Less than a month away from its Finovate debut, SuiteBox earned top honors in the mobile category of the KPMG Fintech Innovation Challenge.

The New Zealand-based company’s technology enables users to hold, manage, and record meetings online as well as share, analyze, and sign documents with any web connection via a virtual office environment.

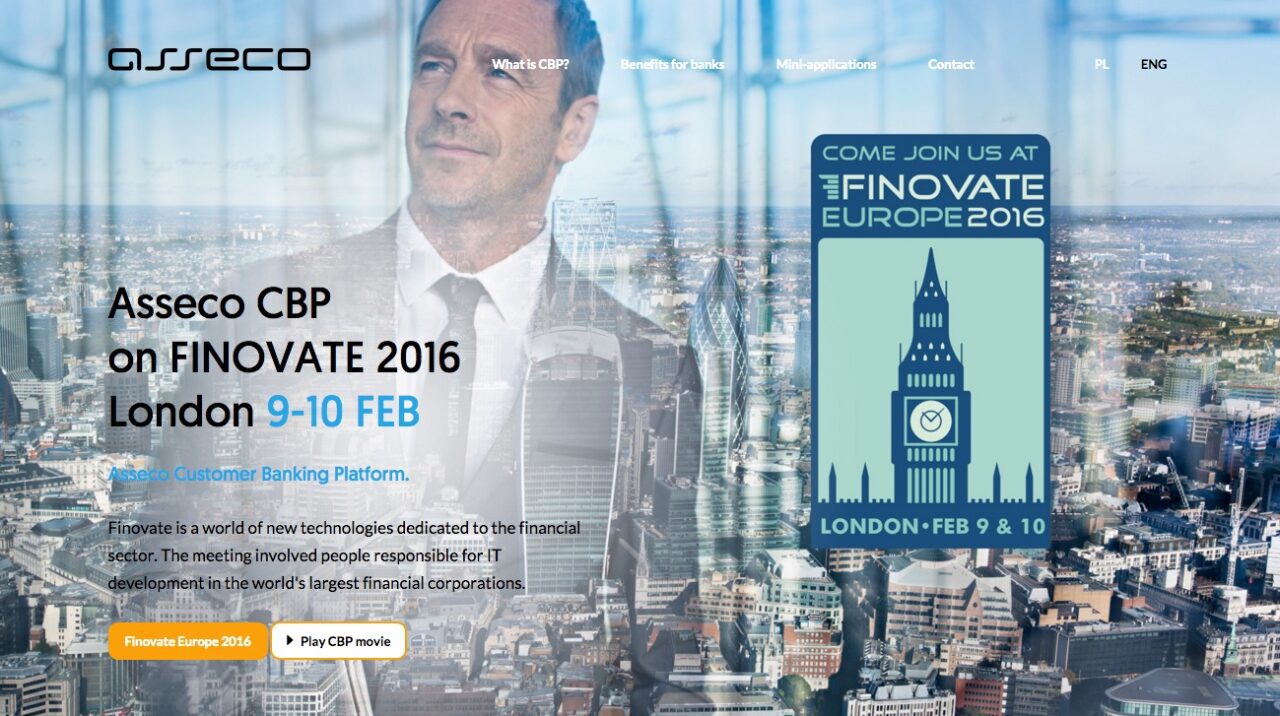

(Click image to play video)

“This success is a ringing endorsement of the opportunity for truly mobile virtual meetings between professionals and their clients across many industries,” SuiteBox CEO Richard Mannell said. “SuiteBox is excited to be at the forefront of delivering mobile office solutions globally.”

Organized by fellow Finovate alum Matchi, the KPMG Fintech Innovation Challenge is designed to encourage collaboration between fintech startups and FIs. Through the Challenge, six companies are selected by a panel of judges, and matched up with financial organizations to develop their technologies. On 10/11 February, the six companies will participate in the KPMG FinTech Innovation Summit in London along with a number of FIs including:

- AIB (Ireland)

- Bank Hapoalim (Israel)

- Caixa Bank (Spain)

- Liberty Group (South Africa)

- Nationwide (United Kingdom)

- Rabobank (Netherlands)

- Standard Bank (South Africa)

- Westpac (Australia)

Founded in 2013 and headquartered in Newmarket, Auckland, SuiteBox has more than 200 companies currently using its technology. This includes financial planners like Midwinter Financial Services, which announced in November that it would integrate SuiteBox, and independent financial advisory firm Canopy Private, “a major adopter of virtual advice solutions.”

Currently expanding in Australia, New Zealand, South Africa, and United Kingdom, SuiteBox will demonstrate its technology at FinovateEurope 2016 in London in February.

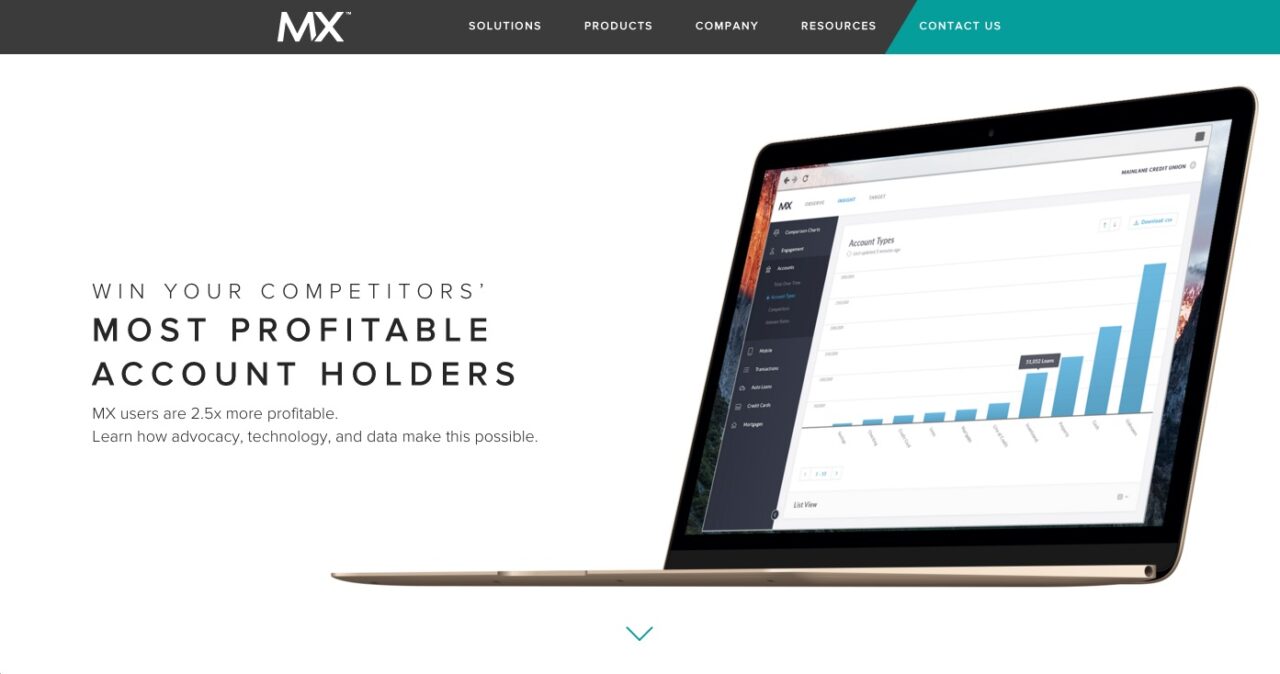

PFM and banking-software company

PFM and banking-software company

Presenters

Presenters Mathew Cagney, General Manager, Sales

Mathew Cagney, General Manager, Sales

Presenters

Presenters Sebastian Hasenack, Head of Product Management

Sebastian Hasenack, Head of Product Management

Presenter

Presenter

Presenters

Presenters Koen Christiaens, Chief Product Officer

Koen Christiaens, Chief Product Officer

Pola Wiza, student

Pola Wiza, student

Taulia CEO Cedric Bru called Holzapfel a “powerhouse” and praised her expertise in strategic marketing and operations. “From incubating SAP’s supplier-relationship management business to driving significant growth through innovation strategies, she has time and again proven her leadership and marketing savvy,” Bru said.

Taulia CEO Cedric Bru called Holzapfel a “powerhouse” and praised her expertise in strategic marketing and operations. “From incubating SAP’s supplier-relationship management business to driving significant growth through innovation strategies, she has time and again proven her leadership and marketing savvy,” Bru said.