning Shoreditch-based digital SaaS company helping small businesses make great decisions about who they trade with.

- PaySwag by Customer Engagement Technologies was founded to create solutions that revolutionize the payment experience for the underbanked.

- Quisk is a Silicon Valley-based startup that partners with banks and others to enable anyone to use their money without needing cash or cards.

- RedCloud Technology is changing the future of fintech. We were responsible for the successful conception and launch of M-PESA.

- RMS is an engagement-solution provider focused on acquisition, cross-sell, rewards, and referral marketing solutions for financial institutions.

- SaleMove’s vision is to meet and exceed the in-person customer experience online.

- Sliced Investing is democratizing access to elite investments including hedge funds and private equity for as little as $10,000.

- Socure utilizes online/social data, facial recognition, and AI for real-time consumer verification. Improving conversion and reducing costs/fraud.

- Soundpays is a universal mobile wallet using sound wave technology. We work with any technology whether online, in store, over TV, YouTube, or digital signage.

- ThetaRay is a leading provider of big data analytics and solutions for operational efficiency and risk detection.

- TradingTicket enables retail investors to place orders anywhere online or in-app with their existing brokerage accounts.

- TransferTo provides a global mobile remittance hub that helps businesses offer mobile money, goods and services, and airtime in real-time.

- Tranwall offers payment solutions which bring control, fraud prevention and flexibility to cardholders and card issuers.

- Travel Notes helps financial institutions improve their cardholders’ experience when traveling by offering powerful, yet simple solutions.

- Trulioo aims to cover the entire global population with verified IDs in an effort to increase trust and safety online and help fuel financial inclusion.

- Urban FT delivers a platform to both financial and non-financial issuers to give their customers industry-leading digital banking products.

- Voitrax provides a comprehensive automated-trade reconstruction solution, designed and built by seasoned Wall Street technologists.

- Walletron automates a brand’s presence in mobile wallets, opening a new communication channel for loyalty and billing.

- Xignite delivers in real-time reference market-data APIs that power fintech digital assets, such as websites and apps.

- Yseop is a global artificial intelligence enterprise software company that works in business intelligence and business process outsourcing.

FinovateFall 2015 is sponsored by The Bancorp, Capital Source, Envestnet, FT Partners, Hudson Cook, KPMG, and Zions SBIC.

Our partners include Aite, American Bankers Association, Bank Innovators Council, BankersHub, bobsguide, Breaking Banks, California Bankers Association, Canadian Trade Commissioner Service, Celent, CoinTelegraph, CrowdFund Beat, ebanking News, Hotwire, IDC Financial Insights, Javelin Strategy & Research, Let’s Talk Payments, Mapa Research, Mercator Advisory Group, Mergermarket, The New Economy, NYPay, The Paypers, SME Finance Forum, and World Finance.

Even if you’ve just worked in fintech for a year, you know that some trends in the industry seem to rise and fall more quickly than back-to-school fashion, while others have never faded out.

Even if you’ve just worked in fintech for a year, you know that some trends in the industry seem to rise and fall more quickly than back-to-school fashion, while others have never faded out.