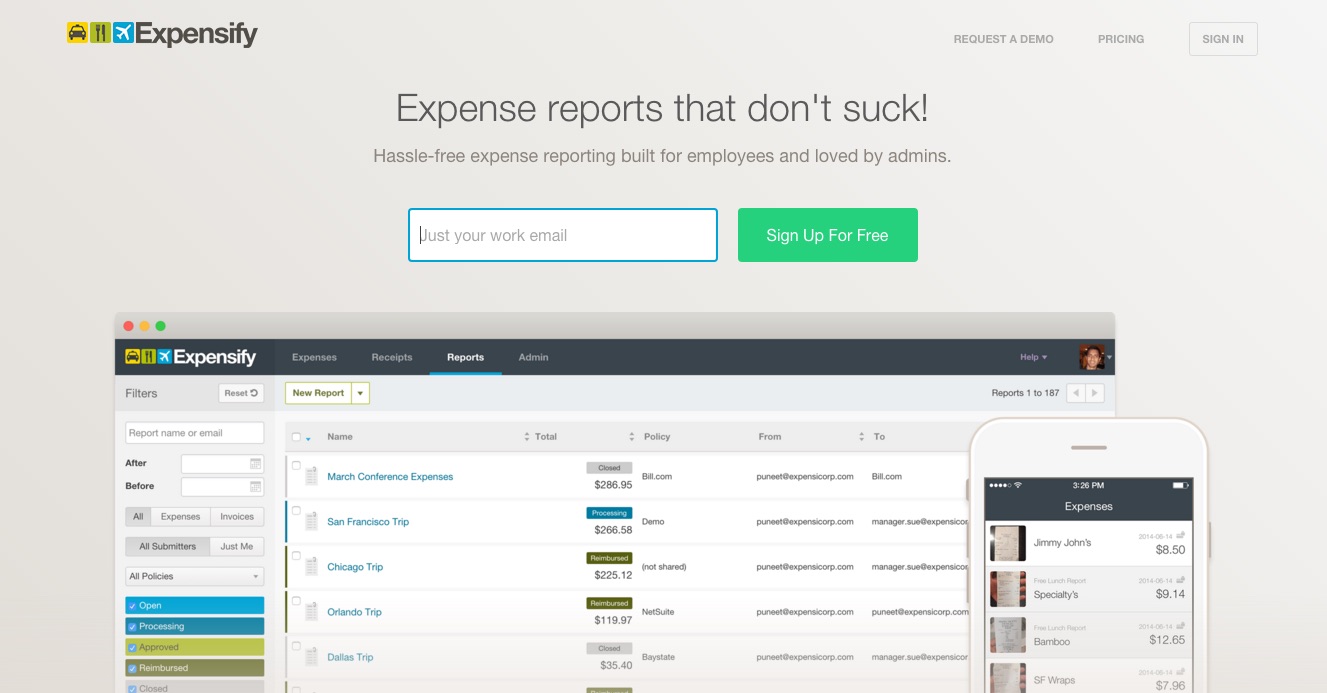

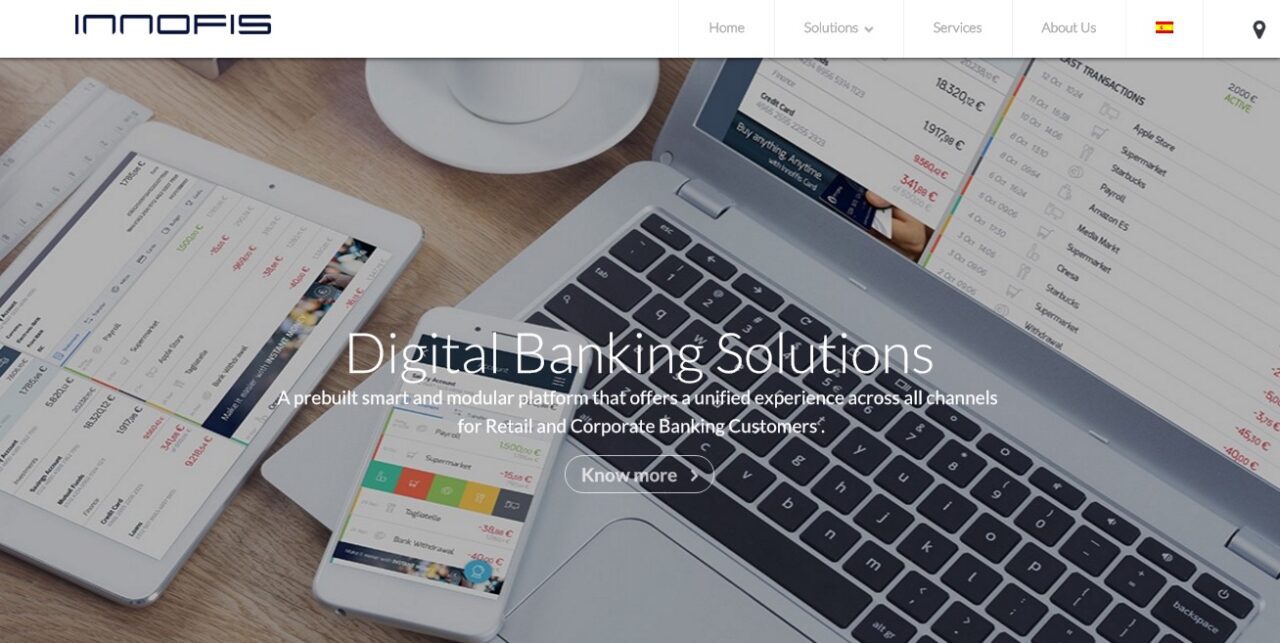

Customers shouldn’t be the only ones enjoying a great user experience. That’s the driving factor behind Innofis, a company that furnishes a suite of digital banking tools providing a beautiful user experience for both bankers and their customers.

In 2012, the company saw an opportunity in offering digital banking services. The initial team, whose roots stem from banking, IT, and digital offerings, launched Innofis that same year. By the end of the year, they already had two customers, and they knew they were onto a great idea.

Company facts

- Headquartered in Barcelona, Spain

- Founded in 2012

- Privately owned

- 80+ employees

- €6M in revenue

- >3 million digital end customers (retail and corporate)

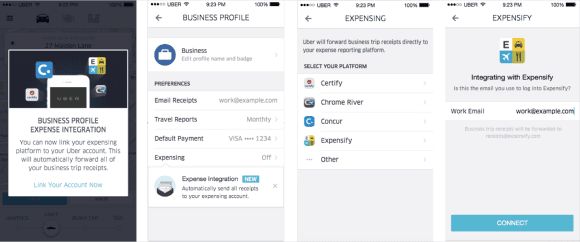

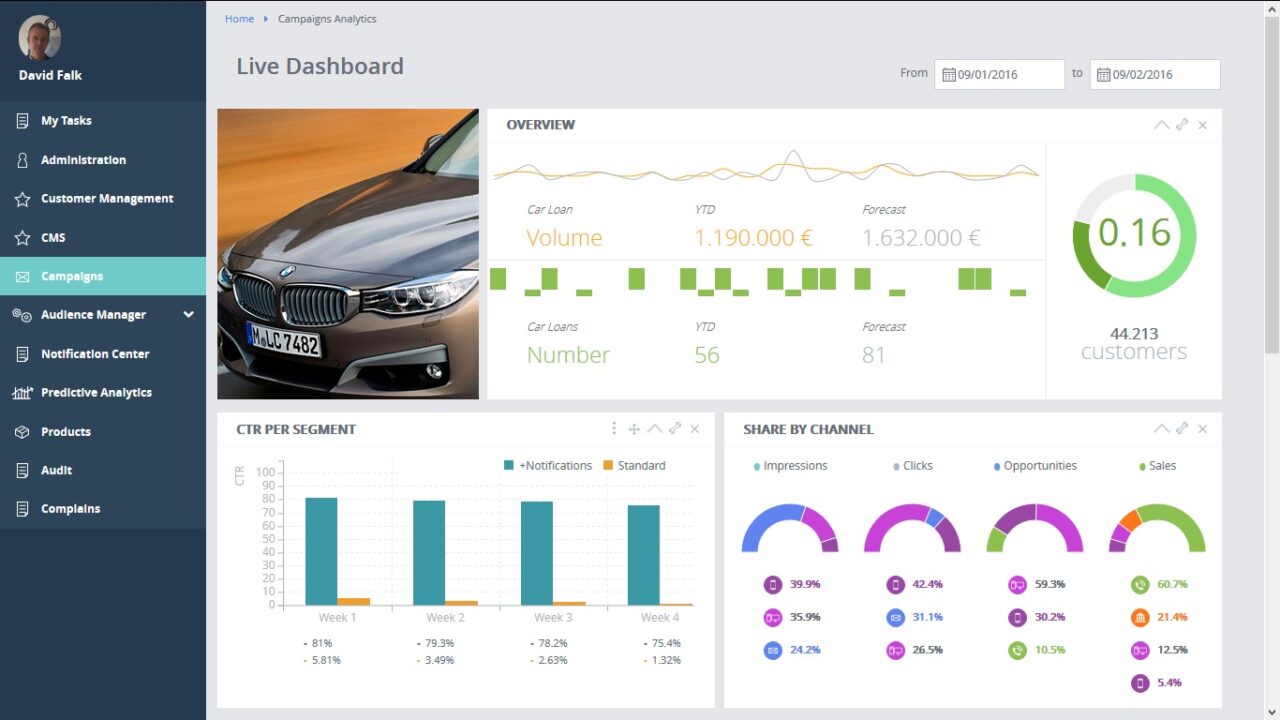

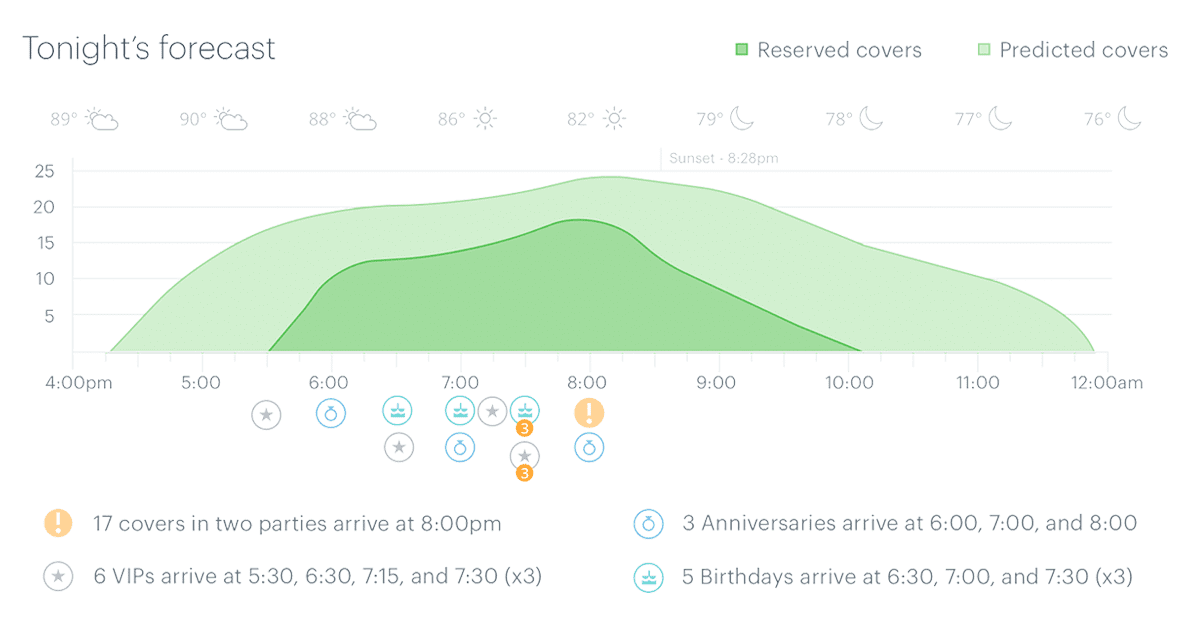

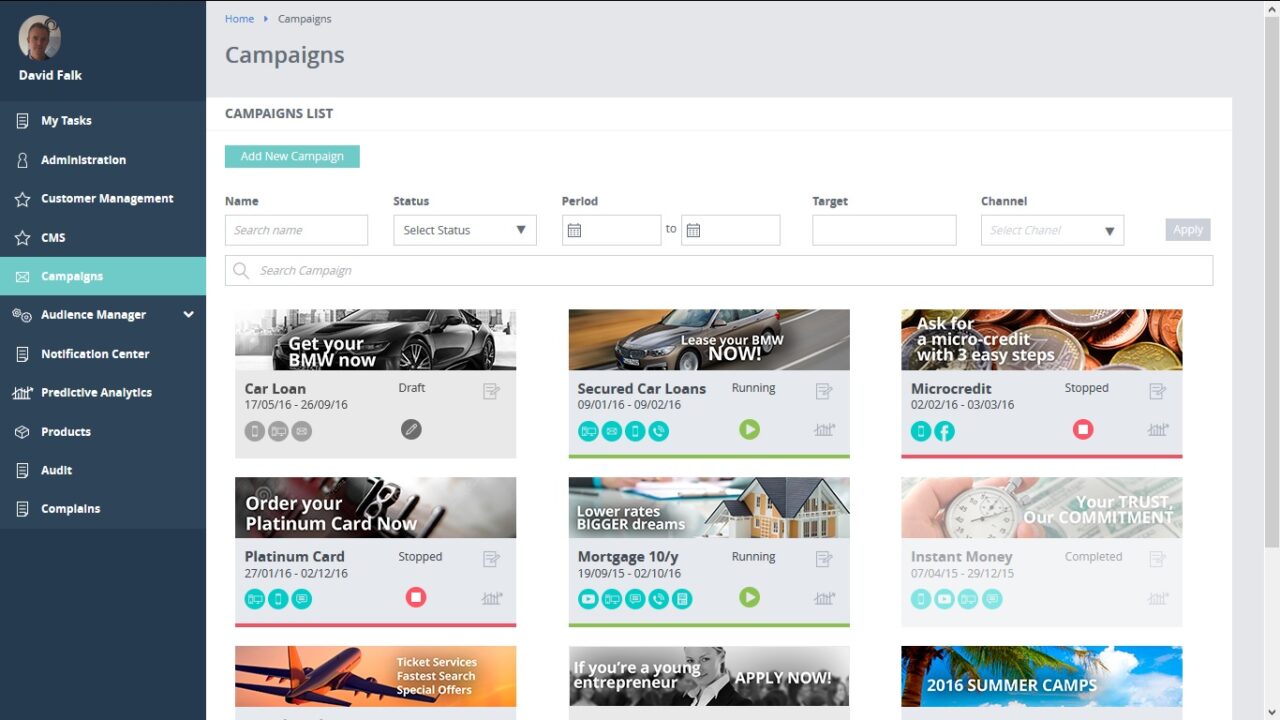

The company’s back-end management tools make it simple for any bank employee to control banking campaigns across all channels. The company uses big data combined with contextual customer behavior to help banks extend relevant calls to action.

We caught up with the company’s CEO, David Moreno at FinovateEurope 2016 for an interview to learn more about Innofis.

We caught up with the company’s CEO, David Moreno at FinovateEurope 2016 for an interview to learn more about Innofis.

Moreno, who has served as CEO of Innofis since 2012, started his career at a bank where he worked in retail and corporate banking, marketing, IT, and consulting. During his 11-year tenure, he saw and experienced many different functions of the bank.

Finovate: What problem does Innofis solve?

Moreno: Many banks are still in the process of either starting up their digital platform or looking for modules which complement their existing offer. Established banks are often struggling with legacy systems and little or no connection between the new digital channels and the more traditional ones. Innofis helps banks solve these issues by either implementing a complete digital platform or providing the missing parts with specific modules. Furthermore, banks face a challenge in keeping up with continuous market innovation, such as wearables, augmented reality and geolocation. Innofis keeps a tab on these developments and adds them to their digital service offering as they appear.

Finovate: Who are your primary customers?

Moreno: Our clients are banks. We are working with some of the world’s largest banks and have millions of their customers using our digital platforms.

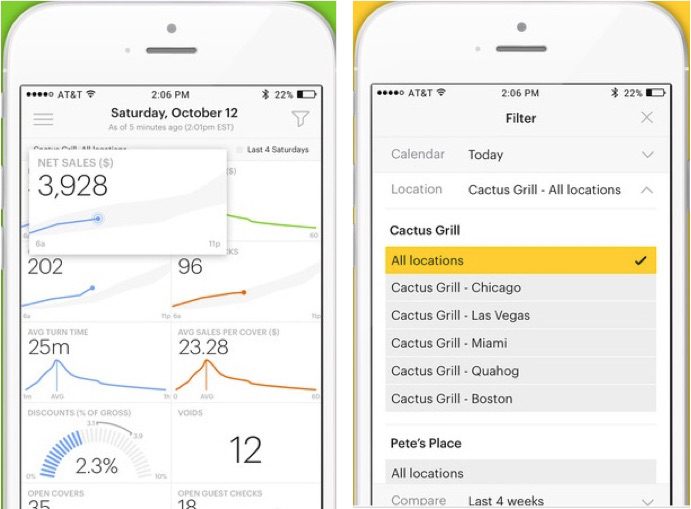

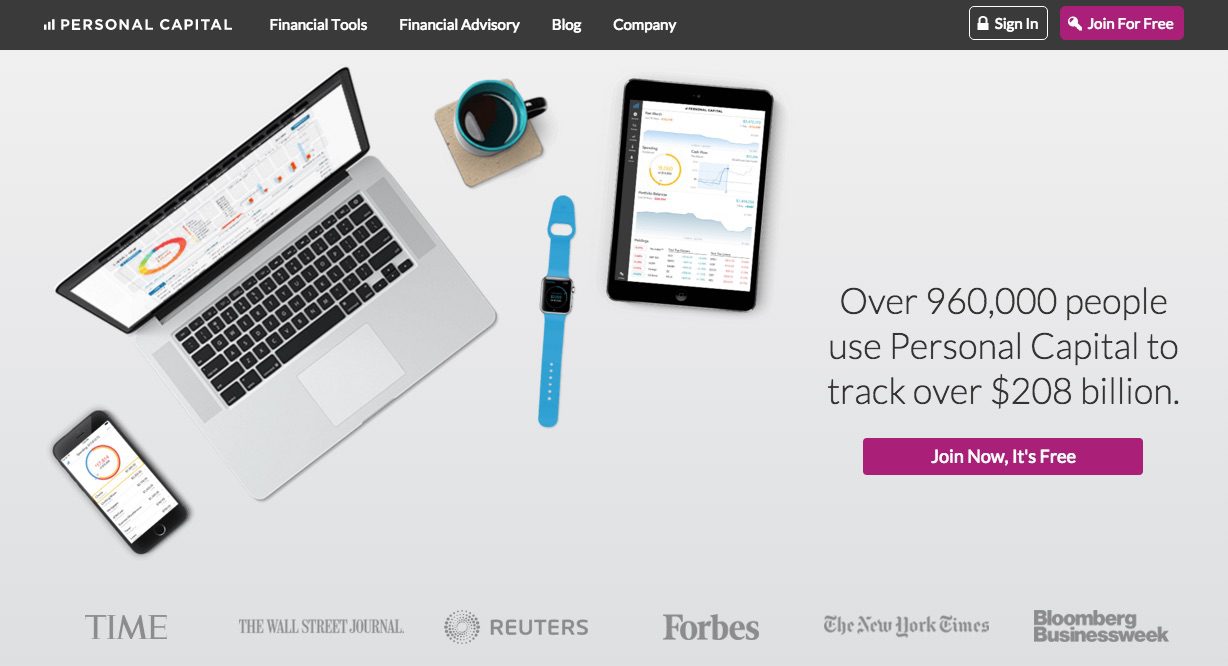

Innofis multi-channel interface

Finovate: How does Innofis solve the problem better?

Moreno: We do not necessarily propose a complete digital ‘reset’ for banks. We are mindful of the investments made and difficulty of infrastructure switching costs. Our modular approach is the ideal answer to this situation. We often actually reuse existing applications and provide an efficient combination between old and new.

Finovate: Tell us about your favorite implementation of your solution.

Moreno: We did recently have the opportunity to help a bank in the Middle East start from scratch and implement our entire range of digital channels (mobile, tablets, desktop, wearables) together with our administration platform that allows to manage completely the channels and the way they interact with their clients . It was great to see these go live and see customer usage rates jump up right away.

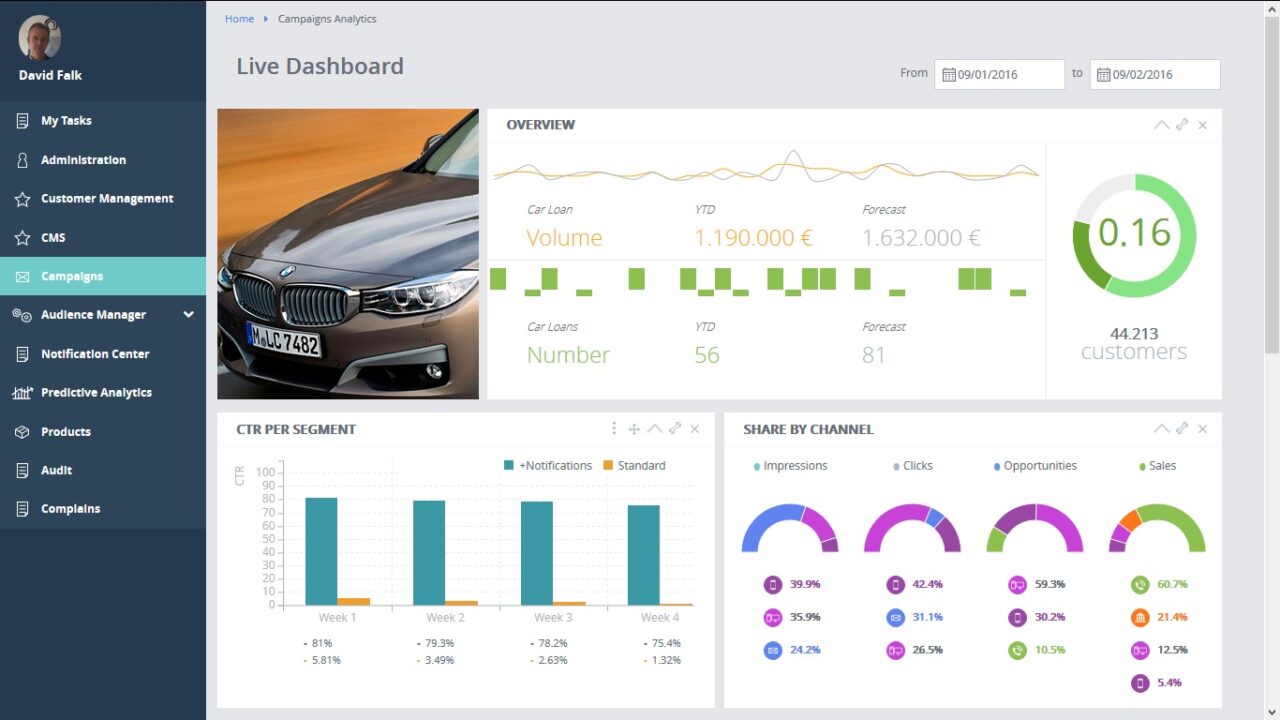

Innofis administration dashboard

Finovate: What in your background gave you the confidence to tackle this challenge?

Moreno: I have many years of experience working in banks. I do not approach the constant financial innovation as a threat for banks, but rather an opportunity to adapt existing resources and provide better service for banking clients. I believe that my background, together with a strong technical team who made our platform a reality, have allowed us to position ourselves as a trusted advisor and provider for banks.

Finovate: What are some upcoming initiatives from Innofis that we can look forward to over the next few months?

Moreno: We continue working on some ground-breaking modules that complement our platform. At FinovateEurope, we showed our approach of focusing on the UX for the people inside the bank who actually have to work with the systems. And the response has been tremendous. We believe banks understand now that a good customer-facing UX is a must. The real challenge now is to provide products that can actually be used easily and efficiently by the banks.

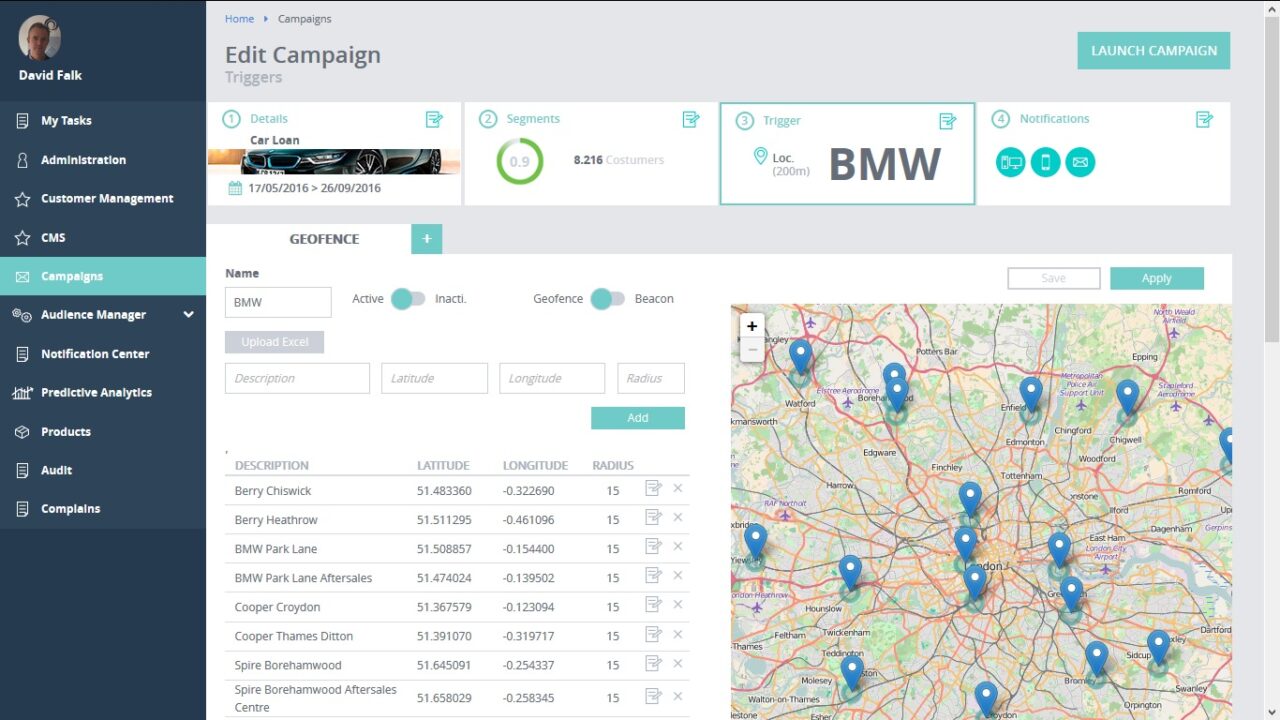

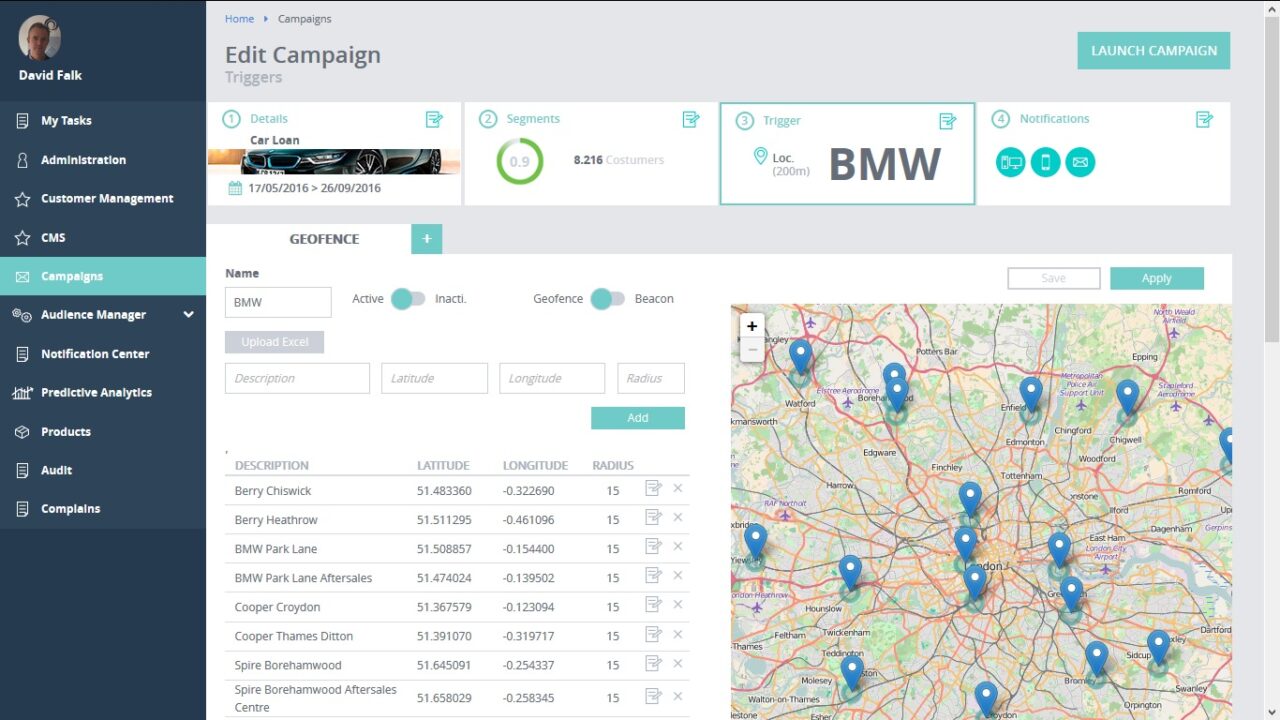

Innofis geofenced offer capability

Innofis geofenced offer capability

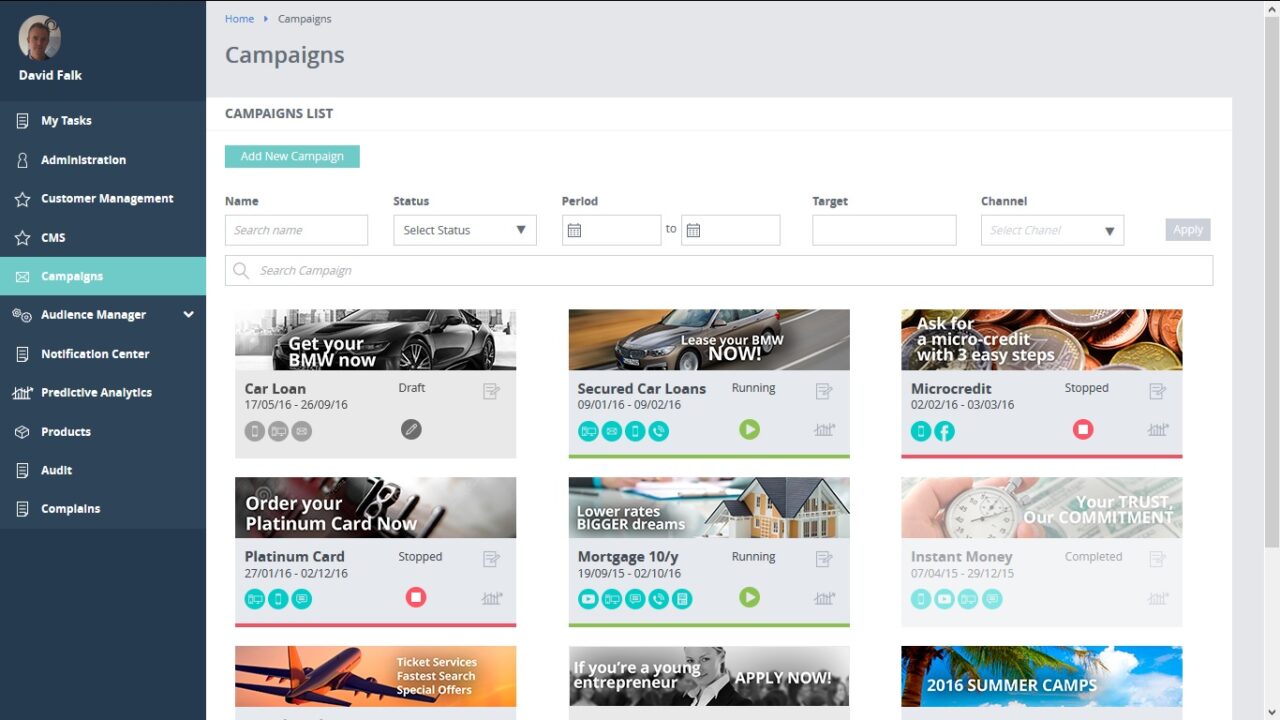

Campaign dashbaord

Campaign dashbaord

Finovate: Where do you see Innofis a year or two from now?

Moreno: We are on a road of international expansion. We are experiencing increasing demand from Asia, South America, Eastern Europe and others and we are planning to build out our organization in order to keep delivering the quality of implementation that customers have come to expect from us.

Innofis CEO David Moreno, along with David Falk, demoed the company’s Omnichannel Predictive Banking at FinovateEurope 2016 in London.

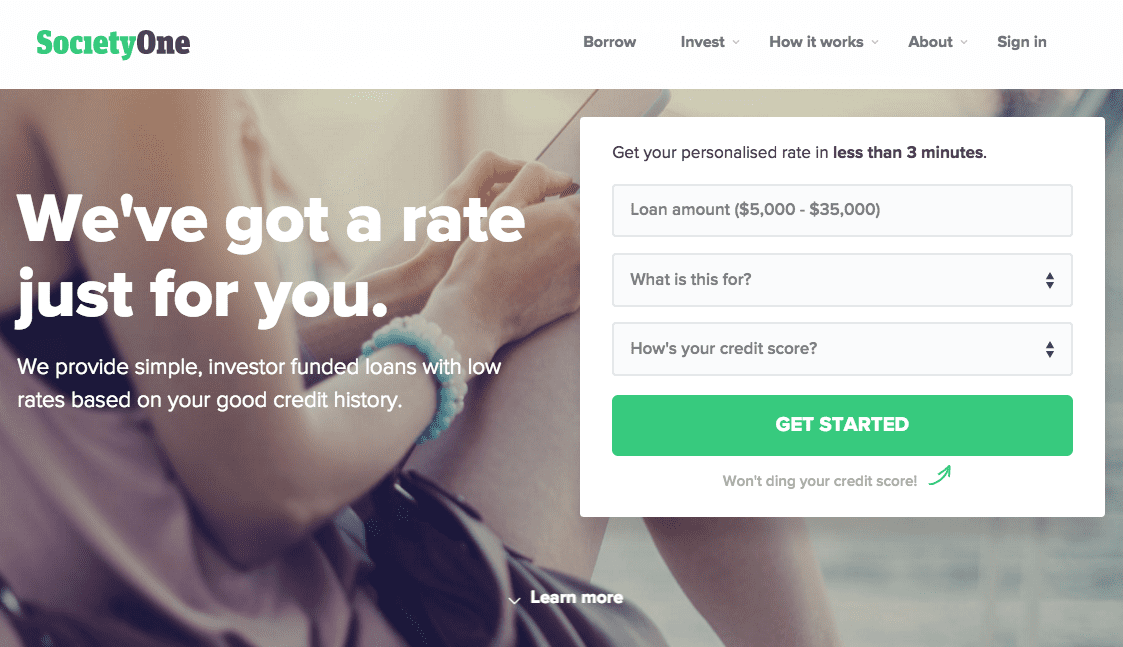

Australia-based P2P lender

Australia-based P2P lender

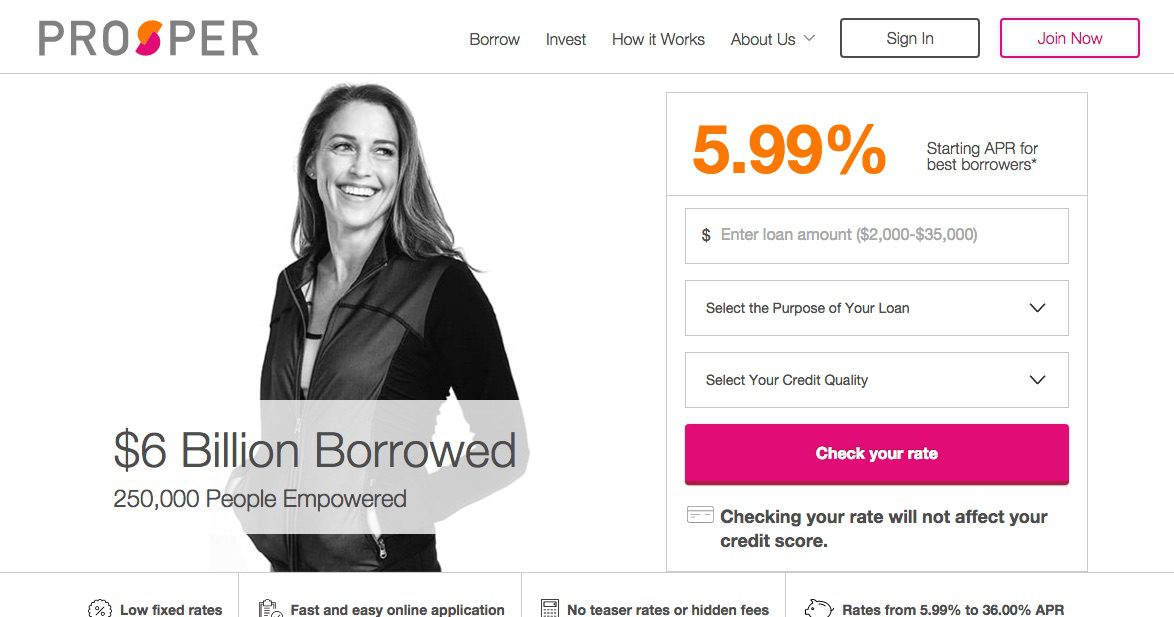

U.S. peer-to-peer lending platform

U.S. peer-to-peer lending platform

We caught up with the company’s CEO, David Moreno at FinovateEurope 2016 for an interview to learn more about Innofis.

We caught up with the company’s CEO, David Moreno at FinovateEurope 2016 for an interview to learn more about Innofis.

Innofis geofenced offer capability

Innofis geofenced offer capability Campaign dashbaord

Campaign dashbaord