Software-based multifactor-authentication provider Encap Security has been acquired by AllClear ID, an Austin-based company that provides data-breach and identity-protection services. Terms of the deal were not disclosed.

In a blog post announcing the change, Norway-based Encap made it clear that it will proceed with business as usual. The company will not only support its Smarter Authentication platform for new and existing customers, but also enhance its offerings by leveraging AllClear ID’s technology.

AllClear ID will use the acquisition to enhance its existing offerings using Encap’s device-authentication and e-signature technology. The move also allows AllClear ID to establish a presence in Europe to “capitalize on emerging opportunities, including major regulatory changes such as the introduction of the General Data Protection Regulation (GDPR) and the Payment Services Directive (PSD II).”

Adam Dolby, Encap vice president of business development, presented at FinovateFall 2015 in New York.

Adam Dolby, Encap vice president of business development, presented at FinovateFall 2015 in New York.

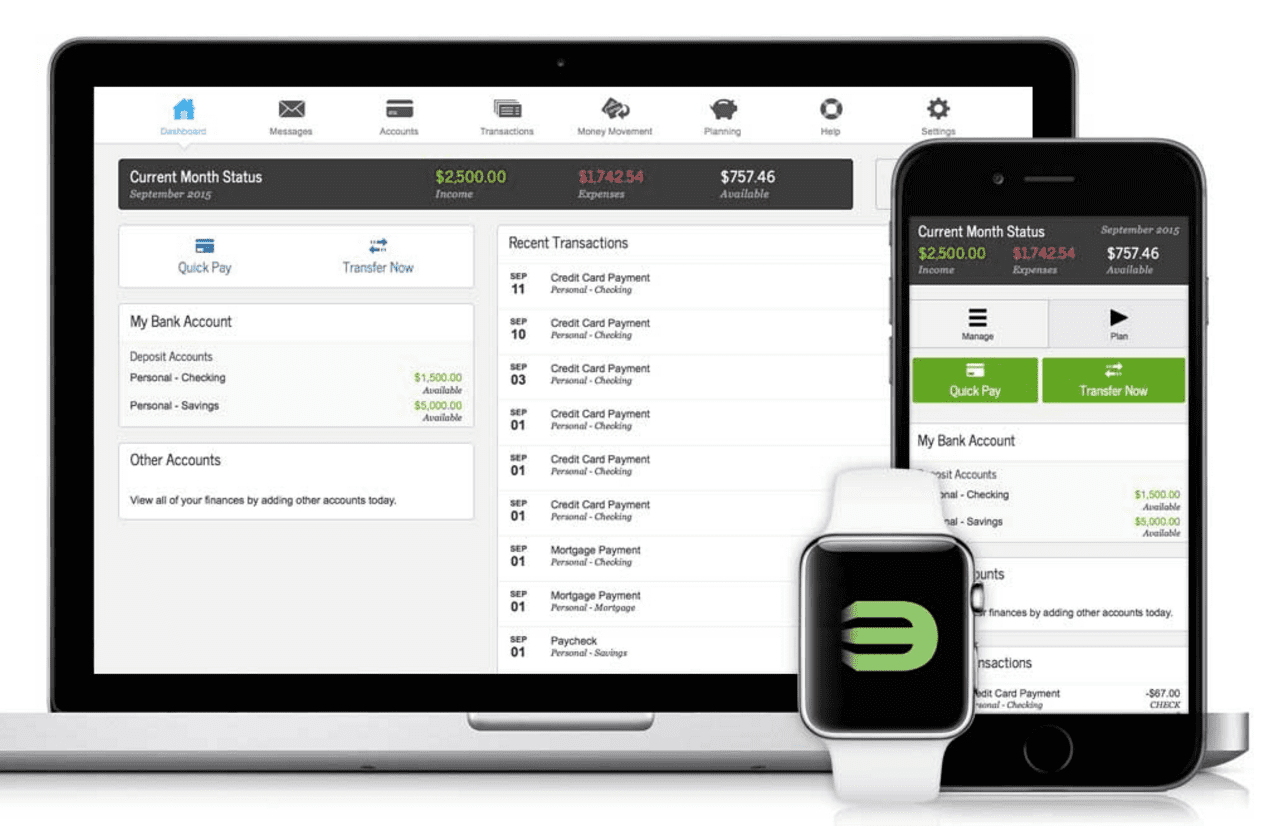

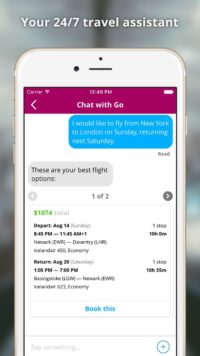

Founded in 2007, Encap debuted Omnichannel Enablement platform at FinovateFall 2015. VP of Business Development Adam Dolby began his presentation by describing why people dislike security. Dolby continued the demo by showing how Encap keeps things simple for end users by keeping the complexities of security behind-the-scenes.

Last week Norway-based BankID partnered with Encap to pilot in-app authentication for its online identity service. In the spring of 2015, Encap integrated with Apple’s TouchID to help financial institutions leverage a new authentication method.

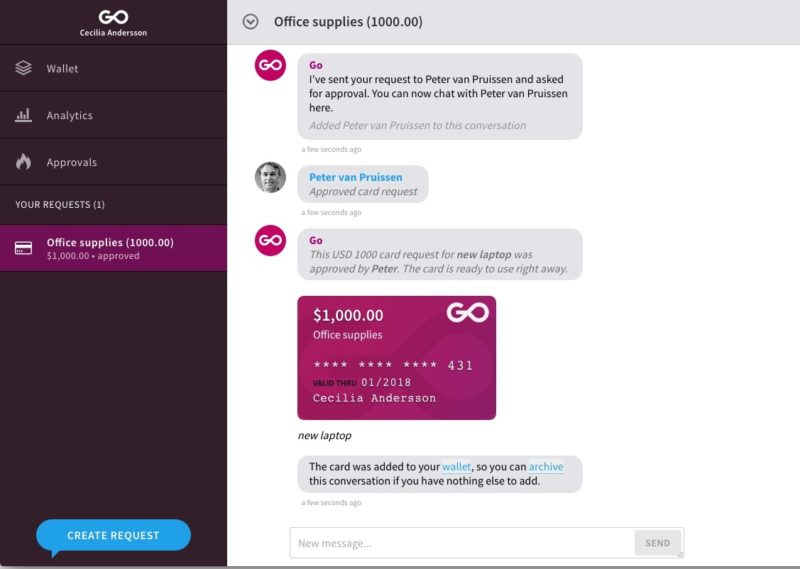

workers the ability to make business purchases via a pre-approved, single-use virtual credit card that is billed to a corporate card. The employee never sees the corporate card number, and the employer has 100% visibility in real-time on how much and what is being purchased. Compare this, Eng suggested, to the typical situation of the financial officer who doesn’t learn what company funds were actually spent until after they are spent.

workers the ability to make business purchases via a pre-approved, single-use virtual credit card that is billed to a corporate card. The employee never sees the corporate card number, and the employer has 100% visibility in real-time on how much and what is being purchased. Compare this, Eng suggested, to the typical situation of the financial officer who doesn’t learn what company funds were actually spent until after they are spent.