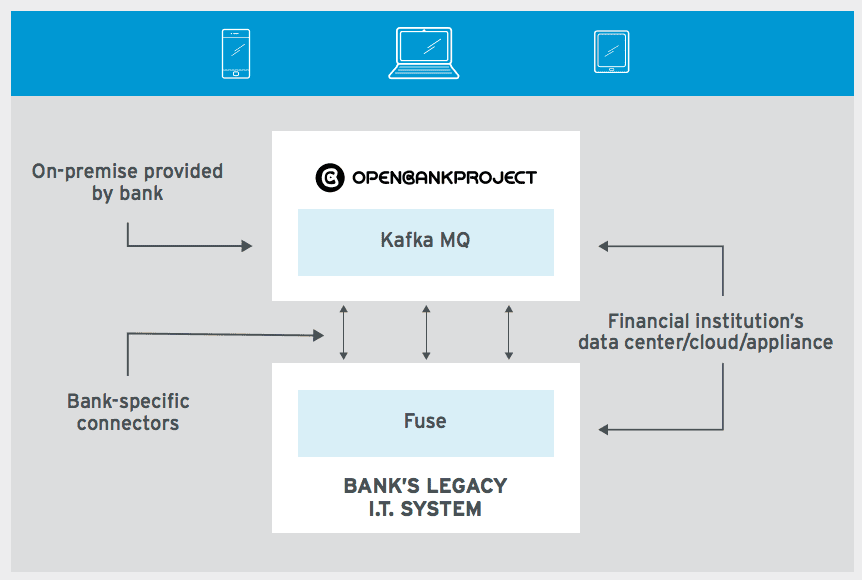

Open source API innovator, TESOBE’s Open Bank Project, announced it has teamed up with Red Hat this week. The two are collaborating on a new API specifically designed for banking and financial services companies.

The Open Bank Project will leverage Red Hat’s Fuse along with the North Carolina-based company’s rule engines to connect banking systems and offer interoperability among a variety of sources of bank data. This combination of the Open Bank Project’s and Red Hat’s open source technologies facilitates banking system connections while delivering a wider range of applications to end users.

TESOBE CEO and Founder of the Open Bank Project, Simon Redfern, said, “Red Hat and TESOBE share a strong commitment to open source and I’m excited to see these technologies working together. The collaboration we have today can offer a valuable opportunity for banks to help reap the benefits of Open Banking.”

Founded in 2005, the Open Bank Project is a pioneer in open banking, an initiative wherein banks open up their architecture via APIs. In addition to allowing third party applications and services to leverage consumer data, open banking helps financial services companies comply with the EU’s recently revised payment services directive, which was implemented in January of this year. For this reason, as Rich Feldmann, global director of financial services for RedHat, noted, “As open source continues to be a part of the financial services and banking industry, it is important to have standards and projects in place to help enable it to be used properly and remain compliant. This is why we are happy to collaborate with TESOBE’s Open Bank Project to help provide technology tools and guidance to enable success in open source banking.”

In addition to today’s Red Hat announcement, the Open Bank Project also divulged it will be working with Australian challenger bank, 86 400. The neobank will leverage the Open Bank Project’s APIs to standardize and harmonize its API design for more than 10,000 fintech developers.

Headquartered in Germany, TESOBE’s Open Bank Project demoed at FinovateFall 2018 last month, where Redfern showcased how banks can leverage APIs to drive innovation. Earlier this summer, the Open Bank Project teamed up with Citizens Bank to power the bank’s hackathon.

Presenters

Presenters Abhishek Joshi, Senior Associate

Abhishek Joshi, Senior Associate

Presenters

Presenters Bodo Grauer, Head of Digital Strategy and Transformation

Bodo Grauer, Head of Digital Strategy and Transformation

Presenters

Presenters Igor Pesin, Co-Founder and CFO

Igor Pesin, Co-Founder and CFO

Presenters

Presenters Ozan Vakar, CTO

Ozan Vakar, CTO