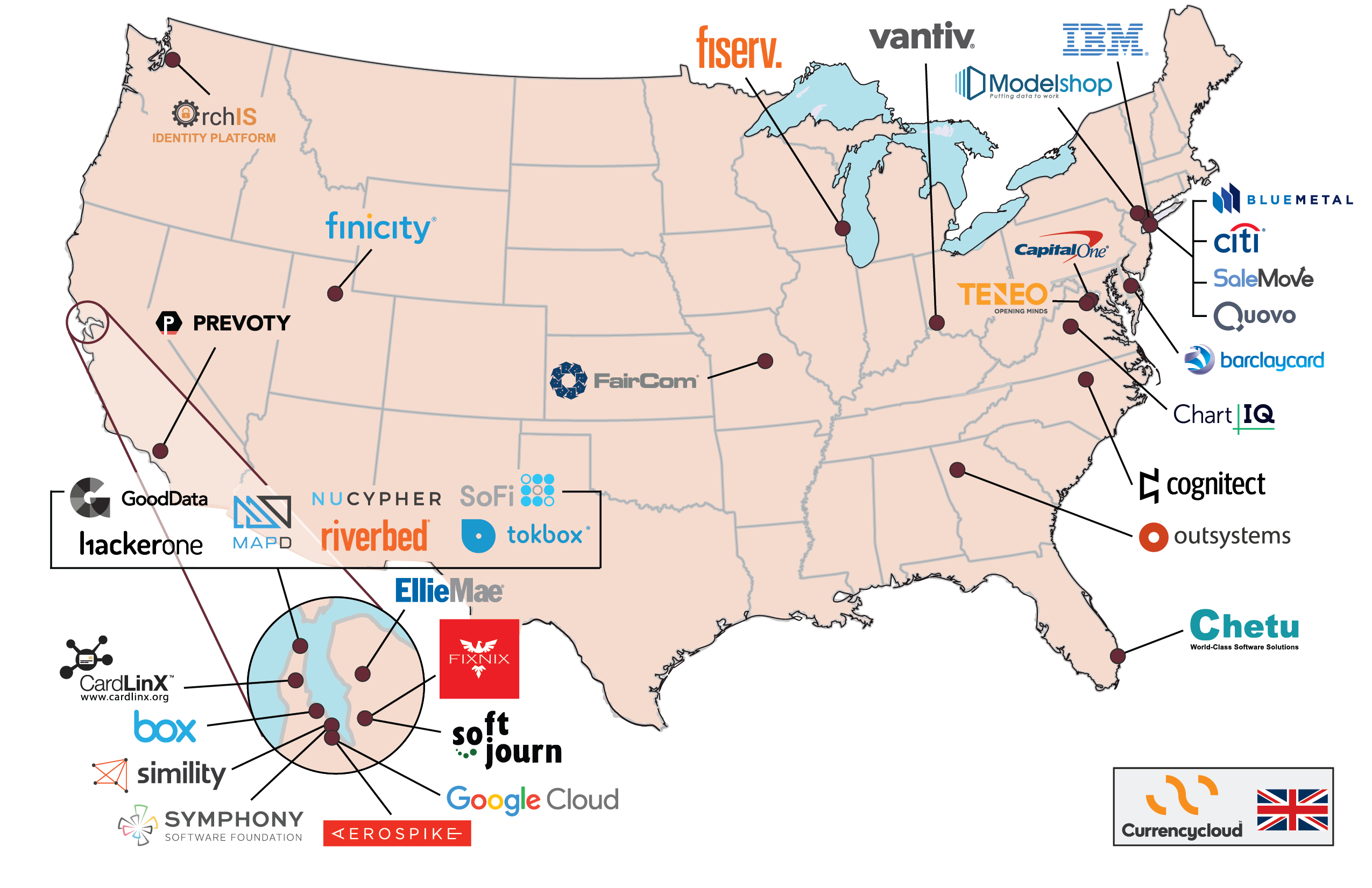

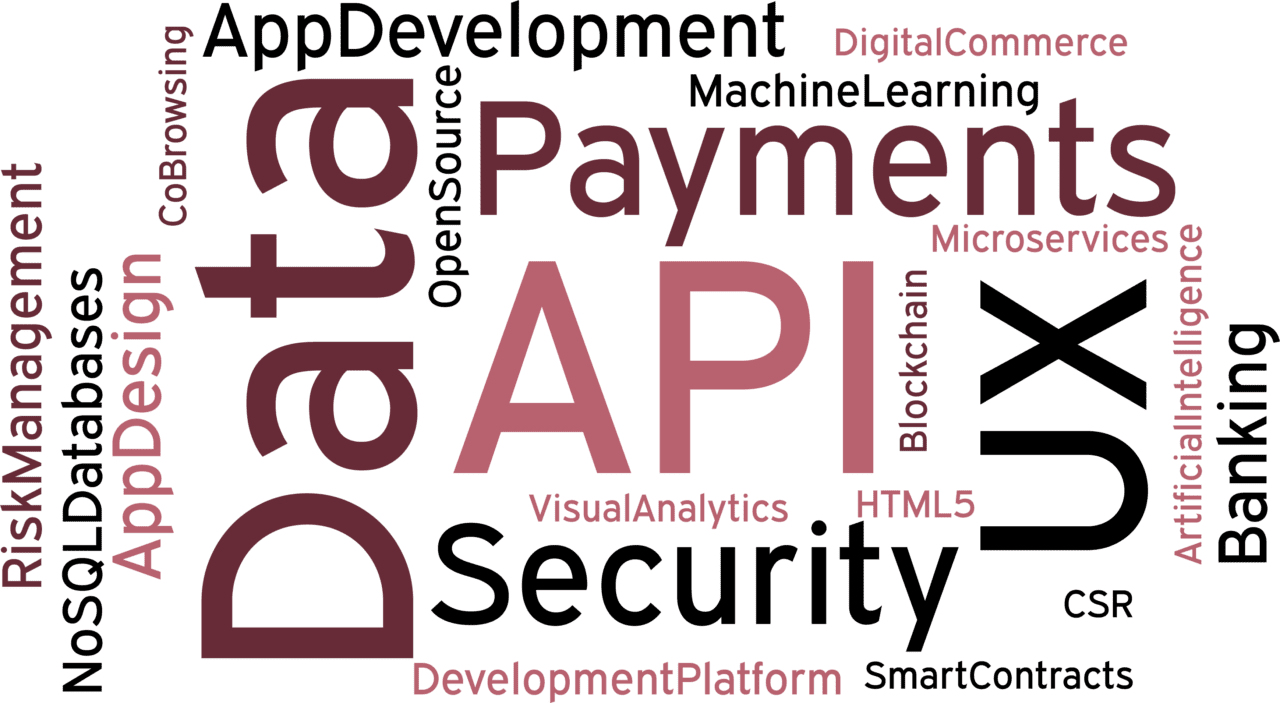

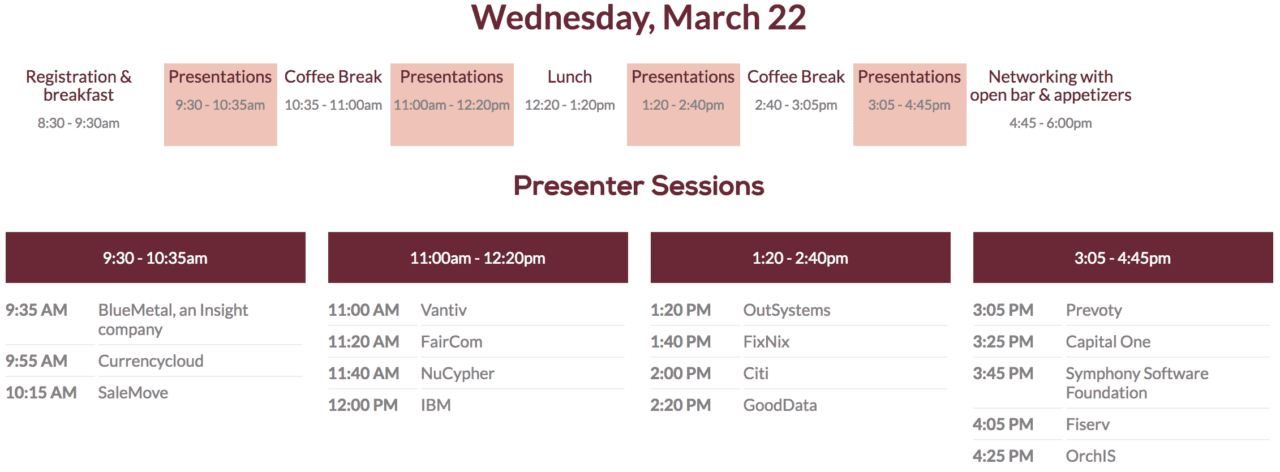

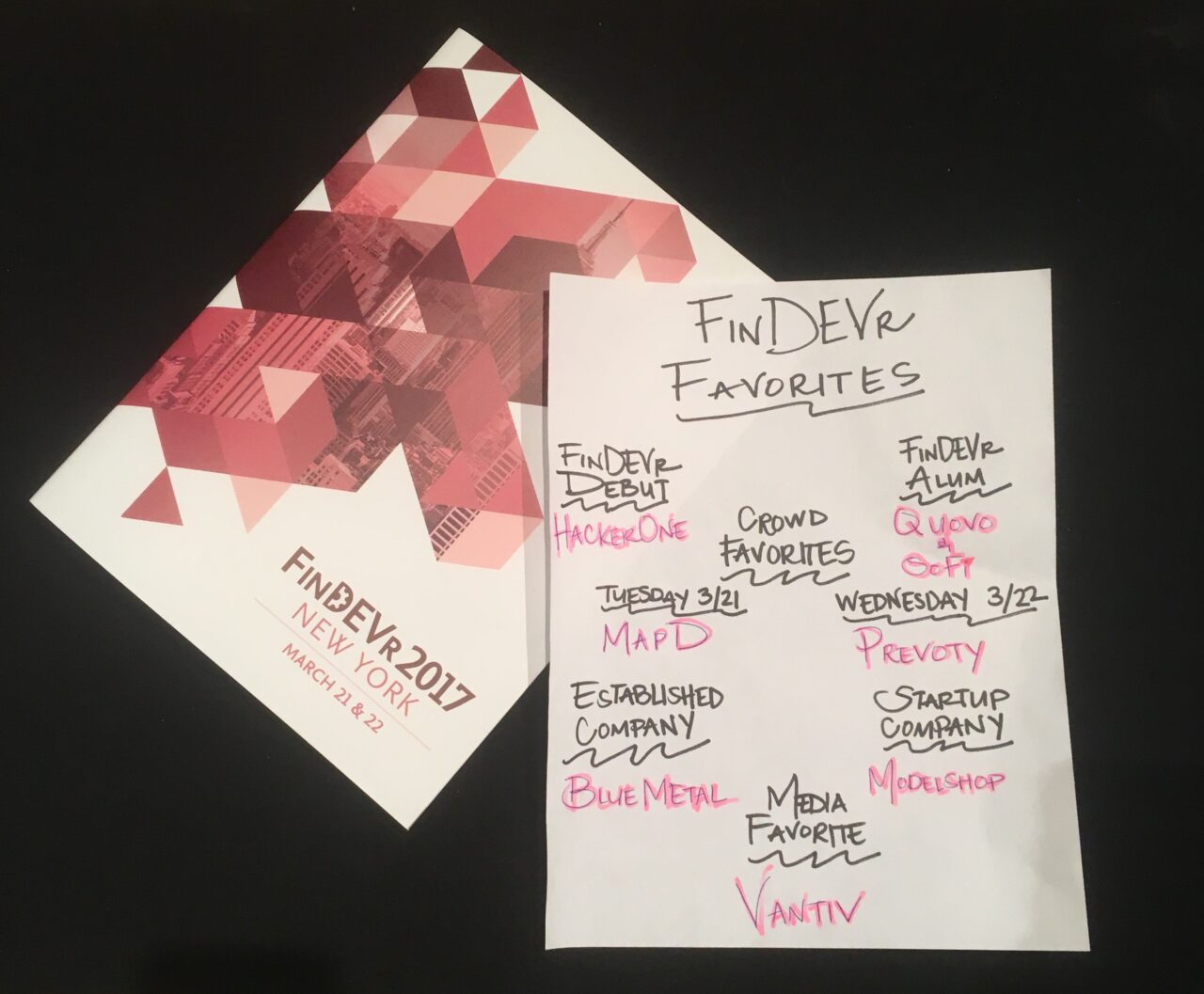

FinDEVr 2017 New York is in the books. Our second developers conference in New York was a great opportunity to take a look at some of the technologies that continue to drive fintech innovation forward. As always, we asked our attendees to tell us which companies and technologies were best positioned to make the greatest impact on the financial services industry in terms of providing greater security, increased efficiency, and a better user experience for consumers. Here is what our attendees had to say:

Favorite FinDEVr Debut

- HackerOne for its bug bounty and vulnerability platform that leverages the talent of trusted hackers to improve the online security of organizations and institutions ranging from Twitter and Uber to Qualcomm and the U.S. Department of Defense.

Favorite FinDEVr Alum

- Quovo and SoFi for their partnership that shows how an easy-to-use authentication API provides security to accounts at more than 200+ FIs while improving and streamlining the user experience.

Day One Attendee Favorite

- MapD for its database and visualization layer that transforms Big Data into immersive, instantaneous, and actionable analytics.

Day Two Attendee Favorite

- Prevoty for its insight into the way embedded, runtime security enables cybersecurity professionals to provide an additional layer of defense against vulnerabilities and fraudulent behavior.

Favorite Established Company

- BlueMetal for its virtual agents, natural language processing, and conversational UX that transforms the nature of customer engagement in financial services.

Favorite Startup Company

- Modelshop for its analytic decision platform that enhances the loan origination, portfolio optimization, and fraud prevention processes for both FIs and consumers.

Media Favorite

- Vantiv for its cloud-based payment app that removes the complexity from financial transactions for both developers and merchants.

Our thanks to our presenting companies, sponsors, partners, and all of you who attended our second developers conference this year in New York. The excitement and enthusiasm for our events only makes us that much more excited for our upcoming FinDEVr debut in London, England in June. If you’re in the U.K. and looking for more insight into the technological side of the fintech ecosystem, then FinDEVr London is the place to be June 12th and 13th. Visit our FinDEVr London 2017 page for more information.