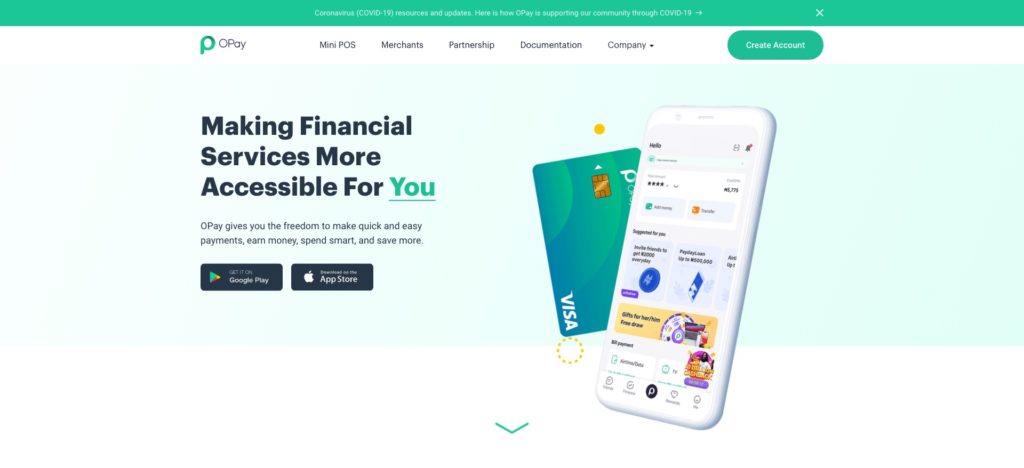

“China-backed and Africa-focused” is a way to describe much of the investment that has poured into sub-Saharan Africa in recent years. This week’s news that African-based fintech platform OPay is in the process of raising $400 million in new funding – giving the firm a valuation of $1.5 billion – is the latest example of this trend.

OPay is a mobile money platform launched in Nigeria by popular internet search engine Opera back in 2018. The funding report, which was published in The Information, noted that the capital would be used to fuel the company’s geographic expansion, having gone live in Egypt earlier this year. With Chinese investors maintaining a majority stake in the company, OPay had raised more than $170 million to date from investors including Sequoia Capital, IDG Capital, Source Code, GSR Ventures, Meituan-Dianping, and parent company Opera.

The company said that it processed $1.4 billion in payments in October alone, a sum that increased to $2 billion by December. Much of this can likely be attributed to COVID-19. In a country where cash is still king, the onset of the global pandemic made in-person, cash-based transactions problematic. Digital payment options like those provided by OPay have soared in popularity; Forbes took a look at the boom in Africa’s mobile money business back in December, noting investments in sub-Saharan payment innovators like Paystack (also of Nigeria) and Chipper Cash, a San Francisco based P2P payments company that serves customers in seven African countries.

That said, OPay is looking to leverage its pedigree as a payments solution to offer additional products including debit and credit cards. Earlier this month, OPay launched its USSD withdrawal service to make it easier for Nigerians to access cash at OPay merchant stores – without needing a debit card. Also this month, the company introduced version 4.0 of its super app. OPay 4.0 now makes it easier for users to connect with friends and family, add contacts, make quick payments for frequently used services, and more.

Interestingly, OPay is the most successful of the ventures Opera has tried to spin off. These efforts include ORide, a bicycle-sharing service that was shut down after the Nigerian government banned the business; a similarly shuttered bus-booking solution, OBus; a logistics delivery service OExpress; a B2B e-commerce platform OTrade; and a food delivery service called OFood.

Here is our look at fintech innovation around the world.

Central and Eastern Europe

- Germany-based neobroker Trade Republic secured $900 million in Series C funding, earning a $5.3 billion valuation after the largest fintech funding in the country to date.

- Santander Bank Polska launched its new e-banking platform for corporate customers.

- Estonian core banking platform Modularbank partnered with identity verification software provider Veriff.

Middle East and Northern Africa

- Arab Financial Services (AFS) inked a network alliance agreement with Discover.

- Israeli transaction monitoring innovator ThetaRay secured $31 million in new funding.

- Egyptian digital bank Telda picked up $5 million in pre-seed funding in a round led by Sequoia Capital.

Central and Southern Asia

- Indian merchant commerce platform Pine Labs raised $285 million in funding and earned a valuation of $3 billion.

- Zaggle, an Indian fintech, announced the launch of its new neo-banking offering via its group company, ZikZuk.

- Crowdfund Insider featured Pakistan-based online payments company SadaPay.

Latin America and the Caribbean

- The Rio Times featured Brazilian microfinancier Grão.

- Chile’s Kredito, which offers loans for small and medium-sized businesses, secured $4 million in pre-seed funding.

- Nearshore Americas looked at how Argentina’s fintech industry has thrived despite the country’s economic challenges.

Asia-Pacific

- Thailand’s Siam Commercial Bank announced that it will deploy technology from Surecomp to power digital trade financing into both Vietnam and Myanmar.

- The Fintech Association of Malaysia (FAOM) appointed its first female president, Karen S. Puah.

- Cross-border payment network Thunes secured $60 million in Series B funding.

Sub-Saharan Africa

- Maviance, a fintech based in Cameroon, locked in a $3 million investment from pan-African digital payments hub MFS Africa.

- South African fintech Ukheshe announced plans to expand to the Asia-Pacific region.

- Kenya’s Asilimia, which launched its digital ledger app earlier this year, is one of 14 startups selected to participate in the Catapult: Inclusion Africa fintech bootcamp program.

Photo by Tope A. Asokere from Pexels