With 2011 put to rest, the Finovate team has returned to the office excited to make FinovateEurope 2012 in February our biggest and best European event ever.

Over the holidays we received a number of inquiries about whether it was still possible to get an early-bird ticket to the event. Given that, we’ve decided to extend our early-bird ticket deadline until this Friday (January 6th) so that you can lock in your spot at the early-bird rate.

Tickets for the event have been selling strongly and we expect a record crowd on February 7th in London. Here is a small sample of the organizations that have already registered to attend:

|

|

|

If you want to guarantee your chance to watch the future of European finance and banking technology debut in London in February, please register soon. As I mentioned above, tickets for the event are selling quickly — well ahead of last year’s pace when we sold out weeks ahead of the conference. In addition, with the extended deadline, if you register by Friday January 6th then you’ll get the affordable early-bird price on your ticket.

FinovateEurope 2012 is sponsored by: Bluerock Consulting & The Bancorp Bank

FinovateEurope 2012 is partners with: BankerStuff, BankInnovation, Celent, Deutsch Startups, Finance on Windows, The Financial Services Club, The Financial Services Innovation Centre, and PYMNTS.com.

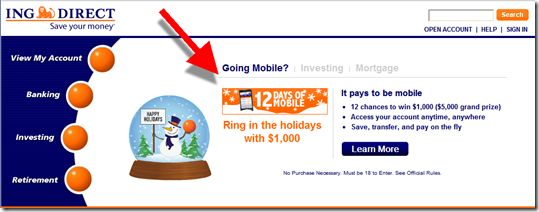

Since I began blogging in 2004, I’ve usually run a year-end post looking at the holiday marketing efforts of the top-20 U.S. banks (links below). This year, only 7 of the 20 banks are using holiday or seasonal imagery on their homepages. That’s a decrease of 3 over last year.

Since I began blogging in 2004, I’ve usually run a year-end post looking at the holiday marketing efforts of the top-20 U.S. banks (links below). This year, only 7 of the 20 banks are using holiday or seasonal imagery on their homepages. That’s a decrease of 3 over last year.