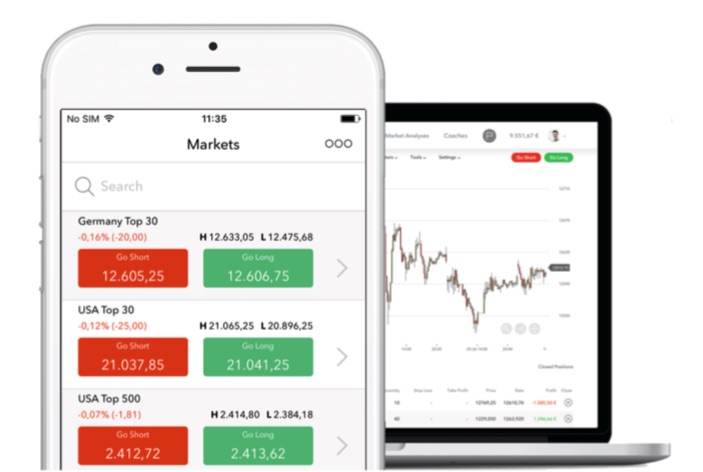

Visa Canada and Finn AI¬†have teamed up to offer new capabilities in conversational banking chatbots and artificial intelligence (AI), powered by the Visa Developer Platform, reports Antony Peyton of Fintech Futures (Finovate’s sister publication).

The Vancouver-based fintech firm will use Visa Developer Platform APIs to enhance its conversational AI technology to ‚Äúprovide a more personalised experience‚ÄĚ for banks to interact with their customers.

Jake Tyler, CEO at Finn AI, said: ‚ÄúThis will help banks meet consumers‚Äô needs on their terms, allowing them to set travel notifications, flag fraudulent transactions, manage subscriptions and more ‚Äď as easily as chatting to their friends ‚Äď 24/7 in the channels of their choice.‚ÄĚ

For example, users could ask ‚ÄúWhere is the closest ATM?‚ÄĚ or ‚ÄúPlease cancel my card‚ÄĚ using Finn AI technology and the APIs.

A customer could chat with a virtual assistant and follow a process to ensure their cards are optimised while they are travelling.

Or they could turn on travel notifications before departing, retrieving foreign exchange rates while at the airport, and locating the nearest ATM at their destination.

A customer can also disable a misplaced card to ensure protection against fraudulent transactions through a ‚Äúsimple, natural conversation‚ÄĚ.

Other Finn AI partnerships include ATB Financial, Bank of Montreal (BMO), Banpro Grupo Promerica in Nicaragua, and Commonwealth Bank of Australia.

Founded in 2014 and headquartered in Vancouver, British Columbia, Finn AI made its Finovate debut at FinovateAsia 2016, winning Best of Show. The company returned to the Finovate stage the following fall for FinovateFall 2017, once again taking home top honors for a demonstration of its virtual banking assistant.

Finn AI has raised $3 million in funding and includes Yaletown Partners, Flying Fish Partners and angel investor John Livingston among its investors.

As part of the agreement Universum will leverage Risk Ident’s¬†FRIDA, a self-learning anti-fraud technology. FRIDA automatically analyzes individual transactions to establish relationships between transactions and quickly identify fraudulent connections. Retailers’ fraud managers receive¬†an overview of flagged transactions, marking potential fraudulent activities, within seconds.

As part of the agreement Universum will leverage Risk Ident’s¬†FRIDA, a self-learning anti-fraud technology. FRIDA automatically analyzes individual transactions to establish relationships between transactions and quickly identify fraudulent connections. Retailers’ fraud managers receive¬†an overview of flagged transactions, marking potential fraudulent activities, within seconds. Universum will also deploy Risk Ident’s DEVICE IDENT, device fingerprinting technology that analyzes consumers’ devices and identifies fraudulent correlations with their use in real time. Retailers integrate DEVICE IDENT into the checkout page on their website and can quickly take action when the system notifies them of potential fraudulent activity.

Universum will also deploy Risk Ident’s DEVICE IDENT, device fingerprinting technology that analyzes consumers’ devices and identifies fraudulent correlations with their use in real time. Retailers integrate DEVICE IDENT into the checkout page on their website and can quickly take action when the system notifies them of potential fraudulent activity.