Bitcoin is inherently difficult to protect and is not guarded from fraud, as many traditional accounts are. To navigate this issue, Ledger has designed hardware to help users preserve ownership of their digital blockchain assets.

The company began as the House of Bitcoin, a physical retail location in Paris where people exchange digital currency in person, learn about bitcoin, and share ideas with other startups (see below). Ledger was born from a merger of three different companies which had gathered at the space to collaborate.

The company’s flagship hardware product Ledger Nano helps individuals protect their bitcoins and make payments safely.

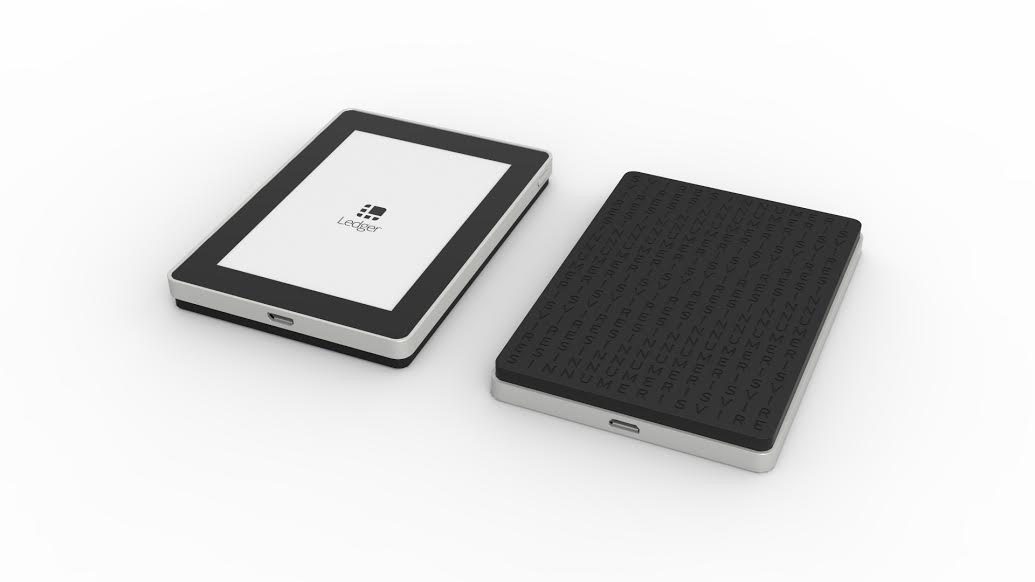

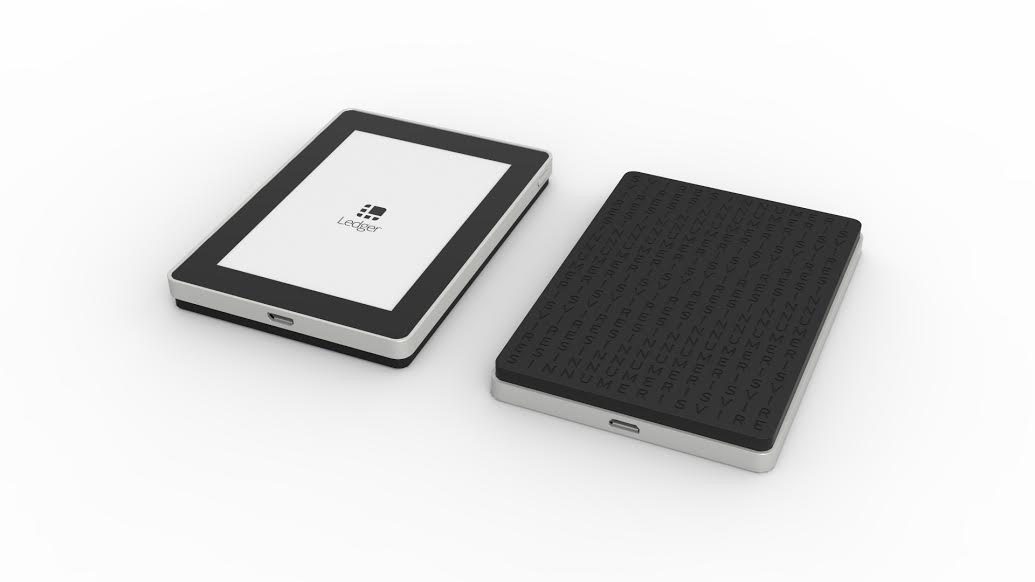

At FinovateEurope 2016, the company launched the Ledger Blue Smartcard (pictured below), an enterprise solution featuring a touch screen to serve as a second factor to validate transaction information before completing a settlement on the blockchain. The device mitigates phishing and malware attacks, which can occur due to inherently insecure computers, smartphones, or human negligence.

Ledger CEO and founder Eric Larchevêque says, “It is a hardware wallet, but we prefer to call it a personal security device because it can do a lot.” The device not only serves as a second factor for bitcoin transactions and interbank settlements, but also secures the movement of any assets held on the blockchain, including P2P stock trading, workflow certification for insurance management, and even process documentation for pharmaceutical clinical trials.

“It’s not about currency,” Larchevêque emphasizes, “but about what you can do with the blockchain.”

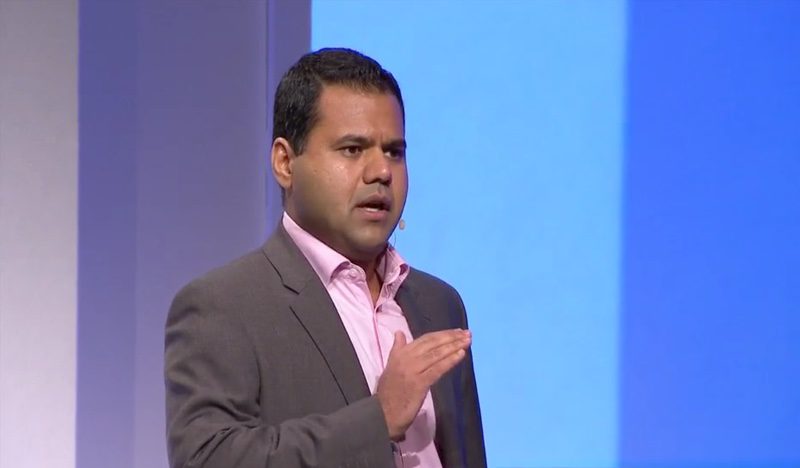

CEO Eric Larchevêque demoed Ledger Blue at FinovateEurope 2016 in London.

Ledger Blue facts:

- Employees: 16

- Funding: €2.5M seed round in 2015

- 10,000 units sold of first device, Ledger Nano

- Customers across 100 countries

- HQ: Paris, France

- Founded: January 2015

Eric Larchevêque demonstrated Ledger’s Blue Smartcard on stage at FinovateEurope in London (above). Larchevêque studied as an engineer of macro electronics at the ESIEE Paris, a French graduate school of engineering. Since 1996 he has been an entrepreneur and has founded, sold, and crashed about a dozen companies.

Eric Larchevêque demonstrated Ledger’s Blue Smartcard on stage at FinovateEurope in London (above). Larchevêque studied as an engineer of macro electronics at the ESIEE Paris, a French graduate school of engineering. Since 1996 he has been an entrepreneur and has founded, sold, and crashed about a dozen companies.

Finovate: What problem does Ledger solve?

Larchevêque: Ledger secures the last meter of the enterprise infrastructure by designing a new generation of hardware security devices enforcing strong authentication, data integrity and compliance. Use cases range from critical workflow security to trusted hardware for blockchain-based applications.

Finovate: Who are your primary customers?

Larchevêque: Enterprises, banks, fintechs, insurers, asset managers, blockchain startups … Any company requiring a high level of compliance and security in their process. We are present on the European and North American market.

Finovate: How does Ledger solve the problem better?

Larchevêque: Ledger has a strong expertise in embedded hardware security and built its reputation on the blockchain market by designing a popular security solution sold in more than 100 countries.

Finovate: Tell us about your favorite implementation of your solution.

Larchevêque: In compliance, necessity of proof lies with the company under scrutiny. Ledger designed a blockchain-based immutable audit trail giving full traceability of any process. Each step is permanently recorded in the blockchain through the signature of personal, secure hardware keys. As the audit trail is fully enforced through a decentralized system, this solution brings the highest possible trust level and prevents any possibility of tampering.

Finovate: What in your background gave you the confidence to tackle this challenge?

Larchevêque: Ledger’s core engineers come from highly regarded hardware and security companies such as Oberthur, Gemalto or STMicroelectronics. Ledger is a full-stack company, with a rare expertise on secure elements (smart cards), and developed its own secure embedded operating system.

Finovate: What are some upcoming initiatives from Ledger that we can look forward to over the next few months?

Larchevêque: Ledger will soon release a suite of FIDO-certified hardware dongles for strong authentication (with USB, NFC and BLE capabilities). It’ll allow enterprises to bring access security to the highest level for both laptop and mobile web apps and native applications.

Finovate: Where do you see Ledger a year or two from now?

Larchevêque: Ledger will be a global leader in trusted hardware for cybersecurity and blockchain-based applications.

Check out Ledger’s live demo video from FinovateEurope 2016:

Eric Larchevêque demonstrated Ledger’s Blue Smartcard on stage at FinovateEurope in London (above). Larchevêque studied as an engineer of macro electronics at the ESIEE Paris, a French graduate school of engineering. Since 1996 he has been an entrepreneur and has founded, sold, and crashed about a dozen companies.

Eric Larchevêque demonstrated Ledger’s Blue Smartcard on stage at FinovateEurope in London (above). Larchevêque studied as an engineer of macro electronics at the ESIEE Paris, a French graduate school of engineering. Since 1996 he has been an entrepreneur and has founded, sold, and crashed about a dozen companies.

The Maryland-based company will use the funds to expand sales and marketing efforts and accelerate product development.

The Maryland-based company will use the funds to expand sales and marketing efforts and accelerate product development. The acquisition was finalized in December.

The acquisition was finalized in December.

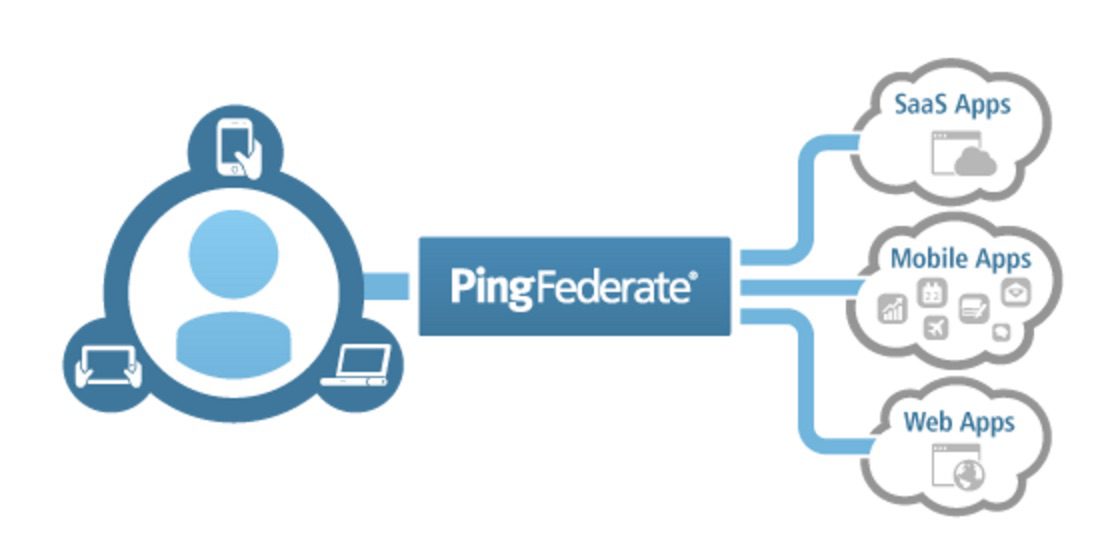

The enhancements are for Ping Federate, which offers banks an omnichannel authentication and access-management solution that uses multi-factor authentication (MFA), single sign-on, and limited access security.

The enhancements are for Ping Federate, which offers banks an omnichannel authentication and access-management solution that uses multi-factor authentication (MFA), single sign-on, and limited access security.