![]() This post is part of our live coverage of FinovateFall 2015.

This post is part of our live coverage of FinovateFall 2015.

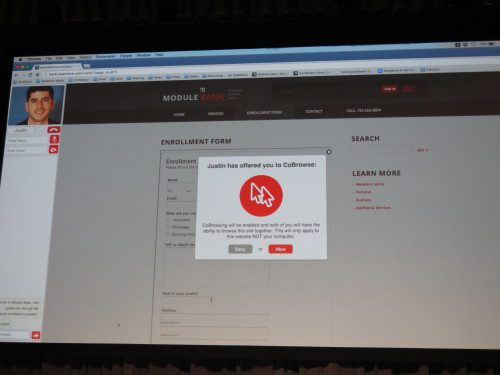

Our second company of the morning is SaleMove.

The SaleMove Engagement Platform is comprised of a Visitor and Operator interface. The Visitor interface is the consumer-facing part of the platform that allows for website visitors to seamlessly engage with financial institutions. The Operator interface is the business-facing part of the platform that provides FIs with complete visibility and live engagement of visitors browsing the website.

OmniCall is SaleMove’s newest feature that is coming out of beta at FinovateFall 2015! It allows for an instant online engagement experience triggered by simply dialing a phone number.

Presenter: SaleMove CEO Daniel Michaeli, founder

Product launch: SaleMove OmniCall is launching September 2015 at FinovateFall

Metrics: ~$7M raised; +100 customers

Product distribution strategy: Direct to business (B2B)

HQ: New York City, New York

Founded: May 2012

Website: salemove.com

Twitter: @SaleMove