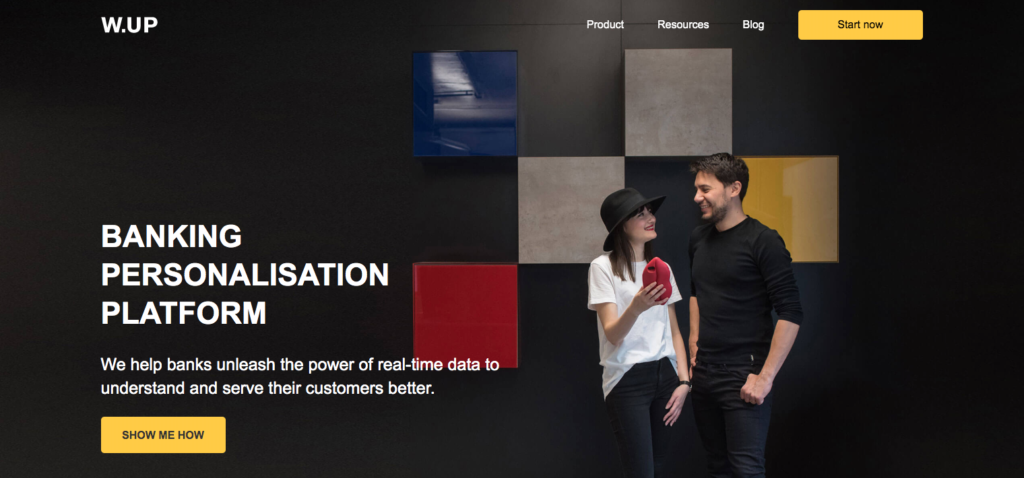

If you ask Balázs Vinnai, president of W.UP, one size does not fit all when it comes to banking. In fact, his company’s entire premise is built around creating a personalized user experience.

Earlier this month we chatted with Vinnai about the struggle that banks face when it comes to tailoring their user experience to suit each customer individually.

Finovate: Why do you think banks have such a difficult time creating a personalized user experience?

Vinnai: There are several reasons: patched-up IT systems, outdated vendors, a lack of entrepreneurial spirit, just to name a few. But legacy thinking is by far the biggest culprit. Many incumbents still think that digital transformation is about buying the right technology and streamlining a few processes. That’s part of it, of course, but mostly it’s about understanding customers as much as possible and catering to their very needs.

Finovate: What is one small step banks can take to improve their customer experience?

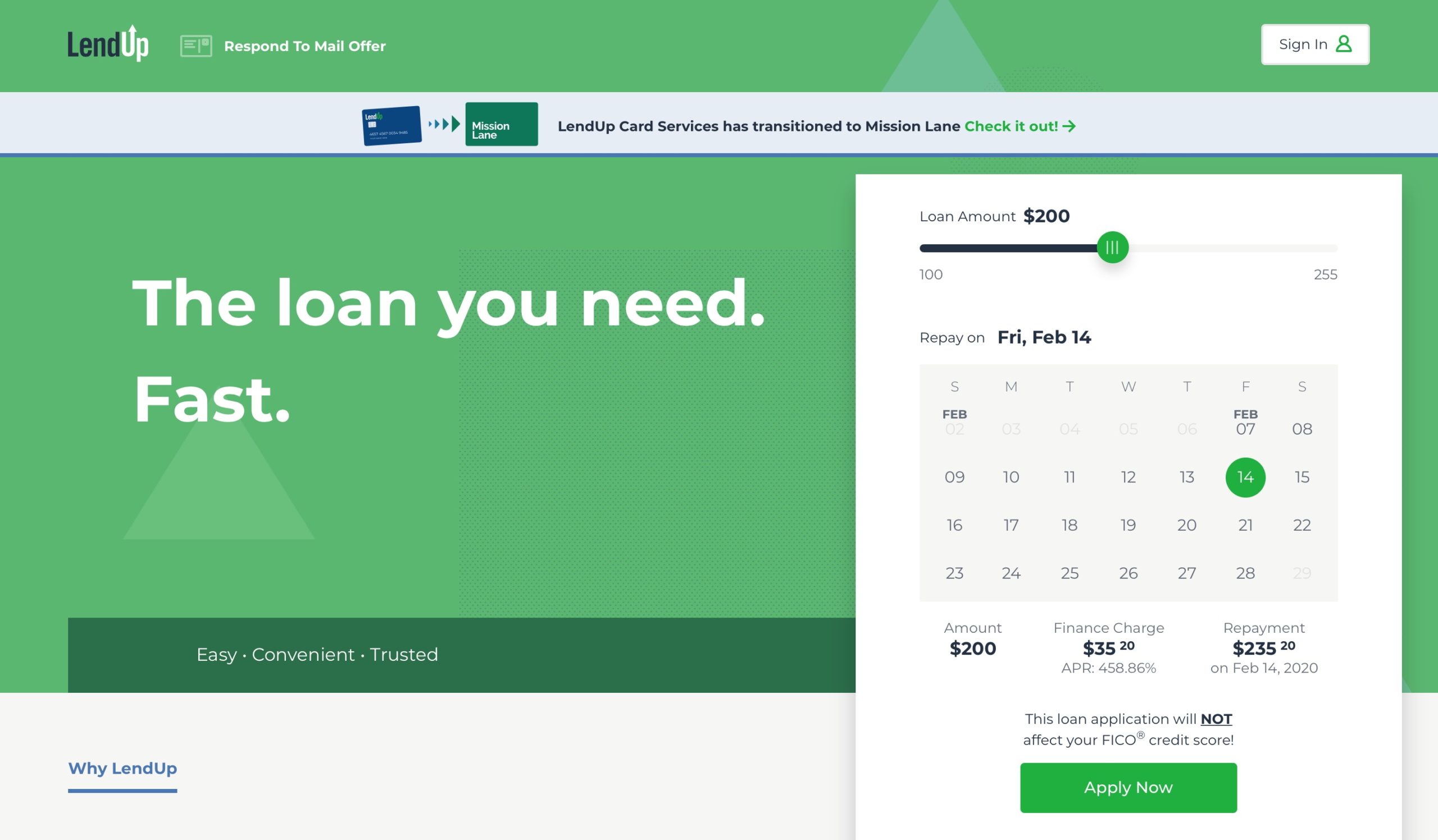

Vinnai: Stop looking at their customer base as a faceless mass. Banking customers are individuals with unique needs and problems, goals and habits. With the help of advanced data analysis, banks can do much more than segment or micro-segment them. They can create segments-of-one and laser-target each and every customer with the right financial solutions.

Finovate: How does improving the customer experience ripple out to add value into other areas of a bank, such as fraud prevention?

Vinnai: Personalization in general is becoming a means of survival instead of added value. Completely rethinking how customer experience is delivered might seem a bit radical today but, in the long run, failing to do so will have more severe consequences. A Gartner study says that by 2030 as many as 80% of traditional financial service providers will go out of business if they can’t catch up with digital-savvy competitors.

Finovate: Tell us about what W.UP does and what sets the company apart from its fintech competitors.

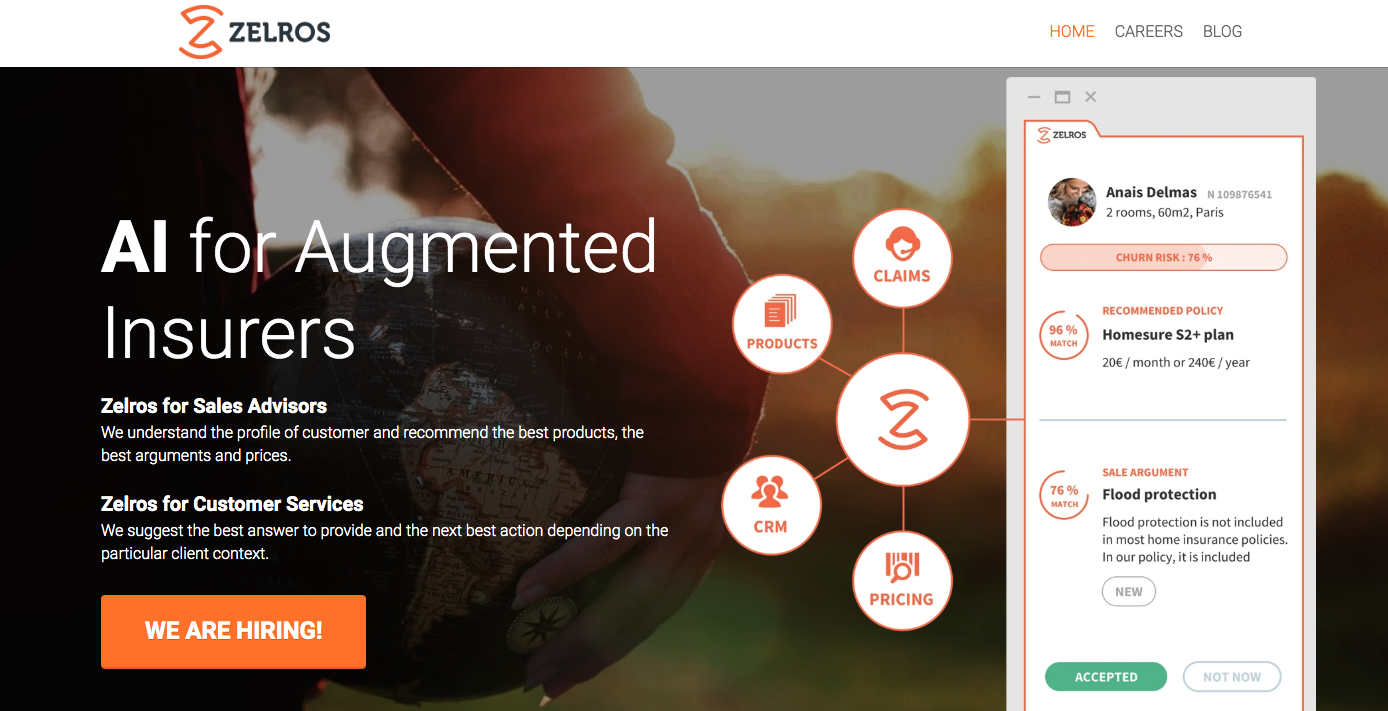

Balázs Vinnai: W.UP is a personalization platform that allows banks to understand and meet their customers’ needs in real time. It comes with pre-built use cases that are easy to set up and tailor to banking systems, processes, and goals. What makes it different from other AI-driven tools is that not only does it give customers a better insight into their finances, but it can also spot and offer solutions for key money moments and complex life situations.

Finovate: Last year was considered to be “the year of the customer” in fintech. Do you think that mentality will continue into 2020?

Vinnai: I think every day should be about the customer in banking and fintech alike, no matter what year it is. And it shouldn’t just be an empty motto or mission statement. It’s time incumbents and challengers teamed up and walked the talk together.

Check out W.UP’s Best of Show-winning demo at FinovateEurope 2019 and don’t miss the company’s upcoming appearance at FinovateEurope on 11 through 13 February in Berlin.