Who knew the leader of the Roman Catholic Church was a fintech fan?

Okay, maybe Pope Francis is in New York City for reasons other than our annual autumn conference. But with news that FinovateFall 2015 has reached a new attendance record of more than 1,500, perhaps you’ll forgive us for thinking that “Il Papa” might be joining us as well.

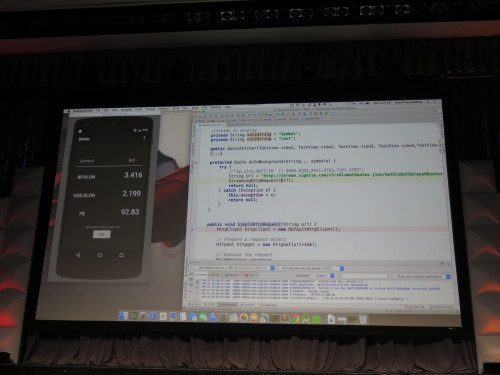

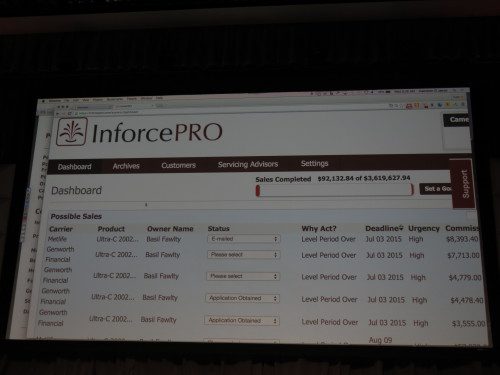

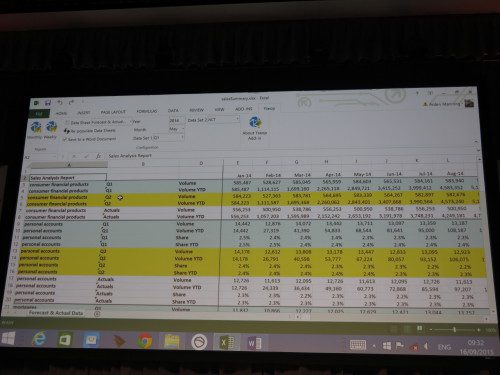

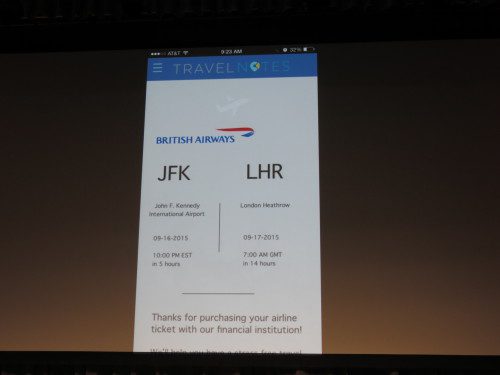

It’s still early here on rehearsal day. But from what we’ve seen on stage so far, we are very excited to share with you the fintech innovations of 72 companies from as far away as Israel and Sweden, and as near as a few blocks from our venue at the Hilton Midtown Manhattan.

So with the first demo of FinovateFall 2015 less than 24 hours away, here are a few tips and reminders to help you get ready for the show.

Get connected with Bizzabo

Get connected with Bizzabo

First, for registered attendees, Bizzabo is a great way to network with presenters, sponsors, partners, and your fellow Finovate attendees. You can download the social networking app—available on both iOS and Android, as well as via the online web interface—at Bizzabo.com.

Once you’ve downloaded the app, search for “Finovate,” select “join” and you’re set. (Please note, only registered Finovate attendees can join the community/networking section of the app.)

Tweet this!

Tweet this!

And even if you won’t be here in New York to join us in person, there are a bunch of great ways to enjoy—and participate in—FinovateFall 2015. Near the top of the list is our Twitter feed.

Our Twitter handle is @Finovate, and by marking your tweets #Finovate you’ll be part of our smart and tech-savvy community of more than 22,ooo followers on Twitter.

It’s a fun way to both follow along with the show, as well as get interesting (and sometimes irreverent) insights from one of the most fintech-friendly audiences you’ll ever find.

We hope you’ll join us! The show begins at 8:55 a.m. on Wednesday, and tickets are still available. Be sure to check our our FAQ page for any questions or send us an email at [email protected].

This post is part of our live coverage of FinovateFall 2015.

This post is part of our live coverage of FinovateFall 2015.