The good news: Of the 135 free applications in the new iTunes App Store, Bank of America’s is a solid number 20, three spots ahead of PayPal, according to rankings within iTunes this morning.

The good news: Of the 135 free applications in the new iTunes App Store, Bank of America’s is a solid number 20, three spots ahead of PayPal, according to rankings within iTunes this morning.

The bad news: The first batch of reviewers hated the app. Their main complaint: It’s not really a native app, just a front door to the bank’s existing mobile site.

The reviews: On a 5-star scale with one star the lowest choice, the app has only a 1.5-star rating (see note 1). Of the 81 reviews, only 19 rated it above one star. Throwing out the five 5-star ratings which are probably from people associated with the product, that leaves only 14 above the bottom rating, an abysmal score by any standard. Following is the breakdown:

| Stars |

Number of Votes |

My Comments |

| ***** |

5 |

I’m skeptical of the objectivity of these reviews |

| **** |

0 |

Other than the suspect 5-star fans above, no one was willing to go 4 stars |

| *** |

6 |

Only six legit users were even OK with the app |

| ** |

8 |

Most of these were critical in their comments |

| * |

62 |

one star is the lowest choice on the review form |

Source: Online Banking Report review of iTunes data, 11AM PST, 11 July 2008

What’s innovative?

1. I was astounded to see 81 reviews in the App Store already. It just opened this morning! It should be noted that you don’t have to actually download the app to post a review. So if and when you post an app here, be prepared for criticism. Even more important, this demonstrates the impact the user voice will have going forward (see note 2).

2. Early adopters, especially techies, can be brutally honest, especially with large corporate efforts deemed lame. But even though the overall grade was very poor, a number of reviewers pointed out that the automatic ATM locator was a significant improvement.

3. BofA needs to upgrade this app ASAP. Some of the criticisms about font size and design can be fixed relatively easily.

Summary

Despite the harsh criticism from the first batch of reviewers, I think BofA did the right thing strategically. It’s too bad they didn’t have something a little flashier, but the bank will get far more mileage by being the first bank in the App Store that it will lose by disappointing the mobile early adopters. It’s unlikely they will lose any business from the negative reviews. They are mostly in the “you should have done better” category, not the “BofA sucks” variety.

You have only one chance to be first, and BofA took it. No one else will ever be able to say they were the first bank in the iPhone (who’s going to be the first credit union?). But the bank better get cracking on version 2.0! (see note 3)

Notes:

1. The only other app from a financial services company was Paypal, which mustered a meager 2-star rating. But it elicited only one-sixth the number of reviewers, just 13. Because you don’t have to actually download the app to post a review, BofA may be getting slammed by people just reading the reviews and jumping on the bandwagon with me-too critiques.

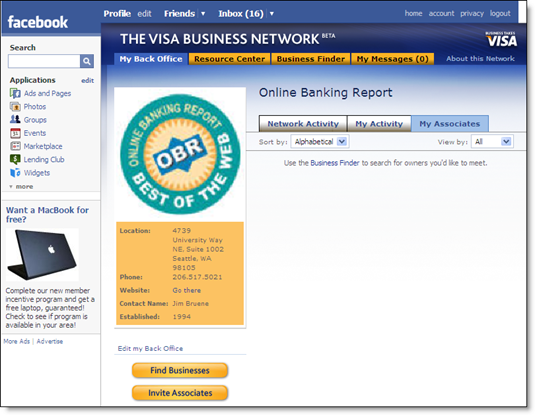

2. See our latest Online Banking Report for more on the growing importance of user reviews. We’ve also published reports on Mobile Banking and Mobile Payments.

3. This post marks the end of iPhone week at Netbanker. We’ll get back to our regularly scheduled programming next week.

Kiwibank has one of the most eye-catching homepage designs in the world. Who can resist a lime green Smart Car with four monstrous speakers strapped to the roof?

Kiwibank has one of the most eye-catching homepage designs in the world. Who can resist a lime green Smart Car with four monstrous speakers strapped to the roof?