Earlier this week, Ron Shevlin wrote about the “disingenuous” (see note 1) advertising from person-to-person lenders (here). He took issue with their claims of facilitating loans primarily for the social good, rather than for a profit motive. That criticism might be a little harsh, but he has a point.

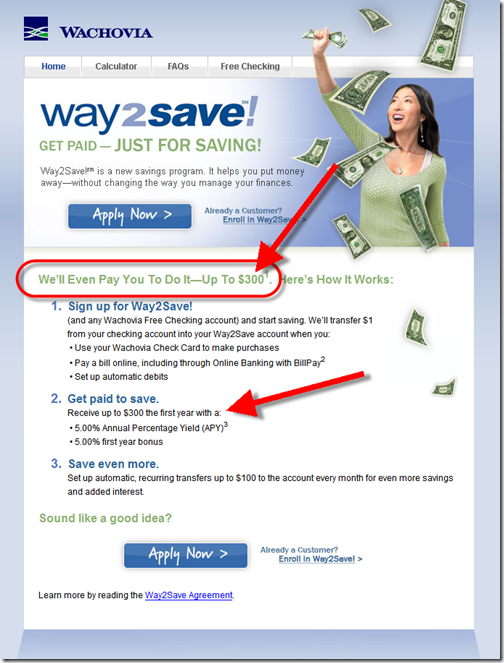

Well if Ron doesn’t like P2P ads, I wonder what he thinks of this one from Wachovia? The advertisement in question is for the bank’s well-named, and well-intentioned new savings account, Way2Save.

Well if Ron doesn’t like P2P ads, I wonder what he thinks of this one from Wachovia? The advertisement in question is for the bank’s well-named, and well-intentioned new savings account, Way2Save.

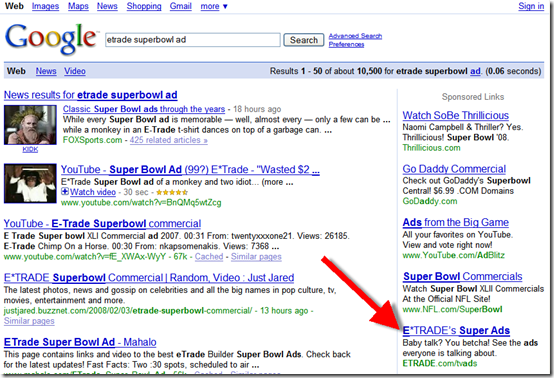

I saw it advertised yesterday, above and adjacent to US Today’s popular Super Bowl Ad Meter (here, screenshot below, note 2). According to BusinessWeek, the product is being supported with an eight-figure ad buy.

Wachovia’s ad promises an impressive return, a 5% APY plus a 5% bonus. On the face of it, that’s a 10% yield. They’d have $100 billion in it tomorrow if it was that simple.

Here’s the fine print:

- Must have a Wachovia checking account (but those are free)

- Limit of one Way2Save per checking account (but you can have more than one free checking account, see note 4)

- The only way to fund the savings account is through automated monthly debits from your Wachovia checking account (and those have to be set up in branch or over the phone)

- Maximum monthly transfer amount is $100, so the most you can add to the account in a year is $1200 (see note 4)

- The savings account has a variable rate and it not guaranteed to stay at 5% over the course of the year; and it is already scheduled to decline to 2% in years 2 and 3 (see detailed disclosures here)

- The bonus in year 2 and 3 falls to 2%

- A hard inquiry is posted to your credit bureau when opening a new checking account

- After the first year, the savings account has a $5/mo fee if there are no automated deposits

Analysis

For a small saver who can sock away $1200 over the course of a year, earning a 5% bonus, or $60, is an excellent deal, amounting to 15% return on the average annual balance of $600 ($30 interest @5% plus $60 bonus = 15%). While that’s a fantastic APY, the $600 balance limit means the total extra earnings are only $5 per month, before tax, hardly a strong motivation for most savers.

The other part of the account that has created more confusion is the $1 transfer to savings with every debit card purchase, automated debit, and online bill pay. Some consumers, and even a few bloggers, have assumed Wachovia is paying a $1 bonus on each transaction. Now that would be a deal, if it were true. The $1 is simply a transfer from the user’s checking account to his/her savings account. Wachovia will apply the 5% bonus to those $1 transfers, but that’s only $0.05 per debit, or $1/month pre-tax for an active electronic banking user making 20 transactions per month. Again, not a strong motivator for most savers.

The semi-disingenuous advertising

Overall, we like the account. But we are not so thrilled with some of the advertising. Our main complaint: the landing page overplays the $300 maximum reward amount, which is virtually impossible to reach. Many visitors will initially believe that a $300 maximum payout means they can drop $6,000 in the account. However, that’s not the case since it’s limited to $100 month contributions, yielding a $60 bonus.

Where does the other potential $240 come from? (This is the disingenuous part.) Answer: From the $1 funds transfers every time a Wachovia debit card is used. So the average visitor might think, “wow I’d have to make 240 debits to come up with the $240.” Wrong again. The $1 is just a funds transfer from checking to savings (note 3). At the 5% bonus level, Wachovia only pays a nickel per transfer.

So how do you get a $240 annual bonus from that? You’d need 400 debit card transactions EVERY MONTH. That’s not a typo, 400 transactions per month, or 4800 per year in order to earn the $300 shown in the headline of the Wachovia landing page. And that’s in the first year. In the second year, with a 2% bonus, you’d need 1250 transactions per month to reach the $300 mark.

Final verdict

Ignoring the advertising, I say it’s a deal for the customer. The product makes sense for beginning savers, a cross between Bank of America’s Keep the Change (coverage here) and WaMu’s Saving for Success (coverage here). I like the focus on automated savings, and the $1 per debit gimmick seems harmless, so long as it’s better disclosed.

However, I’m not sure it’s such a deal for the bank, at least not worth a $10-million ad campaign (note 5). Many Wachovia customers drawn in by the advertising will go away disappointed due to the fine print. In addition, thousands and thousands of zero-balance checking accounts will be opened to game the system, then closed at the end of the year, wasting bank resources and putting pressure on 2009 sales.

Wachovia advertising on USA Today Super Bowl Ad Meter (6 Feb 2008)

Wachovia landing page from USA Today ads

Notes:

- I knew it wasn’t a compliment, but I had to double check that one in the dictionary for the precise meaning: “lacking in candor or sincerity” or “pretending to be unaware.”

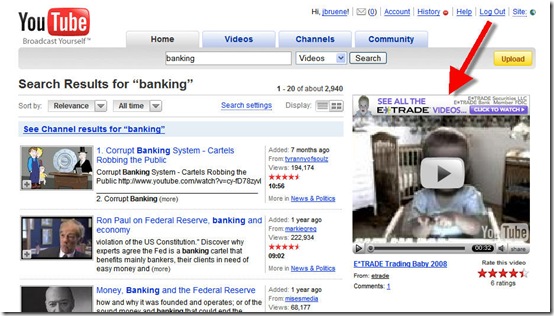

- I was disappointed to find that E*Trade’s ads finished outside the top-10 (#13 and #14).

- Although it’s not addressed in the Wachovia’s FAQs, apparently the $1 automatic funds transfer will be canceled if there are insufficient funds, so it can’t trigger a $30 NSF fee.

- The folks posting at FatWallet are sharing account details to game the syst

em. According to several posters, the bank allows up to 5 accounts per person in the household, but only one Way2Save can be linked to a single checking account. One poster says he opened 15 checking accounts and 15 Way2Save accounts and will transfer $100 per month into all 15 accounts, resulting in an $18,000 year-end balance and a $900 bonus. Then he’ll close all 15 accounts and move on to next year’s hot rate. One poster said, the branch people seemed happy to set up five new checking accounts since they appeared to get a bonus for each one. To avoid the “FatWallet effect,” make sure you always have account limits and sales incentive limits. - Granted, the $10+ million is more to promote the bank’ image than for the product itself. And being associated with savings is good branding these days.