EON, the new digital banking platform from UnionBank of the Philippines, will feature mobile biometric authentication technology from Daon. The company’s solution, Identity X, will enable EON mobile app users to login using fingerprint and face authentication initially, with other authentication options including voice recognition to be available later.

“As banks embark on their digital transformation journey they need strong authentication that doesn’t sacrifice the user experience,” Daon CEO Tom Grissen said, “and that is exactly what biometrics provide, a convenient, easy and secure alternative to passwords.” EON Head Advocate Paolo Baltao called Daon a “global leader in large-scale authentication deployments” in financial services. He credited the company for helping “make banking delightful, adding that “with Daon’s Identity X Platform, EON introduced the first ever Selfie Banking in the Philippines.”

Pictured: Daon President of the Americas Conor White demonstrating the biometric authentication platform, Identity X at FinovateFall 2016.

Headquartered in Reston, Virginia, Daon demonstrated its Identity X platform at FinovateFall 2016. The company offers a variety of biometric authentication solutions including face, voice, and fingerprint in combination with device binding and geolocation. Daon’s “innovate while you authenticate” approach enables clients to add new biometric authentication technologies to their cyberdefense arsenal as they become available. This helps ensure a modern, state-of-the-art authentication regime over multiple channels for the institution and a seamless verification experience for the end user.

Daon was featured in ABA Banking Journal’s look at biometric authentication in January, and in September, the month of its Finovate debut, the company announced that Sumitomo Mitsui Financial Group (SMFG) would deploy Daon’s biometric authentication platform. Check out our Finovate Debut profile of Daon from December.

With assets of more than $8 billion USD (440 billion Philippine pesos), UnionBank of the Philippines was founded in Manila in 1982 and is one of the country’s largest banks. UnionBank has been a publicly-traded firms on the Philippine Stock Exchange since 1992, the year it was granted a license to operates as a universal bank. The bank is credited for being an online banking pioneer in the Philippines, having launched the first bank website in the Philippines, as well as the first digital savings account with its EON program. UnionBank was recognized as Commercial Bank of the Year and Best Innovation in Retail Banking by the International Banker.

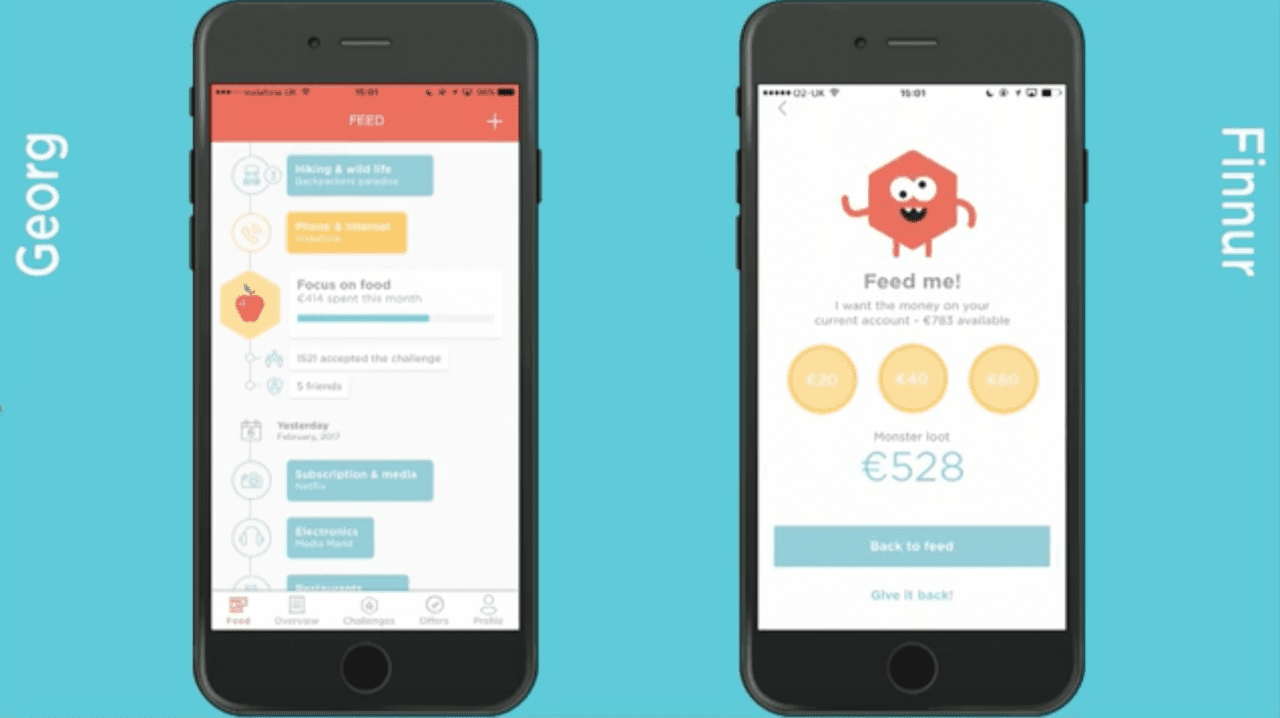

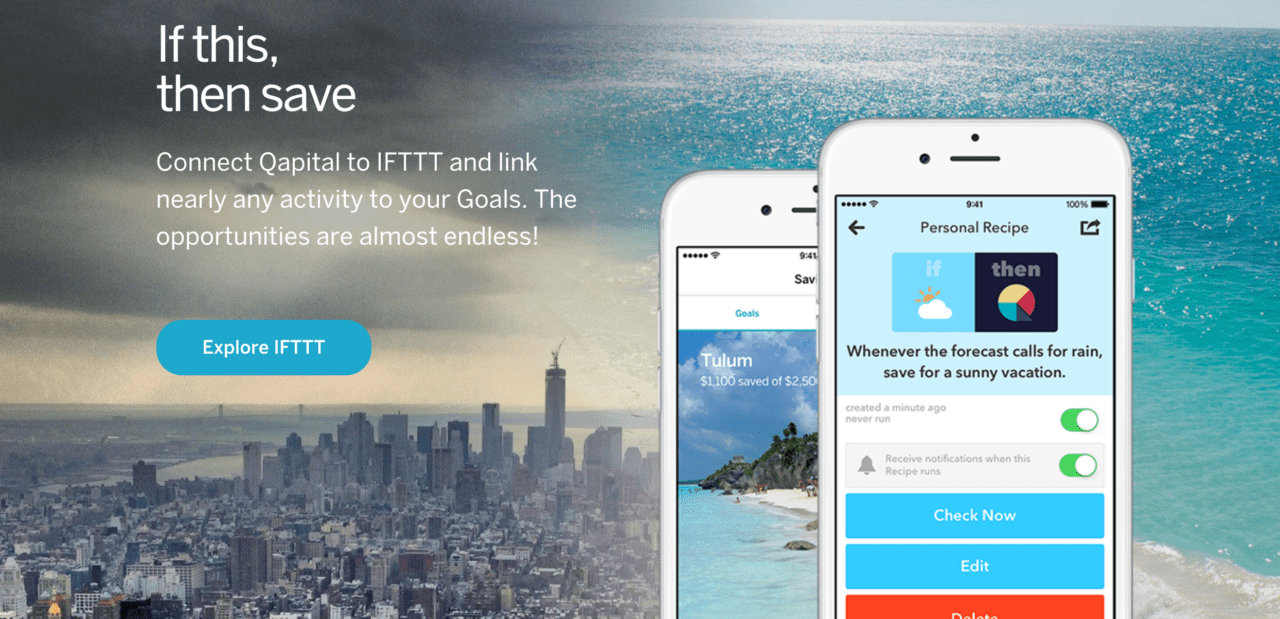

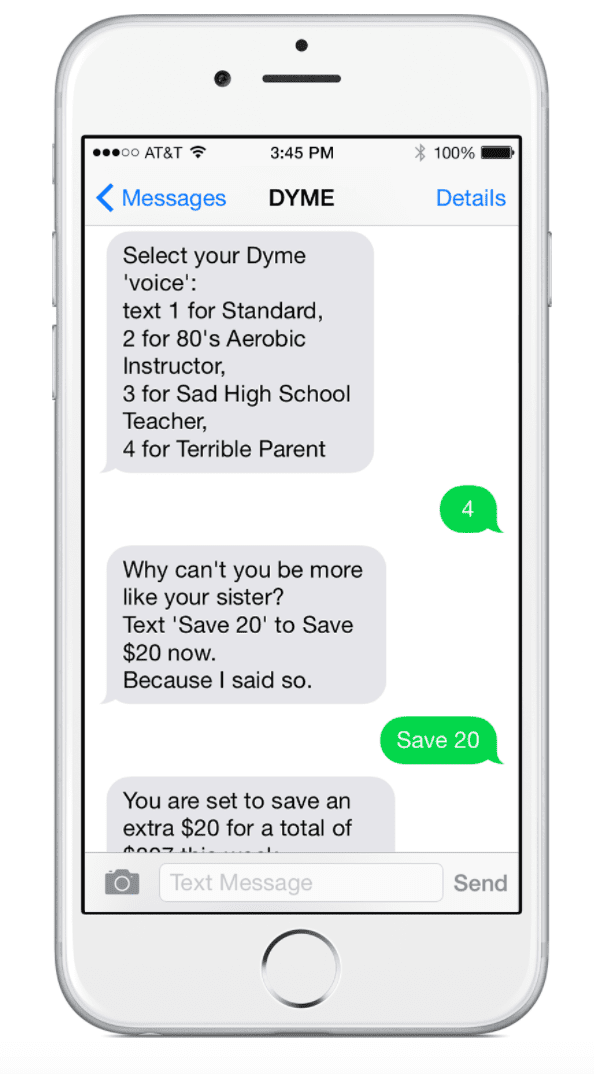

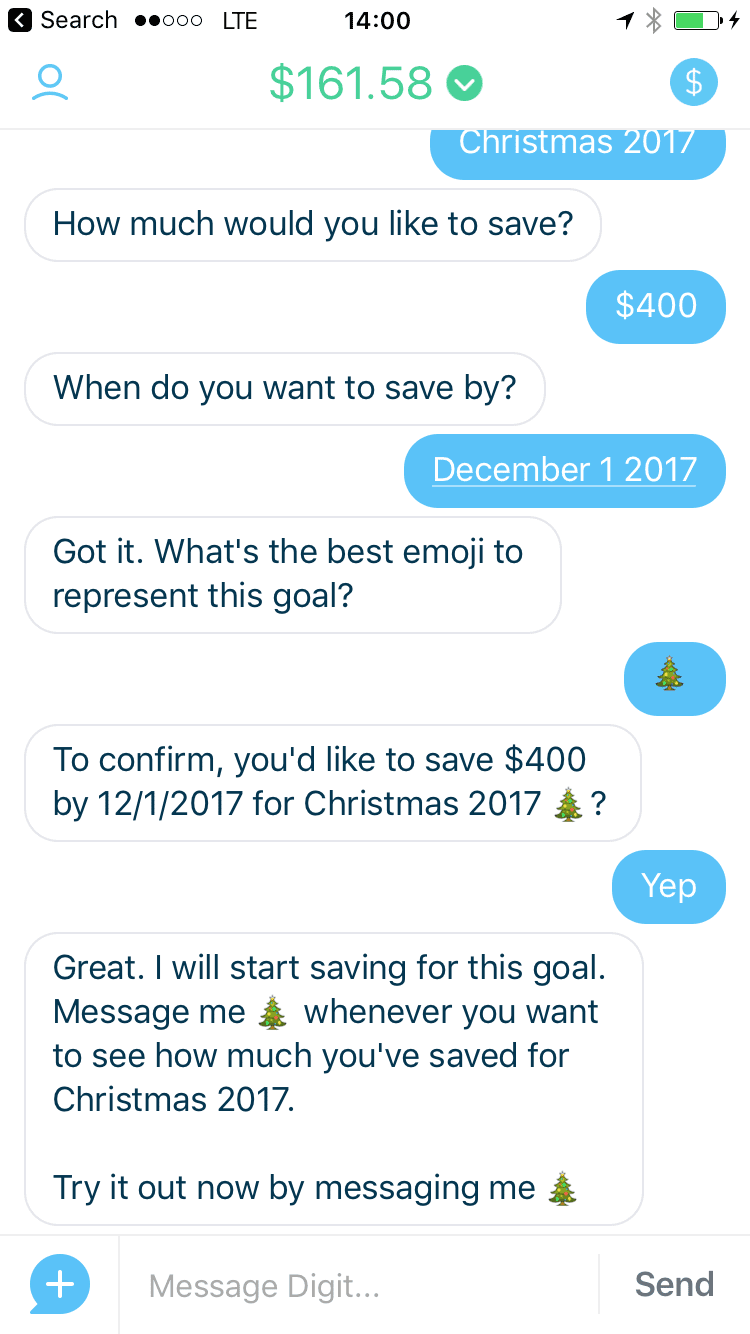

approach to determine the best dollar amount and frequency to save on behalf of the user, based on their historical spend. They use a chat-based interface for client communication and account management. Two examples in this space are Dyme, which takes a strict B2B approach, and Digit, which offers a B2C app.

approach to determine the best dollar amount and frequency to save on behalf of the user, based on their historical spend. They use a chat-based interface for client communication and account management. Two examples in this space are Dyme, which takes a strict B2B approach, and Digit, which offers a B2C app. a smartphone to take advantage of it. All they need to do it set up an account with their primary debit card and text the commands. Want to set aside an extra $10? Text, “save $10.” Want to withdraw your entire balance to pay your taxes? Text, “withdraw $1,700 for taxes.” To encourage interaction, Digit texts users their savings balance and checking account balance on a regular basis.Last month, the company expanded its platform

a smartphone to take advantage of it. All they need to do it set up an account with their primary debit card and text the commands. Want to set aside an extra $10? Text, “save $10.” Want to withdraw your entire balance to pay your taxes? Text, “withdraw $1,700 for taxes.” To encourage interaction, Digit texts users their savings balance and checking account balance on a regular basis.Last month, the company expanded its platform