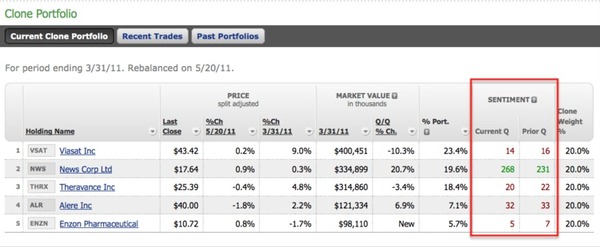

- Green when bullish

- Red when bearish

- Black when there is no change

Guardian Analytics Adds Security Expert to Your Team

- Proactively monitors every online banking session for all customer accounts

- Monitors Transactions and investigates suspicious activity

- Detects anomalies and informs FI of likely account takeover and payments fraud before money is lost

- Provides weekly reports that summarize risk-related trends, analyst activity, and the status of cases in process. The reports also help the FI understand online usage trends and consumer behavior.

New Online Banking Report Published on Youth Banking: Attracting Tween, Teens, & Under-25 via Online/Mobile

We were still in the Web 1.0 world when my kids (teenagers now) started their first savings accounts. So there were few youth banking services available to facilitate online savings and spending.

We were still in the Web 1.0 world when my kids (teenagers now) started their first savings accounts. So there were few youth banking services available to facilitate online savings and spending.

Fast forward 10 years. We have Facebook, we have Twitter, we have mobile weather info. But we still have virtually no youth banking tools at the major U.S. banks (Wells Fargo is furthest along, see screenshot below).

And that makes no sense.

There are 100 million people under age 25 in the U.S., and obviously, 15 to 25 years from now, a good portion of your profits will come from this group. However, in the next five years, this cohort will generate exactly zero percent of profits.

In the branch-based past, it made business sense to wait another five years to start selling to this group. After all, high-school graduates closed their bank accounts when they moved to college. College graduates closed theirs when they moved to their first job. And first-time job holders switched accounts when they landed a better job, and so on.

But that was a different time. In today’s remote-banking world, THERE IS NO REASON TO EVER CLOSE YOUR ACCOUNT. You just send in a change of address and keep logging in to the same place.

A 12 year-old girl today is expected to live another 70 years (boys, only 65 more). So if those kids won’t ever need to close their accounts, it stands to reason that getting them hooked to their parents’ online banking becomes pretty important.

That’s why we are seeing interesting startup activity in this area including (from recent Finovates):

- Bobber Interactive

- Kiboo

- MatchFund

- MoneyIsland (from BancVue)

- Thwakk

- Tile Financial

And there is a rush to social media, such as the brilliant Young & Free campaigns invented by Canada’s Currency Marketing.

Finally, the report includes articles from two industry experts:

- Justin Hosie of Chambliss, Bahner, & Stophel PC on the importance of bank compliance with the Children’s Online Privacy Protection Act (COPPA)

- Matt Cullina, CEO of Identity Theft 911, writes about the importance of protecting your kids against identity theft

______________________________________________________________

About the report

______________________________________________________________

Family Banking: Online/Mobile Services for Tweens, Teens & their Parents (link)

In a remote banking world, your most-promising prospects aren’t even driving yet!

Published: July 15, 2011

Author: Jim Bruene, Editor & Founder, Online Banking Report

Length: 52 pages (10,000 words), 52 Figures, 7 Tables

Cost: No extra charge for OBR subscribers, $495 for everyone else (here)

Abstract here

———————————

Wells Fargo offers up solutions for four age groups (18 July 2011; link)

Alumni News — Week of July 11, 2011

![]()

- BillFloat

- Bling Nation

- Boku

- Cardlytics

- ClairMail

- Expensify

- IDAnalytics

- Lending Club

- SecondMarket

- Wikinvest

- Wonga

- Yodlee

- American Banker reported that Guardian Analytics is planning to launch an outsourced fraud prevention service that will help financial institutions meet new FFIEC guidelines. Link

- Guardian Analytics introduced its FraudDESK service to provide fraud analytics support to financial institutions. Link

- Guardian Analytics is hosting a free webinar on Tuesday that will explore FFIEC guidance. Link

mes. Link

PerkStreet Financial Targets USAA Debit-Rewards Customers with Ads on Facebook

Every once in a while I stumble onto Facebook, usually by following a link from a credit union or banking site. It happened a few days ago, when I clicked a link in the middle of Visions FCU Rocks, a cool youth banking microsite from Visions Federal Credit Union.

Every once in a while I stumble onto Facebook, usually by following a link from a credit union or banking site. It happened a few days ago, when I clicked a link in the middle of Visions FCU Rocks, a cool youth banking microsite from Visions Federal Credit Union.

The Visions Facebook page was fine, but it was the little ad in the lower-right that grabbed my attention (see inset and screenshot below).

PerkStreet Financial, which has perhaps the richest debit-rewards program in the nation, with 1% to 2% cash back, is targeting USAA customers who just lost their debit card rewards program altogether. The landing page (see screenshot below) does a good job laying out the financial benefits and funneling visitors to the online app.

PerkStreet Financial, which has perhaps the richest debit-rewards program in the nation, with 1% to 2% cash back, is targeting USAA customers who just lost their debit card rewards program altogether. The landing page (see screenshot below) does a good job laying out the financial benefits and funneling visitors to the online app.

Bottom line: It’s a good time to tout debit card rewards, if you are sure you are keeping it. And targeting USAA customers specifically seems worth testing.

But if I was a USAA customer doing whatever people do on Facebook, I think I would find the, “Your USAA Account Changes” headline vaguely misleading. It might be better to use a headline more like the first sentence of the ad, “USAA is ending debit card rewards” or even, “Be glad USAA ended debit rewards.”

That’s it for my attempt at teaching “headline writing 101.” Class dismissed. Have a great weekend.

PerkStreet Financial targets USAA customers with Facebook ad (12 July 2011)

PerkStreet landing page (link)

Yodlee Reaches User Milestone, Adds Mobile App

- 12 Facebook FinApps are in process

- Over 250 developers are working on FinApps

- It recently released its MoneyCenter Mobile App for $3.99 (see screenshots below) that features:

- Account Summary Views

- Transaction Views

- Expense Analysis Views

- Ability to set Budgets by Category

- Charting

- Portfolio Management

- Location: Redwood City, CA

- Founded: 1999

- Funding: $116M total from Accel Partners, Institutional Vendor Partners, Warburg Pincus, and Bank of America

- Clients include Bank of America, Fidelity, Amex, and many others

New Funding for Braintree, Dynamics, and Finsphere

- Merchant accounts

- Payment gateways

- Recurring billing

- Credit card storage

- Hidden: Hides the card number until a user enters his pin on the card.

- MultiAccount: Holds two accounts on one card, allowing the user to choose which to use.

- Redemption: Allows the user to choose between using rewards or credit for in-store purchases.

- Dynamic Credit Card: Writes a new security code onto a magnetic stripe for every in-store purchase.

M&A: Fiserv to Purchase CashEdge for $465 Million

- The deal is expected to be complete by September 2011.

- The all-cash $465 million purchase price is more than six times CashEdge’s projected 2011 revenues of $75 million.

- Fiserv’s last large acquisition was CheckFree for $4.4 billion in 2007, which was 4.5 times its expected revenue. In comparison, Jack Henry & Associates’ $300 million purchase of iPay Technologies last year was 5.5 times iPay’s revenue.

- The expected consolidation of CashEdge’s Popmoney P2P transfer service (200 signed clients) and Fiserv’s ZashPay (700 signed clients) will create a stronger competitor to bank-owned clearXchange.

MoveNbank: Can it Out-simplify BankSimple?

I’ve been accused of falling for the Bank Simple hype. Just to prove that I don’t discriminate, I bring you MoveNBank, a mobile-optimized banking startup founded by Bank 2.0 author and consultant Brett King.

I’ve been accused of falling for the Bank Simple hype. Just to prove that I don’t discriminate, I bring you MoveNBank, a mobile-optimized banking startup founded by Bank 2.0 author and consultant Brett King.

From what little is disclosed on its Facebook page, Twitter feed and Startuply profile I’ve assembled the following facts:

Timeline:

- Founded July 2010

- Private beta to begin soon (per 1 July 2011 Tweet)

- Soft launch scheduled for July 2012

Company:

- Global startup with HQ in NYC (Madison Square Park, 25 W. 31st)

- Founder and Chairman is Brett King

- 8 employees

Product description:

- Mobile only, with no paper or plastic

- NFC-enabled app

- Incorporates “gamification” in UX

- According to Startuply, “reinventing credit scores and more with an open, social transparent, and viral model” (sounds P2P lending-esque)

Bottom line: MoveNbank is looking to leapfrog the competition by removing all vestiges of old-school banking. No branches (of course). No paper (no surprise). And no plastic (what?).

That’s how ING Direct got its start (they did have paper statements), so it’s not unprecedented. But if MoveNbank plans on offering payments, it will be harder to pull off. But with a soft-launch still a year away, it should be able to ride the NFC wave expected to roll across the globe in the next five years.

Are there any other remote banking startups I’m missing? Drop me an email ([email protected]).

————————————–

MoveNbank placeholder page (11 July 2011)

Alumni News — Week of July 4, 2011

![]()

PayPal and Cortera Take Charge in May’s Web Traffic

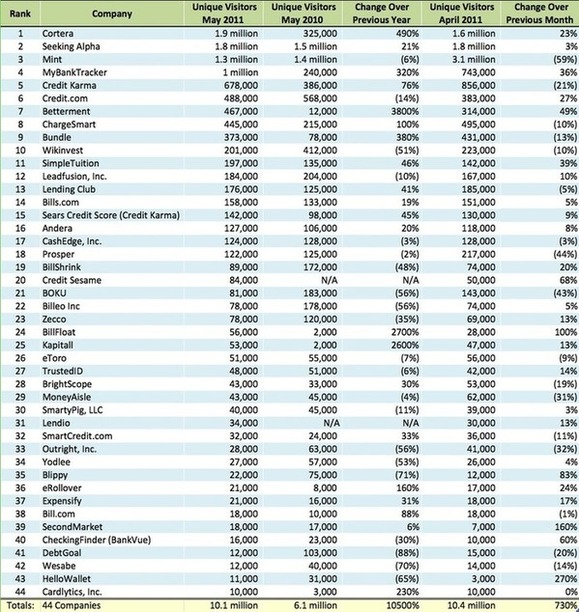

Each month we survey the Web-traffic performance of our alums, using data from Web-analytics company Compete to review the sites they operate.

Out of 255 alumni, 62 (24%) had more than 10,000 unique U.S. visitors in May 2011 (see tables below). Of the 62 reviewed, 25 (40%) had fewer visitors than in the previous month and 28 (45%) saw a decline year-over-year.

Private Companies

The 44 private companies are as follows:

Notable successes:

- Cortera saw the highest number of unique U.S. visitors in May, with almost 2 million hits.

- HelloWallet experienced the greatest month-over-month growth, with more than four times as many visitors.

- Betterment saw its traffic increase an impressive 38 times from May of last year.

Private Finovate Alumni With More Than 10,000 Unique Visitors in May 2011

Source: Compete.com retrieved June 29, 2011

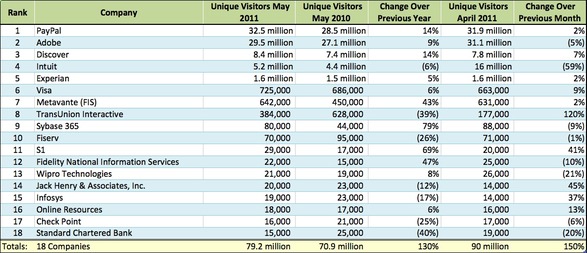

Public Companies

The 18 public companies are as follows:

Notable successes:

- PayPal experienced the highest number of U.S. visitors in May, with over 32 million visitors.

- TransUnion Interactive saw the highest month-over-month growth with more than two times the number of visitors in May than in April.

- Sybase 365 experienced the highest year-over-year growth, with its traffic up almost 80% from last year.

Public Finovate Alumni With More Than 10,000 Unique Visitors in May 2011

Source: Compete.com retrieved June 29, 2011

_____________________________________________________________________________

Notes:

1. We reviewed 255 unique sites. Data was unavailable or irrelevant for 201 sites because:

- They had been acquired.

- They were no longer available online.

- They were not covered by Compete for various reasons (including some that were not U.S. domestic companies).

- The number of unique visits was too small to be considered accurate.

- They were subdomains of larger websites.

2. Numbers have been rounded to three significant digits.

3. The charts include companies that did not have measurable traffic in May 2011, indicated by “N/A.”

4. Compete draws its information from the online activity of a panel of more than 2 million U.S. Internet users. It is only an estimate of traffic, and may undercount at-work usage.

PSECU’s Remote Deposit Honor System Has Processed $1.4 Billion with Only $74,000 in Losses

Sometimes the best ideas are the simplest ones. Ten years ago PSECU launched the Upost@home deposit service. It allows members to manually enter their deposits in the CU’s online banking system for immediate credit, then mail them to the CU in a postage-paid envelope.

Sometimes the best ideas are the simplest ones. Ten years ago PSECU launched the Upost@home deposit service. It allows members to manually enter their deposits in the CU’s online banking system for immediate credit, then mail them to the CU in a postage-paid envelope.

The service, launched in late 2001, was little publicized outside of PSECU’s member base during the first two years. We first heard about it in late 2003 when a second credit union licensed the service. We gave it our highest honor, an OBR Best of the Web award (note 1), one of only five given during the post-bubble dark days of bank-tech innovation (2001 through 2004).

The service, launched in late 2001, was little publicized outside of PSECU’s member base during the first two years. We first heard about it in late 2003 when a second credit union licensed the service. We gave it our highest honor, an OBR Best of the Web award (note 1), one of only five given during the post-bubble dark days of bank-tech innovation (2001 through 2004).

At the time, it seemed an almost crazy idea. An online/offline honor system for deposits. But the CU knew what it was doing. It limited the amount that could be deposited and which members were allowed to use the service.

Now the results speak for themselves (see annual totals in table below):

4.5 million items deposited worth $1.4 billion (avg. of $310 per check)

$74,000 in losses

= 0.0053% loss rate (0.5 basis points)

or 1.6 cents per item

Upost has turned into the least loss-prone method of accepting deposit, including the branch!

Another interesting data point: The CU is processing almost 50,000 Upost@home deposit items per month, about one per month per member enrolled in the service, a pace that’s stayed remarkably consistent over time.

Bottom line: We’ve listed PSECU’s Upost@home on our annual list of top online/mobile innovations of all time (it was ranked #24 of those invented in the past 10 years and #42 of all time). But in terms of “bang for your buck,” it’s probably in the top-5.

Source: PSECU, 5 July 2011

———————————–

Notes:

1. The original article published in Online Banking Report (OBR #103) is reprinted in the Netbanker archives here.

2. The list of top innovators was published in OBR #188.