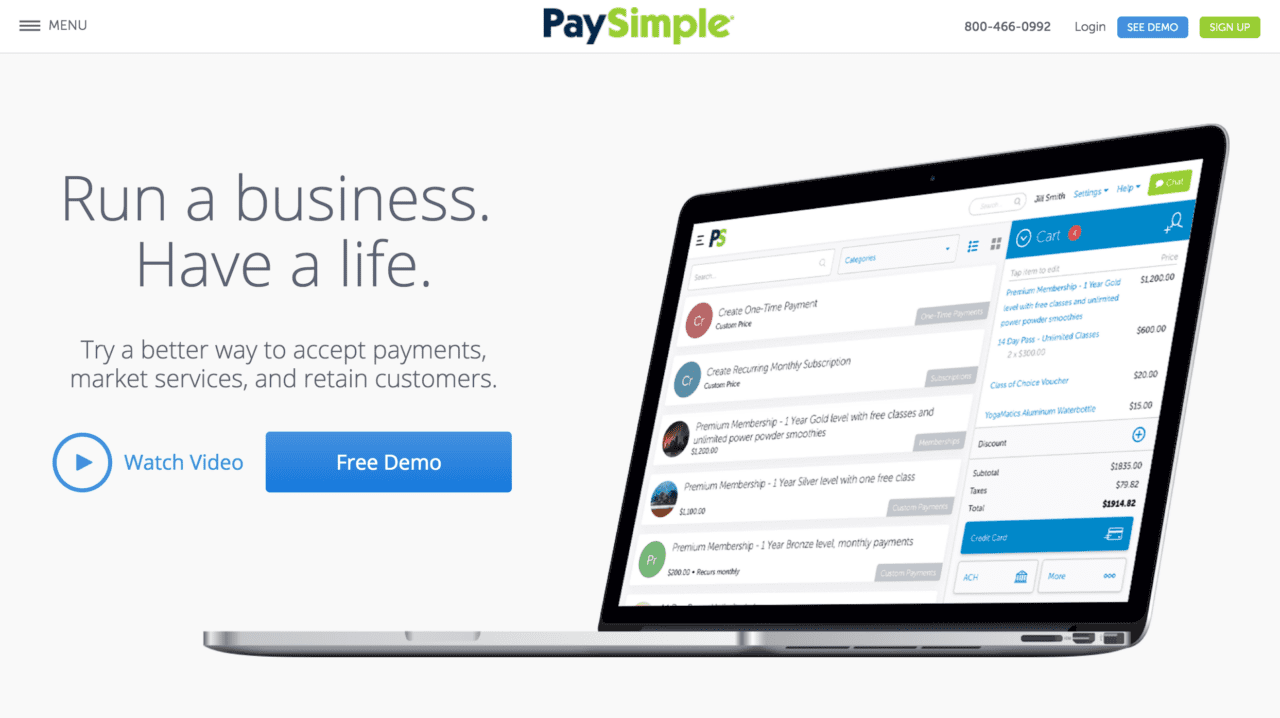

U.S. P2P lending giant Lending Club has been offering car buyers an alternative borrowing experience since it launched ten years ago. Today, the company announced it is bringing that same transparent experience to the auto refinancing industry.

In its press release, the company cited data from the Center for Responsible Lending, which states that consumers pay as much as $25 billion in interest payments every year due to “dealer markup” of their interest rate. Lending Club’s new Auto Refinancing product offers a solution that gives qualified borrowers a more affordable monthly payment and interest rate.

The California-based company, which already offers credit card debt refinancing, hopes to tap into the $1 trillion auto loan market. Consumers can apply online with no hard credit inquiry and compare refinancing offers against their existing auto loan. Lending Club will pilot Auto Refinancing to California residents with FICO scores above 640, but plans to expand geographically and to people with lower FICO scores.

At launch, the company is not using its marketplace lending model to fund the auto debt; instead, the company itself will buy the debt. However, according to Lending Club CEO Scott Sanborn, the leverage of the company’s balance sheet is only temporary and will be immaterial.

Stakeholders seem to be responding well to today’s news. Lending Club’s stock is up 1.64% to $4.95, still below the company’s $15 IPO price. Lending Club’ stock dipped in May after its then CEO Renaud Laplanche stepped down amid accusations of loan-documentation errors.

Founded in 2006, Lending Club demoed at FinovateSpring 2009 and at the inaugural Finovate in 2007.