Two weeks after announcing its purchase of Cardtronics, fintech hardware giant NCR is acquiring Terafina, a company known for its digital account opening and onboarding tools.

Financial terms of the agreement were not disclosed.

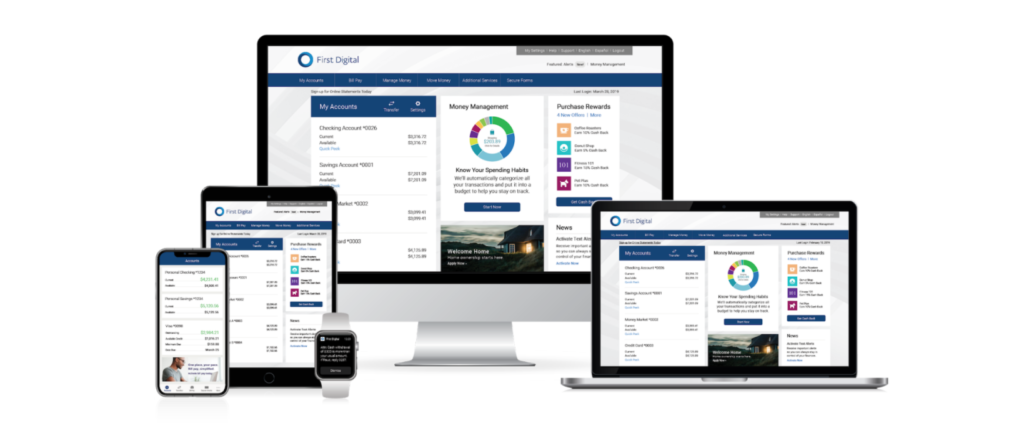

NCR will tap Terafina’s expertise to expand NCR’s sales and marketing capabilities in its Digital First Banking Platform. The offering, which can be tailored to fit institutions ranging in size from large banks to community banks and credit unions, provides an API-led approach to digital banking that can be hosted or deployed on-premise to help banks lower costs and speed up their innovation cycle.

Last year increased the urgency for financial services companies of all kinds to improve their digital customer experiences. Founded in 2014, Terafina suits this need. The company offers a software-as-a-service solution that offers digital onboarding tools and helps banks and credit unions synchronize their branch, call center, and digital operations to provide a consistent user experience across channels.

At FinovateSpring 2019, Terafina Founder and CEO Meheriar Hasan showcased the company’s digital sales platform that helps banks address the needs of their small business clients.

“Digital Banking is a key aspect of the NCR-as-a-Service strategy we laid out at Investor Day in December,” said NCR CEO Michael D. Hayford. “Terafina has been a partner of ours and is already up and running, integrated with our Digital Banking platform. We know this adds value for our clients by making digital account sales, marketing and onboarding easier, so they can provide a superior experience for customers.”

Today’s deal marks NCR’s 29th acquisition since it was founded in 1884. NCR’s purchase of Terafina fits with the company’s strategy to purchase early stage companies to boost its product capabilities and enhance its leadership.

NCR is headquartered in Atlanta, Georgia, and counts 36,000 employees across the globe. The company is listed on the New York Stock Exchange under the ticker NCR and has a market capitalization of $4.81 billion.

Photo by Peter Fazekas from Pexels